First Choice Credit Union merged with Beyond Bank.

First Choice Credit Union Members was merged with Beyond Bank on 1 February 2024. Please find Beyond Bank products here.

First Choice Credit Union Members was merged with Beyond Bank on 1 February 2024. Please find Beyond Bank products here.

Formed in 1970 as Calare Credit Union, First Choice serves all residents of New South Wales (NSW), providing them with an alternative to the larger Australian Banks. You can visit them at their main office in Orange, or at any of their other five locations in NSW to open an account and begin small banking with big benefits.

First Choice Credit Union structures their savings products in a unique manner, encouraging you to continue saving by not paying interest when your balance falls below a certain amount. Interest payments are also different, and while calculated on your minimum monthly balance, in most cases will only be credited to the account annually. These are important features to think about when looking for a savings account that maximises your financial growth potential.

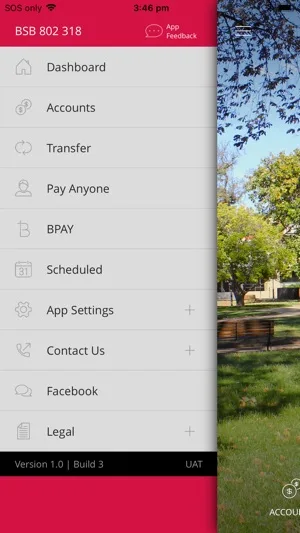

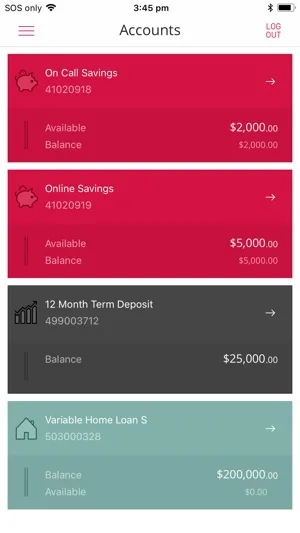

| Login | Menu | Accounts |

|---|---|---|

|  |  |

With First Choice Credit Union you can make a term deposit investment of $500, at a competitive fixed rate of interest. Term periods start at three months and go up to one year, with interest payments limited to maturity only.

With the exception of the Online Saver and Mortgage Offset accounts, you must visit a First Choice Credit Union Branch in order to open an account in your name. In addition to having to be a member first, you also need to be an Australian resident with an Australian mailing address. The age requirement and amount of initial deposit will differ depending on the account that you are applying for. When going to visit your local branch, have with you a photo identification document as well as your tax file number (TFN) to avoid having a withholding tax deducted from your interest earnings.

Get an everyday transaction account for over 50s with no monthly fees, no ATM withdrawal fees in Australia and with Apple Pay, Google Pay and Samsung Pay available.

Having a local bank account makes an international student's life easier and even saves them money.

Spriggy is an app and prepaid card that helps Australian kids understand how to manage digital money, with the help of their parents.

This account offers tiered interest and easy access, and is suited for businesses that carry large balances and make minimal transactions.

Enjoy easy access to your funds and minimal fees with an Adelaide Bank MyEveryday Account. Find out more here.

Whether you’re travelling overseas or just want easy access to your funds, here’s how to find the best debit card to suit your needs.

ANZ vs Commonwealth Bank: which bank has the right accounts and services for you? Find out here.

Consider opening a Greater Bank Access Account if you want to access your money easily, at any time.

Manage your finances right from your smartphone with a mobile banking app. Review the mobile banking offerings of the major banks and leave a review of your own.

Opening a joint bank account is a big step for any couple. Find out more about what to look for in an account and how to avoid the common pitfalls.