Knowing what to do after a car accident can be overwhelming, but follow these 6 simple steps and it'll be a lot easier for you and anyone else involved.

1. Secure the area

A car accident can be a real shock to the system, but being as calm as possible will only help you. First things first, you'll need to stop safely. Then ask yourself the following questions:

- Do you or anyone else require medical assistance? If anyone is injured, call 000 immediately for an ambulance.

- Apply first aid, if you know how to, and make the person comfortable

- If spinal or head injuries are suspected, don’t move them under any circumstances and wait for the ambulance to arrive

- Is the surrounding area safe? Make the area safe to prevent another accident from occurring. Secondary accidents account for many of the accidents that occur on Australian roads.

- Is the car safe? Make sure that there are no hazards such as leaking fuel or debris lying on the road.

- Is the car still running? Make sure engines are switched off.

- Can you move the vehicles? If it’s safe to do so, you should move the vehicles involved in the accident to the side of the road and put on your hazard lights.

- Have you called the police? Call the police if someone has been injured or if there is third-party property damage where the owner is not present. The police should also be notified if there is any suspicion of drugs or alcohol being involved in the accident.

2. Collect details and information

The next step is to exchange details with other drivers involved in the accident. Details you should exchange include:

- Full name

- Residential address

- Mobile phone number

- Driver's licence number

- Registration number

- Insurance details (including name of insurer and policy number).

Ideally, you’ll have a notepad and pen in your glovebox for this purpose. You could also take notes on your phone. Some insurers also now have mobile apps to help with the accident-recording process.

If you have your mobile phone, take photos of the accident scene. As well as the scene itself, these pictures should include the damage to your car, damage to other vehicles and any third-party property damage.

3. Call your insurer

If possible, call your insurance company from the accident scene. They will be able to talk you through the process and advise you of your next steps. You will usually be advised to not admit liability to anyone.

This is because you may be in a state of shock or may not be fully aware of the circumstances of the accident. It is not up to you or anyone else at the scene to determine if an accident's your fault. This should be left to the police and car insurance companies to decide at a later date.

Even if no one is hurt or the damage is only minor, you should still report an accident to your insurer. This is in case the other party involved decides to make a claim against you, or you develop an injury or discover further damage to your vehicle at a later date.

4. Take care of your vehicle

If your vehicle is damaged, you will need to determine whether it is roadworthy before driving it away from the scene of the accident. Damage may be obvious in the form of a flat tyre or punctured radiator, but other damage may be harder to determine, such as steering or brake problems. Check your vehicle over thoroughly before driving it. If there is any doubt about its roadworthiness, do not drive it away from the scene.

If your vehicle is not driveable, tow trucks attending the accident may try to convince you to let them take your vehicle to a panel shop they are affiliated with. Do not let yourself be talked into anything you don’t understand or trust. Under no circumstances should you sign a contract, as it may be committing you to having your vehicle repaired at a particular panel shop.

Ask your insurer what you should do. You will generally be directed to an approved panel shop, which the tow truck should take your vehicle to.

Must read: Police Assistance Line

If your vehicle requires towing from an accident where the police were not called to attend, you must report the accident to the Police Assistance Line on 131 444 within 24 hours of leaving the crash site. Failing to do so could lead to you being fined, getting demerit points or worse.

5. Making a claim

The final step after an accident is to make a claim with your insurance company. If your vehicle was towed to a panel beater approved by your insurer, repairs will usually be authorised fairly quickly.

On the other hand, if your vehicle is driveable after the accident and only needs minor repairs, your insurer may require you to obtain at least two quotes (sometimes three) from different panel shops, from which they will choose the lowest quote.

Whether you choose to make a claim at all will depend on the cost of repairs compared to any excess you must pay (the amount you must contribute to a claim) and the effect a claim would have on your no-claim bonus. Many people choose not to make a claim on repairs under $1,000 for these reasons.

6. Post-accident recap

The main things to ensure after an accident include making sure:

- The area is secure and everyone is safe

- Those who are injured are attended to and an ambulance is called

- The police are called if necessary

- Your insurer is contacted as soon as possible

- Everyone involved exchanges information.

Finder survey: How many Australians have used dashcam footage as evidence in a car insurance claim?

| Response | |

|---|---|

| No - I have never had to make a claim | 55.27% |

| No - I had to make a claim but didn't use dashcam footage | 34.99% |

| Yes | 5.17% |

| I don't own a car | 4.57% |

Receive a quote for car insurance

Compare other products

We currently don't have that product, but here are others to consider:

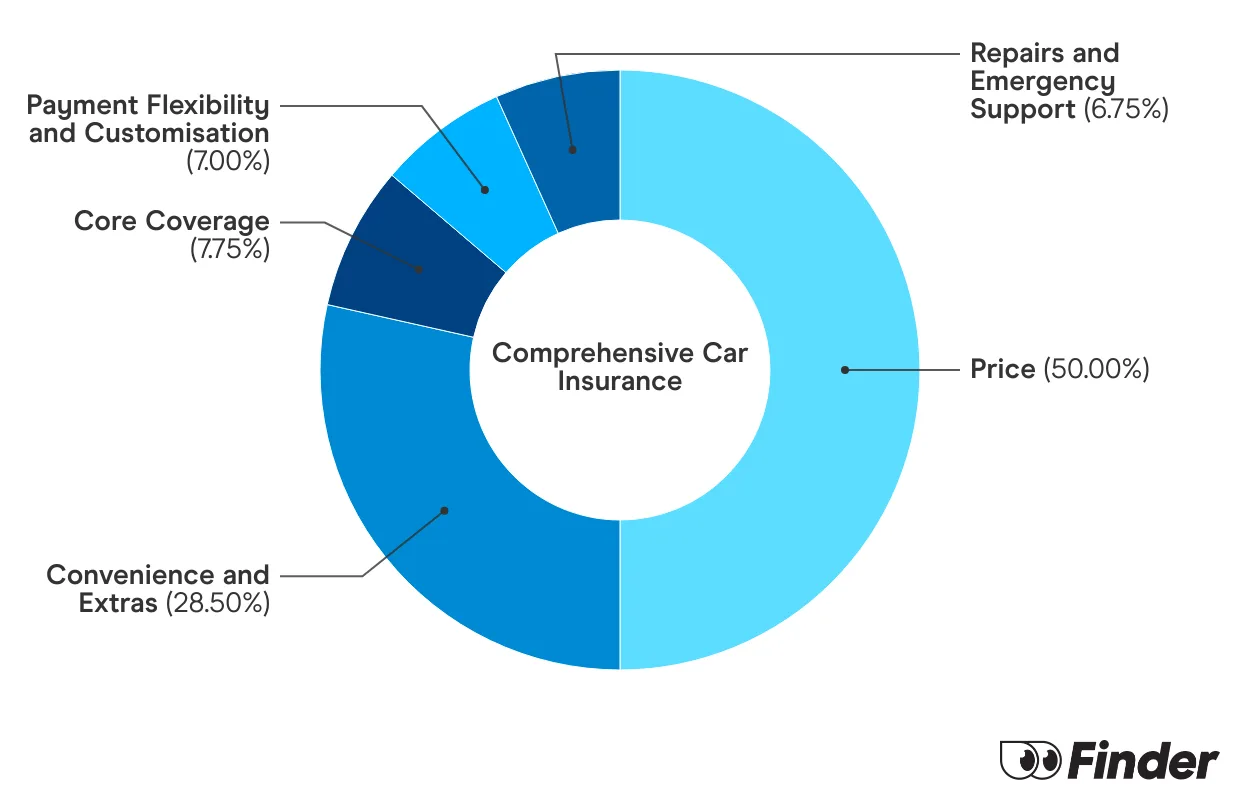

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Sources

Ask a question

2 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

I was sold a new car from the dealership, with apparent insurance coverage, roadside assist, and warranty for the next 7 years. I have contacted them endlessly in order to get information as to what coverage and what insurance, and they have not ever responded. How do I report a vehicle for hitting mine?

Hi Laura,

Thank you for getting in touch with Finder.

Were you able to get the other driver’s details? If not, to help ensure the success of your claim, you’ll need to gather as much evidence as you can. There are several steps you can take to try to track them down, including:

Please contact the business to explain the problem and the outcome you want. In many cases a simple phone call or visit can fix the problem. It is a good idea to write a complaint letter — that way, the seller is clearly aware of the problem and what you want, and you also have a record of your contact.

If you are still having difficulty resolving a problem, you may want to seek assistance. The best place for where to go for consumer help will depend on your circumstances.

I hope this helps.

Have a great day!

Cheers,

Jeni