Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseThe lowdown on Finder Score

The Finder Score helps you sort the junk from the gold so you can compare products faster.

Each month we carefully analyse over 250 credit card products and assess nine features and benefits of each card.

We assign scores out of 10 for each feature, and adjust the scores depending on what category we're looking at.

Credit card scores are category-specific (e.g. low rate, balance transfer). The same card will receive a different score within each category, depending on the features being assessed. This methodology ensures a fair and relevant evaluation of each card.

Remember that Finder Score is just one factor to consider. Look at other aspects like fees, features, benefits and risks to make sure a product is suitable for you. Double-check details that matter to you before applying or buying.

To qualify for this category, credit cards must:

- Offer some form of cashback on spending. Where cashbacks are based on a % value of spend, we use an average monthly spend derived from the RBA.

The Finder Score methodology is designed by our insights and editorial team. Commercial partners carry no weight, and all products are reviewed objectively.

Remember that Finder Score is just one factor to consider. Look at other aspects like fees, features, benefits and risks to make sure a product is suitable for you. Double-check details that matter to you before applying or buying.

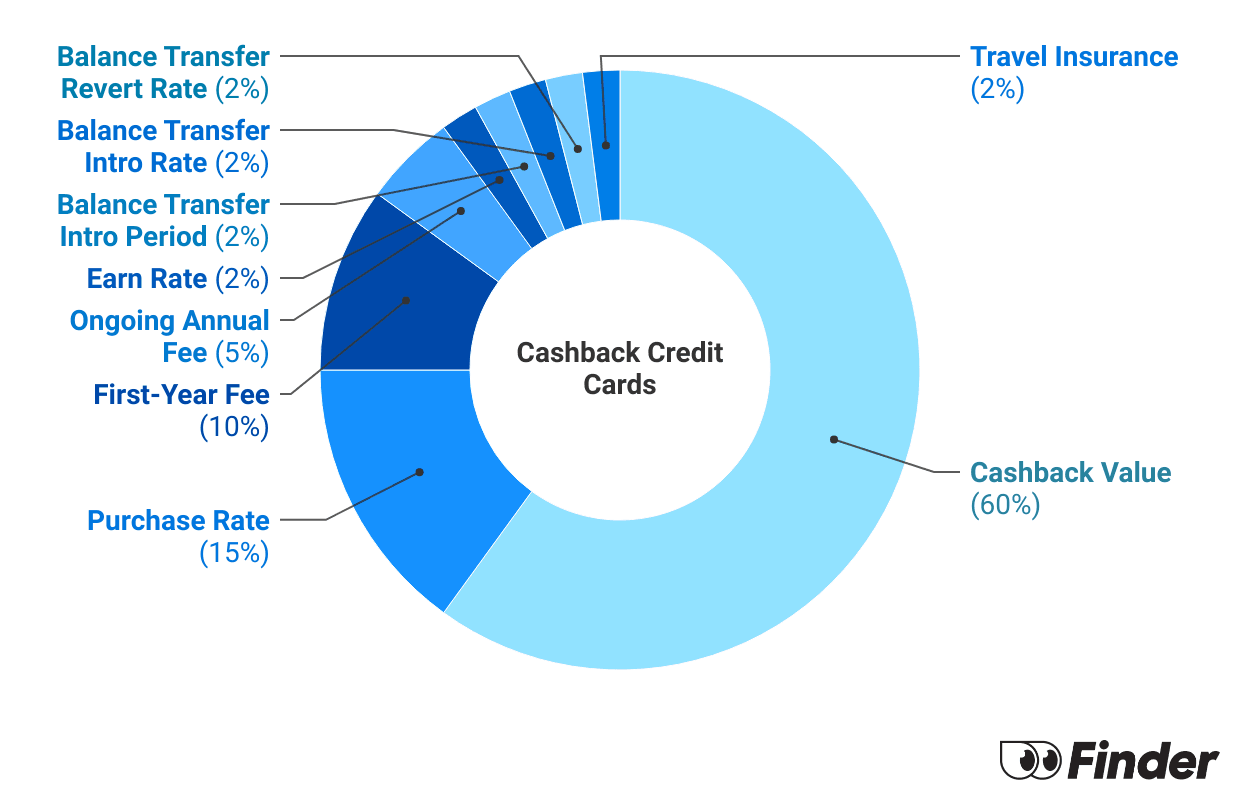

Cashback credit cards - score weightings

| Feature | Definition | Assessment | Weight |

|---|---|---|---|

| Cashback Value | The value of cash returned per dollar spent | Higher cashback rewards result in higher scores | 60% |

| Purchase Rate | Interest rate on new purchases | Lower rates receive higher scores (up to 21.24% max) | 15% |

| First-Year Fee | Fee charged for the first year of card ownership | Lower fees receive higher scores ($0 fee scores highest) | 10% |

| Ongoing Annual Fee | Fee charged from the second year onwards | Lower fees receive higher scores ($0 fee scores highest) | 5% |

| Earn Rate | Points earned for every dollar spent on eligible purchases | Points awarded per dollar (up to 1.5) | 2% |

| Balance Transfer Intro Period | The length of the balance transfer period | Longer periods are awarded higher scores | 2% |

| Balance Transfer Intro Rate | The rate applied to balance transfers | Lower rates receive higher scores (up to 21.99% max) | 2% |

| Balance Transfer Revert Rate | The interest rate charged after the BT period ends | Lower rates receive higher scores (up to 22.24% max) | 2% |

| Travel Insurance | Travel insurance offered with card | Cards that include travel insurance receive the full 10 points | 2% |

Breaking down the score tiers

- 9+ Excellent - These cards offer the highest cash returns with the lowest interest rates.

- 7+ Great - Reasonable ongoing purchase rates and cashback offers.

- 5+ Satisfactory - These cards offer some value in return for spending.

- Less than 5 – Basic - These are generally cards targeted at a consumer segment, with cashback as a feature.