Key takeaways

- All drivers must have compulsory third party car insurance (CTP). It covers you only for costs linked to injuries and deaths from car accidents.

- Even if you do not drive your car, and it is kept parked on a road or in a garage, you still need insurance.

- There are 3 other types of optional insurance available; third party property damage, third party fire and theft and comprehensive car insurance.

Is car insurance compulsory in Australia?

Only CTP insurance is compulsory. In Australia, you must insure each registered vehicle with CTP insurance, sometimes known as Green slip insurance. CTP actually stands for compulsory third party insurance.

You buy your policy from one of a handful of insurers your state has selected to take part in its CTP scheme – all of these state-regulated policies cover you for the medical bills of anyone you injure in an accident. Some states will cover some of your medical bills, even when you're at fault.

In most states, your Green Slip automatically comes with your registration. But you can choose between private insurers if you're in NSW, SA, ACT or QLD.

Finder survey: How many Australians have car insurance?

| Response | |

|---|---|

| Yes | 88.07% |

| No | 5.57% |

| I don't own a car | 5.27% |

| Only some of my cars are insured | 1.09% |

How does car insurance work in Australia?

Once your car has compulsory third party insurance sorted, you can choose to add on other insurance for further protection. This is optional, yet recommended depending on the value of your car. There are three types of additional insurance to go along with your CTP. These are:

Third party property damage (TPPD)

This covers damage you cause to another's property, including cars, homes, land, pets and personal items. But it won't cover repair costs for your car. This level of coverage is a good option for those with less valuable cars.

Third party, fire and theft (TPFT)

This covers everything TPPD does plus fire and theft. It doesn't cover your car if you're involved in an accident or if it's damaged by any other type of natural disaster, besides fire. This level of coverage may be good for those in more dangerous LGAs or those who simply want coverage in the event of fire or theft.

Comprehensive

This covers you for everything third party property damage (TPPD) and third party fire and theft (TPFT) does, plus, many other ways your car can get damaged: storms, natural disasters, vandalism, uninsured drivers, hit-and-runs and at-fault accidents. The most notable difference between comprehensive and third party insurance is that comprehensive car insurance covers damage to your own car.

Additionally, there are specialist types of car insurance that you might need depending on your circumstances. Examples include multi-car insurance, which lets you insure all your cars together – and rideshare insurance, to cover you if you're an Uber or Ola driver, for example. There's also modified car insurance for those with mods that sit outside of regular insurance.

Compare car insurance

Compare other products

We currently don't have that product, but here are others to consider:

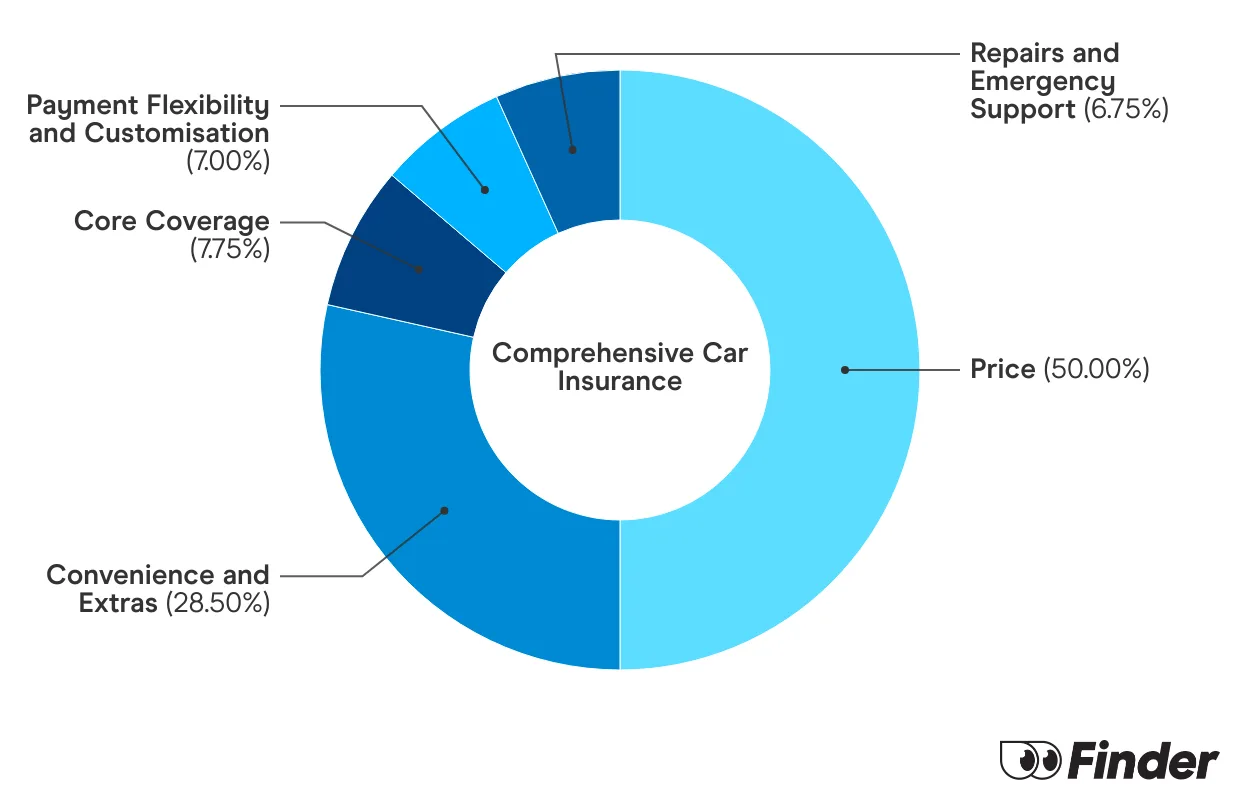

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Why is additional insurance important?

CTP may be the only form of insurance that's compulsory, but that doesn't mean you should go without more cover.

If you want to stop yourself from potentially severe financial hardship, it may well makes sense to get extra cover. Here are 3 reasons why:

Damaging someone's property can be expensive

Causing an accident can be expensive. Even if you forget about the damages to your car, you'll still be responsible for damaging other people's cars plus any other property you can think of, like road signs, bus stops, homes, lawns, shopfronts and animals.

There's often no one else responsible when your car is damaged.

If replacing your car would hurt your wallet, consider these situations where CTP won't pay for your car: you cause the accident, an uninsured driver hits you, someone hits you and drives off, someone steals or vandalises your car or there's a natural disaster like a flood or hailstorm.

Your bank may require it

If you borrowed money for your car, your lender might insist that you take up additional cover to protect the loan.

"While budgets are tight, it can be tempting to drop down a cover level. But I look at it the other way round. Even optional covers can save you money in the long run as they can help you avoid out-of-pocket costs. Take roadside assistance. You can get a standalone policy for around $7 per month. And it could save you hundreds of bucks on the cost of private towing fees if you find yourself stranded at the side of the road following an accident."

Weighing up your car insurance options

The type of insurance that's best for you will depend on your personal circumstances. Below are some questions to ask yourself that can help determine what level of cover may be best for your car.

- Do you owe money on your car? If you're still paying for your car, there's a good chance your lender will require you to have comprehensive car insurance because that's the only level that fully covers your car. Even if not, you should strongly consider comprehensive cover so you don't need to take out a second loan to replace the vehicle.

- How much is your car worth? If replacing your car wouldn't break the bank, you can get away with third party property cover. It won't cover your car, but will help you avoid massive bills if you crash into someone else's.

- Do you drive often or rely on your car? If you're on the road a lot, comprehensive car insurance can swoop in to help if an accident leaves your car undriveable. For example, it can provide you with a hire car while yours is in the shop and put you up in a hotel if you're stranded far from home.

- Where do you live? If you live in an area that's prone to natural disasters or theft, you should get a level of insurance that will cover those specific risks. Third party, fire and theft will help out if you live in a bushfire-prone area. If you live in a flood zone or somewhere that experiences cyclones, you'll need comprehensive cover.

Frequently asked questions

Sources

Ask a question

4 Responses

More guides on Finder

-

High risk car insurance

Learn the factors that may cause you to be considered a high-risk driver and whether you might be eligible for cover.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car Insurance ACT

Living in the ACT? Here’s all you need to know about car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Can DUI offenders get car insurance?

Your guide to car insurance when you've been convicted of drink driving.

-

Learner driver insurance

Complete guide to getting car insurance for learner drivers in Australia.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Short term car insurance Australia

Find out what short term car insurance options are available in Australia.

-

Switching car insurance

Is it time to make the switch? If you're not happy with your current car insurance provider then the answer might be yes.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.

I am in QLD on WHV 417 and want to buy a car to travel around the country. If I buy a car i understand i must register it as the new owner – do you know how much that is? and then I must insure it with a green slip if I sort this in QLD am I then covered for insurance across all australia?

Hi Corrine,

Thank you for reaching out to finder.

Depending on the vehicle number of cylinders, your vehicle registration in QLD may range from $350-$670. The rules of CTP insurance vary from state to state. For example, drivers in New South Wales, Queensland, South Australia and the Australian Capital Territory have the power to choose their CTP/Green Slip insurance provider. All vehicles in Australia must have CTP insurance before they can be registered and legally driven in any road in Australia. Hope this helps!

Cheers,

Reggie

Can you insure the car you are driving if it is not registered in your name/

Hi Sue,

Thanks for reaching out! You may certainly insure a car you’re driving that’s not registered under your name. Non-owner car insurance allows you to drive someone else’s car and be protected.Typically this insurance only provides liability coverage, not optional coverage like damage to the car, rental reimbursement or medical expenses. Do your research by viewing this list of car insurance providers on our page and ask if they offer this type.

As a friendly reminder, carefully review the Product Disclosure Statement of the product before applying. You may also contact the insurance provider should you have any questions about their policy.

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Best,

Nikki