Important information

On March 2023, SERVICE ONE Alliance Bank has merged with Bendigo Bank.

Existing SERVICE ONE Alliance Bank customers will be notified directly about changes to their banking.

SERVICE ONE Alliance Bank is a regional mutual bank. Buy a small share when you open a savings account to become a member. Mutual banks are operated to benefit members through better rates and fees.

On March 2023, SERVICE ONE Alliance Bank has merged with Bendigo Bank.

Existing SERVICE ONE Alliance Bank customers will be notified directly about changes to their banking.

SERVICE ONE Alliance Bank have a diverse product mix. Although they do not offer a high interest saving account with bonus interest, they have an account for you if you’re a student, on an aged pension or just looking for an everyday banking solution.

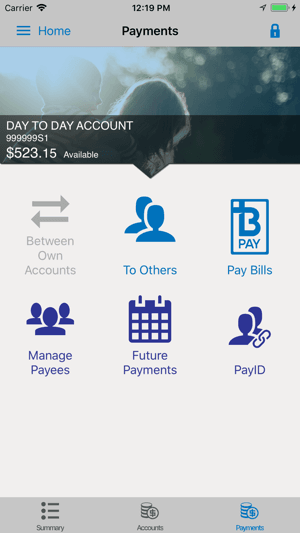

SERVICE ONE Alliance Bank let you manage your transaction and investment accounts online. This browser based platform lets you make payments to other accounts in Australia or overseas, view account balances and interest earned and make BPAY payments all from the comfort of your home, or when you’re on the go from your mobile device.

If you’re applying for a transaction or investment account in the name of more than one person, you have the option of setting the level of internet banking access for each account owner when you apply. You can choose to limit the access of signatories to view only, no access or grant full online access to the account.

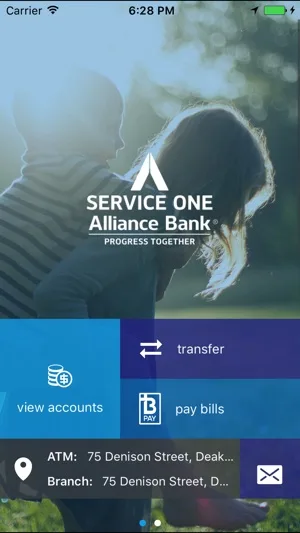

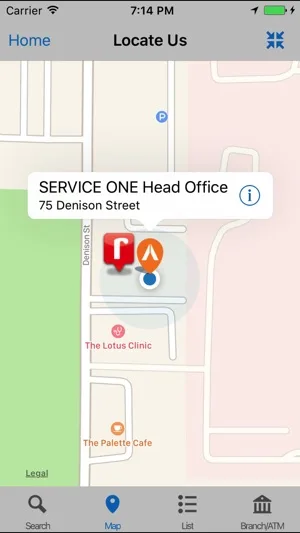

| Login Page | Payments | Locate ATM/Branch |

|---|---|---|

|  |  |

To apply for a SERVICE ONE Alliance Bank savings or transaction account, download and complete an application form and return the document to a SERVICE ONE Alliance Bank branch. If you need some extra help, an Alliance One customer service agent can guide you through the process.

When you open one of these accounts, you’ll also be registered as a member of the mutual bank. You’re required to purchase a $10 member share, which entitles you to a say in the operation of the institution.

If you have any questions about the products listed on this page, we can help answer questions about fees and features, just ask us a question using the form below.

Get an everyday transaction account for over 50s with no monthly fees, no ATM withdrawal fees in Australia and with Apple Pay, Google Pay and Samsung Pay available.

Having a local bank account makes an international student's life easier and even saves them money.

Spriggy is an app and prepaid card that helps Australian kids understand how to manage digital money, with the help of their parents.

This account offers tiered interest and easy access, and is suited for businesses that carry large balances and make minimal transactions.

Enjoy easy access to your funds and minimal fees with an Adelaide Bank MyEveryday Account. Find out more here.

Whether you’re travelling overseas or just want easy access to your funds, here’s how to find the best debit card to suit your needs.

ANZ vs Commonwealth Bank: which bank has the right accounts and services for you? Find out here.

Consider opening a Greater Bank Access Account if you want to access your money easily, at any time.

If you’re a new Australian Defence Force recruit this everyday account with the Australian Military Bank deserves your attention. Here’s why.

Opening a joint bank account is a big step for any couple. Find out more about what to look for in an account and how to avoid the common pitfalls.