We researched over 30 comprehensive car insurance providers and 19 third party car insurance brands. We found the average annual car insurance premium costs:

$522 for Third Party Property Damage insurance

$1,362 for Comprehensive insurance

Note: For information on how we got these quotes, see our car insurance methodology.

Comparison of the annual car insurance costs in Australia

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseCompare other products

We currently don't have that product, but here are others to consider:

How we picked theseHow much does car insurance cost?

| Average cost in Australia | New South Wales | Queensland | South Australia | Tasmania | Victoria | Western Australia | |

|---|---|---|---|---|---|---|---|

| Budget Direct | $992 | $1,148 | $941 | $978 | $829 | $1,180 | $880 |

| Virgin | $1,057 | $1,214 | $1,013 | $1,046 | $880 | $1,254 | $934 |

| Suncorp | $1,559 | $2,003 | $2,107 | $1,240 | $1,100 | $1,588 | $1,317 |

| Everday | $1,552 | $1,861 | $1,356 | $1,402 | $1,218 | $2,070 | $1,403 |

| Hume Bank | $959 | $900 | $1,036 | $922 | $783 | $1,280 | $831 |

| ROLLiN' | $886 | $1,151 | $843 | $690 | $709 | $1,248 | $674 |

| Bingle | $862 | $935 | $872 | $724 | $726 | $1,156 | $761 |

| Huddle | $1,407 | $1,702 | $1,261 | $1,286 | $1,112 | $1,848 | $1,233 |

| Real Insurance | $1,464 | $1,752 | $1,277 | $1,326 | $1,147 | $1,959 | $1,321 |

| AAMI | $1,218 | $1,884 | $1,106 | $1,015 | $985 | $1,318 | $1,002 |

Average cost of car insurance by state

| State | Cost |

|---|---|

| New south wales | $1,698 |

| Victoria | $1,721 |

| Queensland | $1,274 |

| South australia | $1,233 |

| Western australia | $1,242 |

| Tasmania | $1,128 |

How much does it cost on average for your age?

| Age | Average cost |

|---|---|

| 20 | $2,387 |

| 30 | $1,293 |

| 40 | $1,116 |

| 50 | $1,010 |

| 60 | $899 |

How much does a third party property damage policy cost?

| Brand | Cost |

|---|---|

| Virgin | $378.90 |

| Budget Direct | $379.57 |

| Bingle | $425.84 |

| Qantas | $434.42 |

| Australia Post | $449.69 |

| Allianz | $481.65 |

| Kogan | $515.04 |

| AAMI | $516.02 |

| NRMA | $524.56 |

| GIO | $526.89 |

What affects the cost of car insurance?

The cost of car insurance is impacted by the level of policy you choose, who is driving the car, what type of car you have, where you live, as well as other factors.

The policy you choose

Aside from compulsory third party (CTP) insurance, which is mandatory for all Australian drivers, there are 3 levels of car insurance cover to choose from: comprehensive, third party fire and theft, and third party property damage. The policy you choose will influence the cost of cover due to:

- Your level of cover. Comprehensive car insurance provides protection against an extensive range of risks, so it costs more to purchase than a third party policy.

- Market value or agreed value cover. This is the amount your insurer will pay you in the event your car is written off. Market value cover is typically the cheaper option because there’s no certainty around what the insurer will pay you; it’s simply whatever the cost of your car is in the market at that time. Agreed value cover involves agreeing on a figure before paying your premium. This tends to be more expensive because you’re locking in the value.

- Your excess amount. Most insurers allow you to adjust the excess payable when you claim in order to vary your premium – the higher your excess, the less you pay for cover, and vice versa. Just be sure you can still pay your excess in the event you need to.

- Optional extras. When you buy car insurance, you may be given the choice of adding extra-cost options to your policy – for example, roadside assistance or excess-free windscreen cover. Adding these extras to your policy will drive up your premium.

If you pay monthly or annually

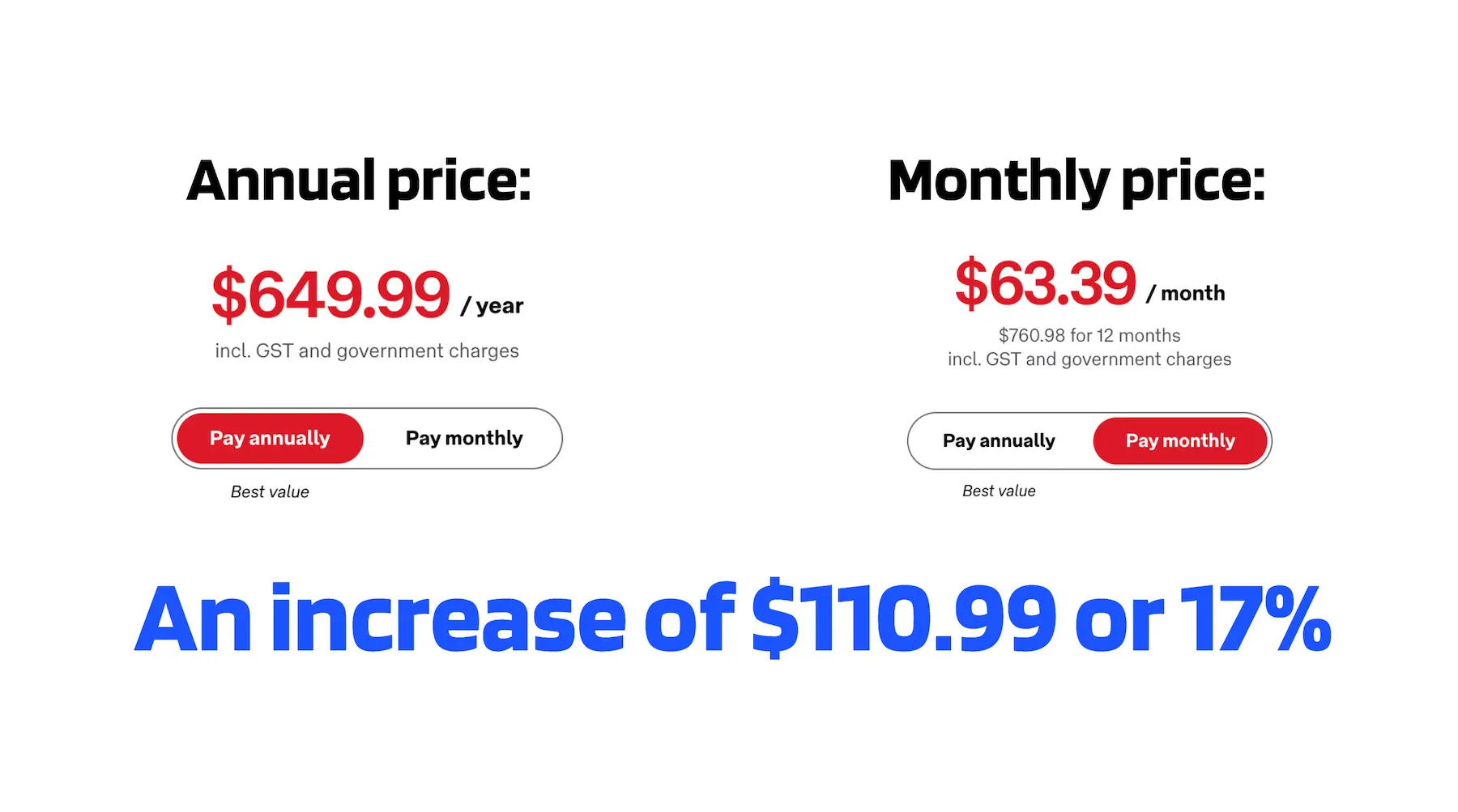

A lot of insurers will offer the option to pay monthly, but you need to check if you're being charged an additional fee for this. We researched over 50 car insurance providers and found that about 30 of them will add a surcharge for paying monthly. In some cases, this is as high as an additional 15% which can be hundreds of dollars over the course of a year. Below is a real life example of this surcharge in action.

Based on comprehensive insurance, female driver aged 40, parked in QLD, car insured at market value.

So, if you'd like to pay monthly, just be sure to check if this is a financially sound choice for the longterm.

Who drives the car

To help determine your risk, all insurers will ask you about the following:

- Gender

- Age

- Driving experience

- Claims history

- Driving record

- Number of drivers listed on the policy

- Your suburb

Other factors

- How many kilometres you drive per year

- Where you park; on the street or in a garage

- When you drive; like peak hour

- If the car is used for business or personal use

The type of car you drive

Some vehicles are more expensive to insure than others for several reasons, and insurers will consider the following factors when calculating your premium:

- The value of your car

- The cost of repairs

- How powerful it is

And at the end of all this, if you’re deemed a high risk driver, your premium will be more expensive.

FAQs

Sources

Ask a question

4 Responses

More guides on Finder

-

High risk car insurance

Learn the factors that may cause you to be considered a high-risk driver and whether you might be eligible for cover.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car Insurance ACT

Living in the ACT? Here’s all you need to know about car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Can DUI offenders get car insurance?

Your guide to car insurance when you've been convicted of drink driving.

-

Learner driver insurance

Complete guide to getting car insurance for learner drivers in Australia.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Short term car insurance Australia

Find out what short term car insurance options are available in Australia.

-

Switching car insurance

Is it time to make the switch? If you're not happy with your current car insurance provider then the answer might be yes.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.

How much higher or lower than the purchase price should you insure for a new car if agree value option is chosen?

Hi Richard,

The goal is to be insured enough that you’re not terribly out of pocket if the car were to be written off. If you bought the car outright, it’s smart to insure it for at least what you paid. If you’ve bought the car with finance of some sort (loan, lease etc) then it’s smart to consider what you owe with interest and any other fees accounted for, then ensure your agreed value reflects at least that amount.

Typically, you won’t want to to try to insure it for loads more than you bought it for because that’ll only drive up the cost of your premium. Insurers will also have a cap on how much they’re willing to insure it for so you don’t want to price yourself out of coverage either. The higher your agreed value, the more your premium will cost. So you’ll want to strike a good balance between enough coverage that you’d be okay if the car was written off, while maintaining an affordable premium.

I hope this helps!

can i get a range of figures like on this page for a van, used only for private puproses?

Hi Trav,

We don’t have a page full of statistics about van insurance, but we do have a guide with some info you mind find useful. Hope this helps!