Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for car insurance

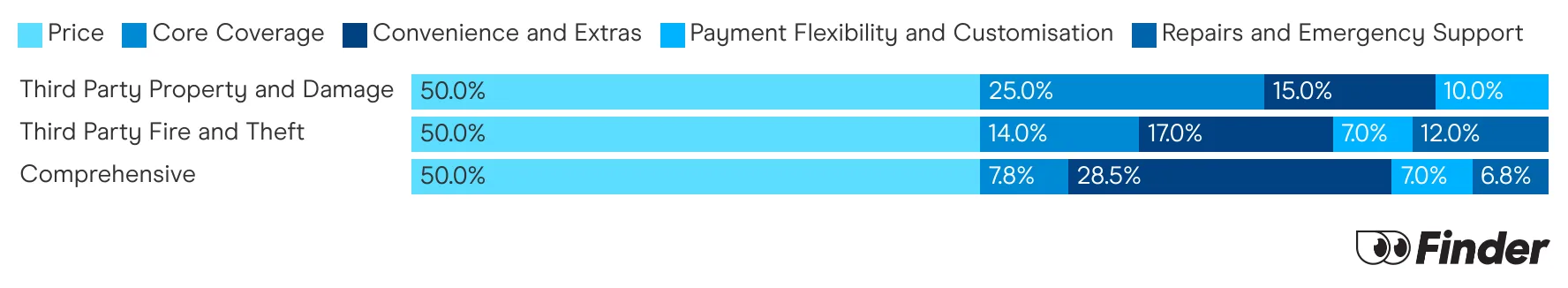

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Key takeaways

- Car insurance for younger drivers is more expensive because you have less driving experience, and the chance of an accident is higher.

- You could pay lower premiums by sharing the car with your parent, if they are the main driver and you have permission to use the car.

- Insurers all price risk differently, so get at least three quotes to try and find the best deal.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked these$188

Price based on 100+ responses about their monthly premium in January 2026.Why is car insurance for under 25s so expensive?

Car insurance for young drivers, specifically those under 25 years old, is so expensive because insurers see these drivers as risky and will therefore inflate the premium to cover this risk. If you're a young driver with a perfect driving record, you'll likely still find that insurance is expensive. If you're a young driver with a a bad driving history then you might find it difficult to get cover at all.

Can I get a cheaper policy if I use my parent's name?

Sharing the car with your parent is typically the cheapest way to get lower car insurance premiums. In this situation, the insurance policy is valid if your parent is the main driver and you have permission to use the car.

It’s important to remember that you’re only covered by your parent’s car insurance policy if you use the car less than them. Also, an age-based excess may apply, which means the regular excess might be $700, but the excess for drivers under 25 is $1,500.

3 other ways young drivers can save on car insurance

Look for sign up discounts

Many car insurers offer sign up discounts that can translate to $100 or more in savings. Instead of auto-renewing your exisiting policy, it can be so worth shopping around and seeing what other providers can offer you. Keep in mind, a percentage discount will often be more valuable than just a cash amount discount. Take time to run the numbers.

Be willing to make a phone call

Some insurers will be happy to negotiate on price over the phone, all you've got to do is call and tell them you're thinking of switching providers. Do some research prior so you can prove that similar products are available at a cheaper rate, if asked. This is a tried and tested tip by Finder's insurance team.

Choose a higher excess

Choosing a higher excess will lower the cost of your premium. Just be aware that this is the amount you'll have to pay if you ever need to make a claim, so be sure you can afford it.

Expert tips about getting car insurance for under-25s

What's the best car insurance for under-25s?

The best car insurance for a young driver is one that suits your circumstances and offers you the most value. That means the policy that's right for one person will be different from the one that's right for someone else.

Here's how to find the best policy based on your situation:

| Car | Which insurance? |

|---|---|

| You bought a new car or you drive an expensive one | Comprehensive insurance is likely the best level of insurance for you since it will cost you dearly if your car is totalled. It covers your car in a wide variety of situations including accidents you cause, natural disasters and uninsured drivers. Plus, if you bought your car with finance, your lender will probably require that you have comprehensive cover. |

| You have an expensive car and you drive long distances | The best policy for you would probably be a comprehensive policy, with all the options. Besides giving you the full protection of a comprehensive policy, it can also include some extra selling points such as a hire car after a bingle (if you cause the accident), sending a tow truck to you if you break down and replacing your windscreen without requiring you to pay an excess. Always check the PDS (the terms and conditions) for an insurance policy so you know exactly what's included in each one. |

| Your car isn't super expensive but you live in a high-risk area | Third party fire and theft is likely the best policy for someone who lives in a high-crime area or somewhere that's prone to bushfires – but doesn't need the full cover of a comprehensive policy. It'll cost you less than comprehensive insurance, but it still protects your car against fire and theft. Again, check the PDS of the insurance policy you're considering to make sure exactly what's covered and what's excluded. |

| You drive a banger | Third party property damage is probably the best cover for you if your car isn't worth much and you can afford to replace it. Third party property damage doesn't protect your car, but it does protect you if you damage other people's stuff – like their cars or property. |

| You live with your parents | If you don't mind driving your parents' car (and you drive it less than they do), the best option for you is to stay on your parents' policy so you can save some money. Make sure you don't end up committing insurance fraud though by having your parents do something called "fronting". |

Who has the cheapest car insurance for young people?

For cheap car insurance for young people in Australia, the cheapest policies for newer drives often come from insurers like AAMI, Budget Direct, Bingle and Coles.

However, that depends on the inclusions you want, the excess you choose and discounts, and the absolute lowest price depends on your personal details. Comparing quotes from multiple providers is recommended, as policies can vary widely between insurers.

FAQs

Sources

Ask a question

2 Responses

More guides on Finder

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

NRMA roadside assistance options compared

NRMA offers 3 levels of roadside assistance. We’ve compared the pricing and features of them all in this article.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

My son is 17. Can I insure a Subaru Forester 2007 XT turbo with him as the second driver? If so, who will insure him? Thanks

Hi,

Thanks for reaching out to us. Please note that we are not affiliated with any company we feature on our site and so we can only offer you general advice.

You’re actually already on the correct page on where you can get helpful information and where you can compare your options for your son. You may click on the name of your preferred insurance on the list to see more details then you may click on the green ‘Get Quote’ button to get in contact with them and inquire. You should be able to inquire with them on what will be the requirements.

Best regards,

Rench