Key takeaways

- Home insurance isn't likely to cover you for preventable events that lead to foundation damage.

- Foundation repairs are only covered when the damage is from specific events including fire, natural disasters, and malicious damage.

- You should think about your property's risk and location when you're buying home insurance.

Does home insurance cover foundation repairs?

Home insurance can help you pay for significant costs that can come with any foundation repairs that need to be made to your property. However, most policies will only cover you if the damage is caused by specific events like fire, lightning, and floods.

Foundation repairs can include things like crack filling, wall bracing, or preventing your house from sinking. However, with home insurance covering a wide range of events, it can be hard to know if your specific foundation repairs are included.

We’ve broken things down into the most common situations where home insurance will cover your foundation repairs.

When can home insurance cover foundation repairs?

If your home insurance covers whatever caused the foundation damage, then it'll pay out for the foundation repairs too. Your product disclosure statement (PDS) will tell you everything your policy covers. Common inclusions are:

- Fire

- Impact (for example, a vehicle, or falling tree)

- Lightning

- Storms and rainwater

- Earthquake or tsunami

- Vandalism or malicious damage

- Explosion

- Escape of liquid

- Floods (often an extra add-on)

When won't home insurance cover foundation repair?

If your home insurance doesn't cover the event which caused the foundation damage, then it won't pay out for the repairs. What's covered by your policy will vary between different insurers – but some common exclusions are:

- Normal wear and tear

- Damage by your carelessness or neglect

- Termite damage

- Damage caused by your illegal behaviour

- Pre-existing damage

- Faulty construction

- Damage from natural events that you opted not to include

- Faulty construction

- Storm surges

- Tree-root damage

- Shifting soil

Compare home insurance options with foundation repair

Compare other products

We currently don't have that product, but here are others to consider:

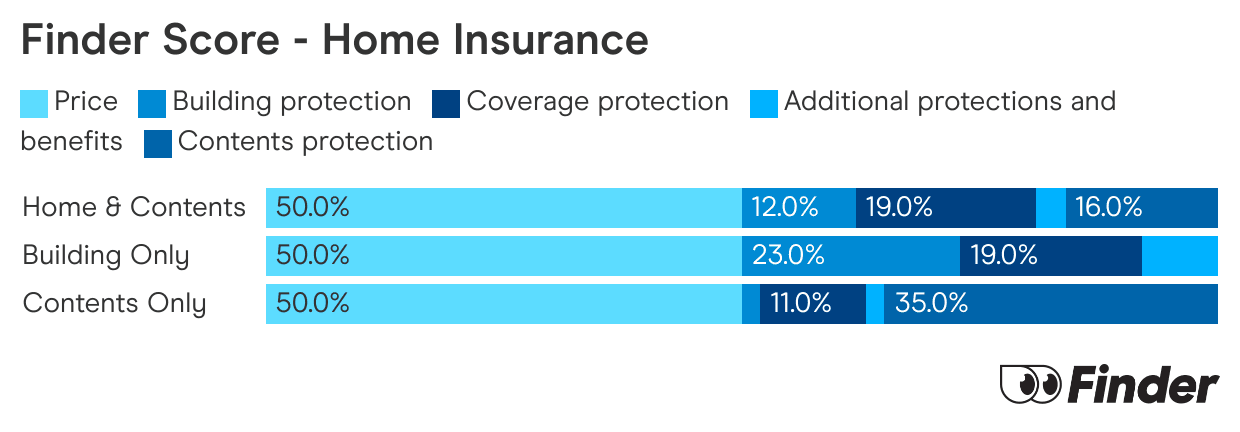

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Is underpinning covered by home insurance?

Unfortunately, the typical answer is no. Underpinning can strengthen and stabilise an existing foundation, which can be particularly helpful if a property lies on weakened soil. But, because it is a preventative measure it generally won’t be covered by most home and content policies.

From our research of Australian providers we haven’t found any that cover underpinning. However, it’s always a good idea to consult with your provider and check the Product Disclosure Statement (PDS).

Is soil shift caused by floods covered by home insurance?

Soil shifts caused by floods may be covered by your home insurance, but it’s not always straightforward. Cover largely depends on whether the flood is seen as the immediate cause of soil movement.

Soil shifts can happen for a number of reasons like earthquakes, subsidence, or erosion.

If you can show that a flood directly led to events like landslides or erosion and your policy includes flood cover, you might be able to file a claim.

However, if the flood subtly altered the soil’s condition and it shifted later, your claim might be denied, even with flood cover. Insurers often have different definitions for covered events, which can make it tricky to determine what’s included. As in most cases, it’s important to carefully review a policy’s PDS or contact your insurer to clarify the specifics of your coverage.

What are my options if I'm not covered by insurance?

More often than not, if foundation damage happens to your property and the cause of damage isn’t covered by your insurance, you’ll have to pay for the repairs yourself. This can include any specialists or engineers to assess the damage and recommend repairs, so it can be a costly expense.

But before you decide to start the process, it can be helpful to reach out to a foundation specialist for a second opinion if your claim gets denied. For instance, if your insurer suggests that flooding was an indirect factor in causing the damage, a specialist might be able to clarify that it was, in fact, the direct cause.

Find and compare Australian home insurance providers with Finder today.

FAQs

Sources

Ask a question

More guides on Finder

-

National Seniors home insurance review

If you're over the age of 50 and are looking for the right home insurance policy, National Seniors could be one to consider.

-

Home Insurance Victoria

Be ware of the unique risks faced by Victorian homeowners. Discover how to find a home insurance policy that gives you the cover you really need with this handy guide.

-

RACV home insurance

Find out what you will be covered for with RACV Home Insurance.

-

NAB home insurance review

A review of NAB's home and contents insurance policies. Find out how NAB can cover your house and possessions, giving you peace of mind and protection against the worst.

-

St.George Home Insurance review

Compare 3 home and contents insurance policies with St.George. Get a 10% discount for the first year if buying online.

-

Bendigo Bank home insurance review

Here's a detailed review of Bendigo Bank home insurance with information on 3 cover options.

-

Bupa home insurance review

Bupa Health Members may want to consider taking out a Bupa Home Insurance policy – you can get up to 15% off.

-

Home insurance deals

Access the latest home insurance deals and special offers to save further on your policy.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.