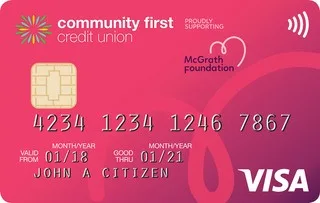

This low-cost Community First credit card gives you a way to show support for breast cancer, as half of the $50 annual fee is donated to the McGrath Foundation every year.

Community First Low Rate Pink credit card

We currently don't have this product on Finder

- Balance transfer rate for 12 months with no balance transfer fee

- 0% p.a.

- Purchase rate

- 8.99% p.a.

- Annual fee

- $50 p.a.

- Interest-free on purchases

- Up to 55 days

Our verdict

Save with low interest rates and a 0% balance transfer offer while supporting the McGrath Foundation.

Pros

-

A low annual fee of $50 p.a. of which half is donated to the McGrath Foundation

-

0% p.a. for 12 months on balance transfers

-

Same low interest rate of 8.99% p.a. on purchases, cash advances and balance transfers

Cons

-

Charges a 3% international transaction fee

Details

Product details

| Product Name | Community First Low Rate Pink credit card |

| Balance transfer rate p.a. | 0% for 12 months, then 8.99% |

| Purchase rate p.a. | Purchase rate p.a.8.99% |

| Interest-free days | Up to 55 days on purchases |

| Cash advance rate p.a. | 8.99% |

| Min credit limit | $500 |

| Card type | Visa |

Eligibility

| Available to temporary residents | No |

| Joint application | No |

Rewards

| Bonus points | N/A |

| Rewards points cap |

Fees

| Annual fee | $50 |

| Minimum monthly repayment | 3% of the closing balance or $20, whichever is greater |

| Late payment fee | $25 |

| Foreign currency conversion fee | 3% |

| Cash advance fee | $2 |

| Overseas cash advance fee | 5% |

| Overseas ATM withdrawal fee | $5 |

| Additional cardholder fee | $0 |

Sources

Your reviews

Amy Finder

Journalist

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Sarah Megginson Finder

October 13, 2025

Hi Yash,

If you use the card to pay, you will only have up to 55 days. If you pay the fees on a different card and then transfer that balance to this card as a balance transfer, you will pay 0% on the balance transfer for 12 months. You can repay it however you like over 12 months in instalments, provided you make the minimum repayment amount each month. Hope this helps!

Show more Show less

Nicole

August 14, 2019

How l can apply for this credit card?

Jhez Finder

August 14, 2019

Hi Nicole,

Thank you for your comment.

You can apply for the McGrath Pink Visa online by filling out a secure application form on the Community First website. Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you.

Regards,

Jhezelyn

Show more Show less

Rosalea

August 04, 2019

What is the maximum balance transfer?How do i go about doing this? I live in a small town with only the three main banks.Is this card accepted at all atm’s?How many balance transfers can i do?

Nikki Angco

August 05, 2019

Hi Rosalea,

Thanks for your questions.

This card has a maximum credit limit of $15,000, however, the maximum balance transfer and balance transfer frequency will depend on the bank’s approval of your application. This card is accepted in ATM’s where a Visa is accepted and note that there is a Cash Advance Rate (8.99% p.a.).

To get started with your application, check the part of our page that says “How to apply.” As a friendly reminder, check the eligibility requirements of the card before proceeding with your application. Also, read about its features and benefits and see how it fits your financial needs. Additionally, it’s helpful to review the PDS and Terms & Conditions of the card before fully committing to the card. You may also reach out to the bank if you have any clarifications.

Hope this helps!

Cheers,

Nikki

Show more Show less

Robert

January 13, 2019

I would like to credit card that has low interest rate, no annual fees, no atm fees and low if any foreign currency withdraw fee.

Also is there a loyalty card that can provide this?

Nikki Angco

January 15, 2019

Hi Robert,

Thanks for getting in touch! Those features you want are all available in cards but not all 4 will be available in one card. Below are the links you can review:

Credit card with low interest

Credit card with no annual fee

Credit card with no annual and foreign transaction fees

These pages have a comparison table you can use to find the card that suits you. When you are ready, you may then click on the “Go to site” button and you will be redirected to the bank’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Best,

Nikki

Show more Show less

Sinai

March 31, 2018

How to become a member in order to apply for a McGrath Pink visa card? How do I get an application for the credit card?

Thanks.

Jeni Velasco Finder

March 31, 2018

Hi Sinai,

Thank you for getting in touch with finder.

Community First Bank issues these cards, so you can apply by visiting any Community First service centre, and you can also apply online and over the phone. To apply online, start by visiting the McGrath Pink Visa website, but only after making sure you meet the eligibility criteria such as you must be over 18 years of age, you are an Australian citizen or permanent resident and you have a good credit history.

I hope this helps.

Have a great day!

Cheers,

Jeni

Show more Show less

Yash

October 12, 2025

So, if I use the card to pay my University fees then do I get 12 months of period to repay or just 55 days?

Also does this allow me to repay in lump sum or installments?