Searching a PDS for terms like "water damage", "leak" and "escape of liquid" will help you find the specifics quickly.

Key takeaways

- Damage from shower leaks can be covered by home insurance in some situations.

- The damage needs to be from an unforeseen event outside of your control.

- Damage from wear and tear or lack of maintenance is not going to be covered.

Can home insurance cover shower leaks?

Yes, if a leaking shower is caused by a sudden burst pipe or other event that occurred quickly and unexpectedly – for example, a plumbing malfunction or broken pipe – home insurance can cover you for the damage caused.

Gradual water damage by a shower leak, on the other hand, is usually not covered by most home insurance policies.

When won't I be covered for a shower leak?

You probably won't be covered for a shower leak insurance claim if:

- It was the result of wear and tear – for example, the leak occurred gradually over time

- The leak was caused by lack of maintenance – for example, an unrepaired hole in the wall behind a shower

- The source of the leaking water was not within your own plumbing system

Get cover for shower leaks with home insurance

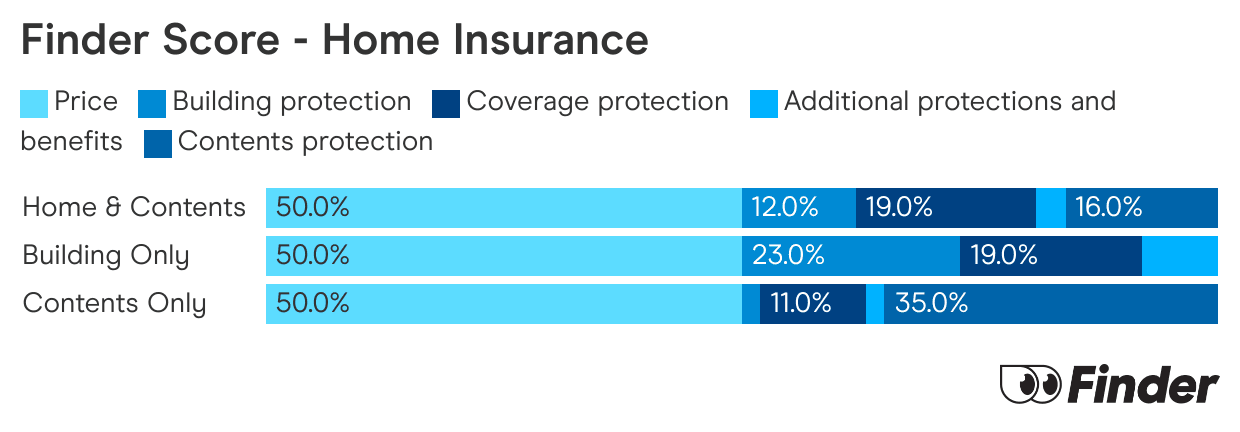

Finder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Which home insurance policy should you buy?

Different types of insurance treat shower leaks, and the damage they can inflict, in different ways.

Home and contents insurance

With most combined home and contents policies, you'll be covered for repairs to certain kinds of shower leaks as well as any water damage they cause to your insured contents.

That is, if your shower leaked overnight and you woke up to find the escaping water had ruined some of your belongings, the right home and contents policy could cover you for the leak as well as any insured items it damaged.

Contents insurance

The assets you've insured under a contents policy should be covered against damage caused by a leaking shower – but you won't be covered for the plumbing costs involved in repairing the leak.

Home/building insurance

Most building insurance policies will give you a similar level of cover for repairing shower leaks as straight home insurance policies, but, like contents insurance, they won't cover any belongings that are damaged as a result of the leaks.

How to make a leaking shower insurance claim

Follow these 4 steps to make a leaking shower insurance claim:

Prevent further damage and contact your insurer

If it's a sudden and strong leak (e.g. from a burst pipe) and the escaping water could damage property or become an electrical hazard, switch off your water supply at the mains. The next step will usually be calling in a professional. You should also contact your insurer to let them know what happened.

Take stock of the loss

Take photos of the affected areas while the leak is in progress. Your insurer will probably send someone to take stock of the damage and estimate the extent of the damage.

File a claim

Fill out a leaking shower insurance claim by answering a few questions about the incident. Attach all relevant evidence (e.g. photographs, receipts).

Wait for your claim to be accepted or rejected

If your claim is denied, you can file an internal dispute with your insurer. If that doesn't result in it being accepted, you can also file a complaint with the Australian Financial Complaints Authority.

Here's the bottom line

Left unattended, even the smallest shower leak can turn into a full-blown plumbing emergency. Home insurance can't cover you in every leak situation, but it can significantly reduce the repair costs involved when water turns up uninvited in and around your shower.

Frequently asked questions

Sources

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

Home Insurance Victoria

Be ware of the unique risks faced by Victorian homeowners. Discover how to find a home insurance policy that gives you the cover you really need with this handy guide.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

Home insurance deals

Access the latest home insurance deals and special offers to save further on your policy.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.