Whether a big storm batters the roof or a burst pipe floods the basement, seniors home insurance can help pay for important repairs, replace damaged items, and even cover alternative accommodation if you have to stay elsewhere for a while.

This guide will explain how to compare home insurance policies to find one that's right for you, and will reveal which insurers offer discounts to older customers.

Who offers discounts for seniors home insurance?

There are a few insurers that offer discounts tailored to seniors only, such as Australian Seniors. We would always encourage seniors to do the maths when it comes to seniors discounts and see how good a deal it actually is.

For example, buying a policy online can sometimes give you a greater discount than your seniors card.

Here's a quick list of discounts offered by some insurers:

| Insurer | Seniors discounts | Other discounts | Get quote |

|---|---|---|---|

|

|

| |

|

| More info | |

|

| More info | |

|

| More info | |

|

| ||

|

|

This information is correct as of February 2019

How to review a seniors home and contents insurance policy. What do I look for?

When looking into purchasing a home insurance policy, seniors should consider a few things:

- Do your kids store belongings in your home? Many policies don't automatically include cover for items other people bring into your residence, unless you list their names on the policy.

- Do you travel often? Are you spending your retirement or weekends on the road? If your home is unoccupied for 60–90 days at a time, you may not be covered.

- Do you have an older house? Been in the same place for a few decades? The cost of home insurance is often higher for older homes, as not all insurers are willing to take on the risk of insuring an older home. Plenty of companies will still provide cover, but you may need to pay a bit extra for the cover you need.

- The cost to rebuild your home. Also factor in other costs you may not have thought about, such as accommodation while you rebuild, as some policies cover this.

- Calculate how much your house is worth. Use an online calculator to help you. These calculators will estimate rebuilding costs based on either a rough guide of cost per square metres or elemental estimating, which is a more personalised estimate of the cost, asking several questions about your home.

- Are you considering renovating to make your home more accessible? If your physical needs change, you may need to make adjustments to your home and significant renovations might not be covered. Before work begins, read the PDS and call your home and contents insurer to see what your policy will cover.

- Do you need specialised medical equipment at home? Home insurance may cover damage to or the loss of durable medical equipment (such as assistive devices) under the personal property section of the policy, but you may have to pay extra under some policies to be covered. Some insurers may also ask for documentation from your medical professional.

- Do you live in a risk-prone area? If floods, bushfires and cyclones are common, ensure your home and contents insurance covers these events.

- What do you really want or need covered? Consider personalising your policy to save money. Budget Direct allows you to tailor your cover to your specific needs by letting you choose your excess to reduce your premiums.

Finder survey: Which home insurance products do Australians of different ages have?

| Response | Gen Z | Gen Y | Gen X | Baby Boomers |

|---|---|---|---|---|

| Home and contents | 43.82% | 66.03% | 70.39% | 81.53% |

| I do not have any form of home insurance | 41.57% | 23.37% | 20.39% | 13.64% |

| Building (without contents) | 20.22% | 15.76% | 16.78% | 10.8% |

| Landlord | 7.87% | 10.87% | 9.87% | 9.09% |

| Airbnb/Short Term | 3.37% | 2.99% | 0.66% | 0.28% |

What's the difference between a seniors home insurance policy and a normal policy?

Every insurance company offers home insurance for seniors, but certain insurers do cater specifically to seniors, such as the Australian Seniors, APIA and National Seniors Insurance.

The main difference is the price since some insurers provide discounts for seniors. In terms of the benefits, there are no differences between different policyholders.

It's handy to keep in mind that insurance needs change as you age, so choosing a flexible policy that covers your key concerns is a great way to save money and have peace of mind.

Compare seniors home insurance and get a quote

Compare other products

We currently don't have that product, but here are others to consider:

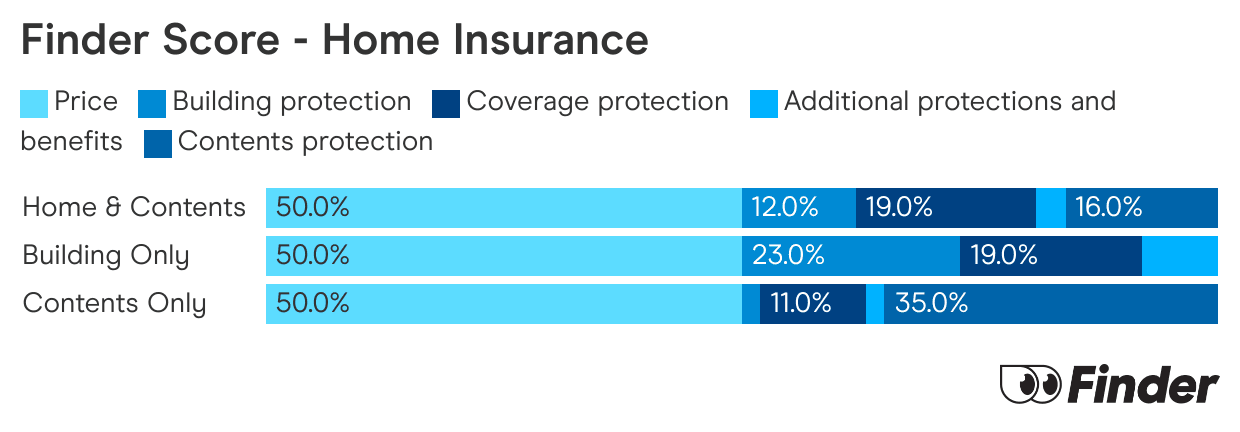

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Home Insurance Victoria

Be ware of the unique risks faced by Victorian homeowners. Discover how to find a home insurance policy that gives you the cover you really need with this handy guide.

-

Home insurance deals

Access the latest home insurance deals and special offers to save further on your policy.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.