Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseHow the Finder Score helps you find a better savings account

The Finder Score is a simple score out of 10. The higher a savings account's score, the better we think it is for the average customer.

We score each savings account in our database of hundreds based on a data-driven methodology with 2 main criteria: Does the account offer a high interest rate? And is it easy for savers to actually earn that rate?

Key takeaways

- A cash management account can help you keep your investment money seperate from your personal funds.

- You can use the account to receive income from investments, like rent or dividends, while earning interest on the balance.

- Cash management accounts typically have no fees, but some offer better interest rates than others so it's worth comparing.

How does a cash management account work?

A cash management account is essentially a savings account or bank account, although some financial institutions classify them as investment accounts. They're for individual investors, self-managed super funds, companies and trusts.

Some cash management accounts offer higher interest rates than standard bank accounts, but less interest than a high interest savings account.

As an account holder, you'll have easy access to funds in your account, and some accounts can be linked to online trading platforms so you can easily manage your investments.

What can you use a cash management account for?

A cash management account is ideal is you want to keep your investment cash flow separate from your personal banking. For example, you can use the account to receive your rental income from an investment property or dividends from shares.

It can also be a hub for your self managed super fund, where you make investments for the fund and receive income.

Looking for an account for your SMSF? There are dedicated SMSF bank accounts that act as a cash hub and also pay interest.

"One thing to be aware of is that cash management accounts typically don't come with debit card access. They're intended for holding your money between investment opportunities - not for day-to-day spending.

So if you'd prefer to be able to access your funds via a debit card then a standard bank account would probably suit you better - although these don't pay any interest."

How do I compare cash management accounts?

Interest rate. Some cash management accounts offer the same interest rate no matter how much your account balance is, while others offer tiered interest rates.

Access to funds. Check how you can access the money, for e.g.: does the account offer Internet banking, phone banking, cheque books, branch banking, and even BPAY?

Online trading. If you trade shares online, or if you plan to in the future, consider opening a cash management account that you can link to an online trading account.

Fees and charges. Cash management accounts don't usually attract ongoing account keeping or management fees. Some might not charge any transaction fees, and some others might offer a limited number of free transactions per month.

Benefits of a cash management account

- High interest rate. When compared to a standard bank account, many cash management accounts offer a better interest rate.

- Easy access to funds. You can access funds 24/7 via online banking, and also use your money to pay bills via BPAY.

- Ideal for SMSFs. A cash management account can simplify your tax returns, super fund accounting and long term record keeping, given that all related transactions appear on a single statement.

- Manage cashflow. It helps manage your investment cashflow by keeping your investment money seperate from your personal accounts.

Frequently asked questions

Sources

Ask a question

4 Responses

More guides on Finder

-

Australian debit card statistics

Explore how the typical Australian uses their debit card in our detailed guide to debit card statistics.

-

Virgin Money Savings Accounts

Compare Virgin Money's savings and transaction accounts.

-

Virgin Money Go Account

Virgin Money Go bank account: Pay no monthly account fees, earn points as you spend and earn bonus interest on a linked Virgin Money savings account.

-

Australian Mutual Bank savings and bank accounts

Australian Mutual Bank offer different types of savings accounts depending on your age, your goal and your financial position.

-

AMP SuperEdge Pension Account

Use your SMSF pension money wisely through an account that gives you unlimited free transactions to spend it along with interest to help keep it growing.

-

Gateway Bank savings accounts

Gateway Bank Ltd provides its members with different types of accounts, which you can choose from as per your needs.

-

Travel debit cards to use overseas

A travel debit card is just a regular Australian debit card with less international fees an charges, making it a great option to use overseas. See a range of debit cards suited for travel in this guide.

-

Best bank accounts in Australia

The best bank account will help you manage your everyday spending with low fees and easy access to your money. Check out our Top Picks curated by experts.

-

Compare Debit Cards Australia

When used wisely, a debit card provides you with great flexibility when it comes to handling your everyday financial needs.

-

ME Bank savings and bank accounts

ME Bank is an online bank that offers a high interest savings account and fee-free everyday bank account. See ME's accounts and latest rates here.

I will be receiving proceeds of sale of my home of about $1900000 and wish to invest it for about 2 months when I will be paying most of it as balance owing on a retirement unit I am buying. I want to maximise my interest for this period and seek advice.

Hi Mary,

Thanks for getting in touch with Finder.

You might want to consider storing your money in a high-interest savings account.

On that page, you will see a table that allows you to conveniently compare high-interest savings accounts. Click on the “Go to site” button when you finally found a product that fits your needs and preference. Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

I hope this helps. Should you have further questions, please don’t hesitate to reach out again.

Have a wonderful day!

Cheers,

Joshua

Please advise which Bank will open a Cash Management account with cheque book facility and pay interest on total balance on my self managed super fund account

Hi Alexander,

Thank you for your inquiry.

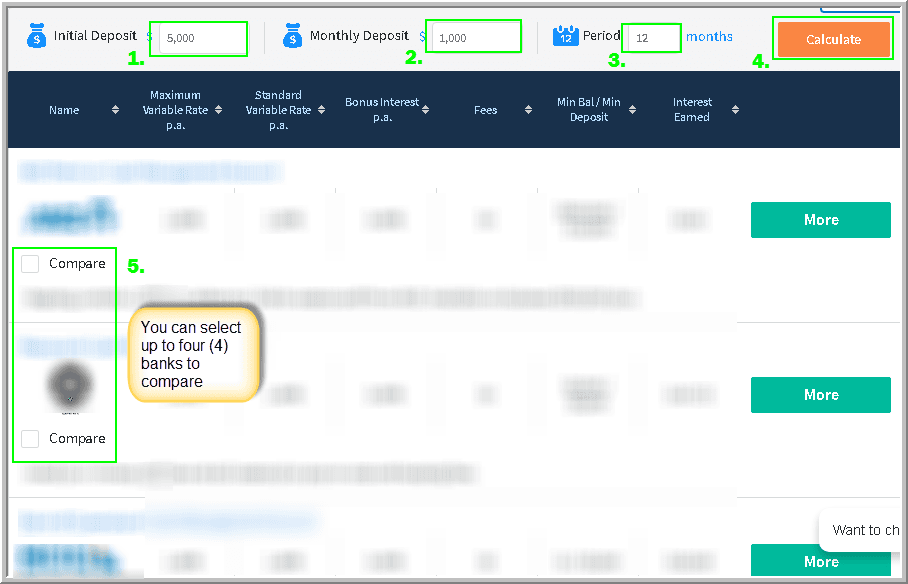

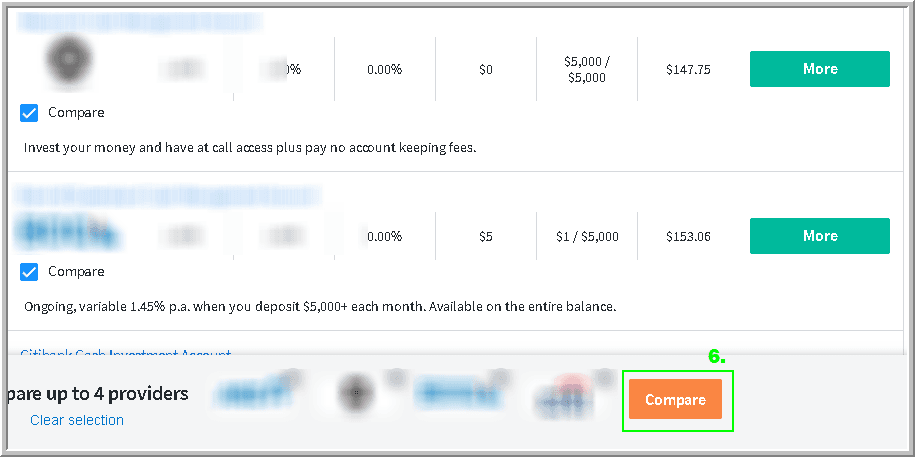

While we cannot recommend what is best for you, we can offer you a general information. As per checking you are already on the right page where you can compare the banks that offers Cash Management account. You can follow the process provided below to optimize your comparison procedure.

I hope this information has helped.

Cheers,

Harold