Compare other products

We currently don't have that product, but here are others to consider:

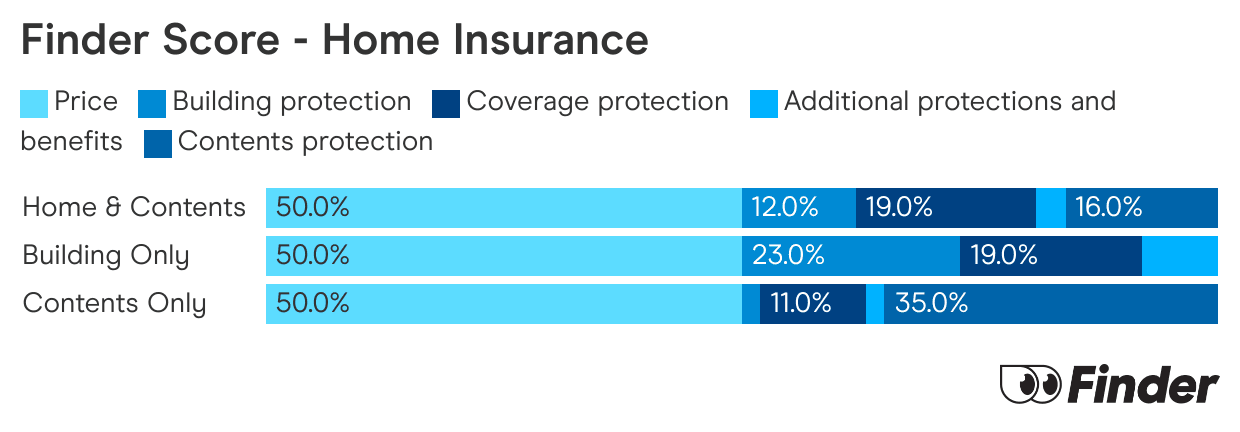

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Can I get insurance for an unoccupied home?

Most likely, yes. If you’re expecting your home to become unoccupied then you should still be able to get home insurance, or continue with your existing policy. You’ll just need to let your insurer know.

Most insurers define ‘unoccupied’ as being vacant for more than 60 days. If you’ll be back before then, you likely don’t need to do anything. If you’ll be gone for longer than 60 days, you’ll need to get in touch with your insurer. If you don’t, you risk losing cover.

How different insurers define 'unoccupied' homes

Often, insurers will have different definitions of what it means for your home to be ‘unoccupied’. Every month, we check how popular providers define this.

Table updated February 2026

When would I need unoccupied home insurance?

Here are some common scenarios where you might leave your home unoccupied for long enough that it could affect your insurance.

- Leaving your home empty while travelling. If you're planning an extended holiday, there's probably a high likelihood that you'll exceed your insurer's maximum unoccupied limit. For cover to continue, make sure you contact your insurer and notify them of your plans before you depart.

- Leaving your home empty while you renovate. Living in your house while it's being renovated can be stressful and far from practical, so moving out for a few months while work is completed may be the best solution. Not only will your home insurance cover be cancelled if you're away for an extended period, but keep in mind that home insurance commonly won't cover claims that arise because of the renovations.

- Leaving a house vacant while trying to sell it or rent it out. If you plan to leave the property vacant while you either look to sell it or try to find new tenants to rent it out, check with your insurer to find out how this will affect your policy. While many insurers will cover unoccupied homes for up to 60 or 90 days, there are some landlord insurance policies that require you to notify the insurer each time your home is left vacant due to a change of tenant.

Our expert says

"When you first take out a home insurance policy, you’ll agree that you’ll notify your insurer of any changes to your circumstances. Leaving your home unoccupied is one of those circumstances where your insurer will want to be informed. They’ll be able to tell you if any changes to your policy or premium are needed and you can decide what’s best from there."

FAQS

Sources

Ask a question

2 Responses

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

Home Insurance Victoria

Be ware of the unique risks faced by Victorian homeowners. Discover how to find a home insurance policy that gives you the cover you really need with this handy guide.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

Home insurance deals

Access the latest home insurance deals and special offers to save further on your policy.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.

Is there an Insurance Company that will insure an unoccupied home belonging to my deceased father. I am one of the executors and we cannot sell the home until 6 months after probate. This must be a fairly common situation, but so far, no insurance company will offer a policy. Can you advise please.

Many insurers do offer unoccupied insurance, but you’ll often have to pay an excess in the event of a claim. You might find it helpful to work with a broker to narrow down your policy choices.