Finder Score for car insurance

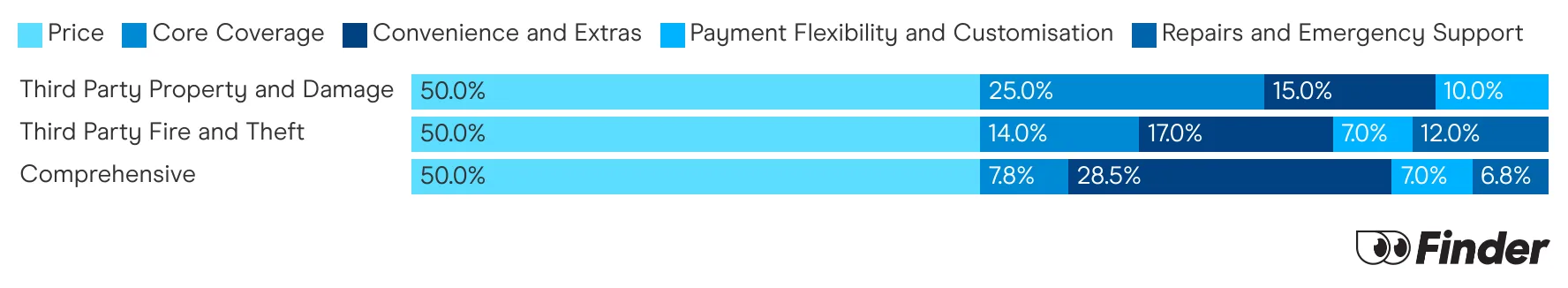

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Key takeaways

- Car insurance for backpackers is no different to regular car insurance. It's more about what options may be better suited to backpackers.

- If you're only here for a short time, you might be better off just renting a car.

- If you own or are borrowing a car while you're in Australia, you'll want insurance. More on that below.

Car insurance for backpackers

If you're backpacking around Australia and will be buying or borrowing (not renting) a car to get around, then there's a few things you need to about car insurance and driving here legally.

- You may need an International Driving Permit (IDP) if your native language is not English.

- You're legally required to have compulsory third party (CTP) cover.

- Unlike other countries, in Australia you insure the car, not the person.

- Comprehensive insurance and third party insurance is optional (CTP is different to other third party insurance). However, to avoid hefty out of pocket costs in the event of an accident, you'll likely want to get one of these.

How do I get car insurance for a backpacker?

Finding cover for a backpacker is relatively straightforward. You'll need to make sure you have a main address you can put down, as all insurers require you to have one. This is mainly so that your insurer knows where your car is usually kept, helping them calculate your premium. If you're worried that you won't be in one place long enough to have a main address, call the insurer and they'll let you know how to navigate that.

Driver's license requirements

You must have a valid driver's license on you at all times while driving. Whether you can use an overseas driver's license depends on which state you're in and how long you'll be staying. In all cases, you must meet the following criteria:

- Your overseas license must be current and valid. Any conditions that apply to your overseas license will also apply in Australia.

- You will need a certified English translation or an International Driving Permit (IDP) if your license is in a language other than English.

- New Zealand residents are treated as interstate drivers for licensing purposes. If you have registered your vehicle in a different state or if your visa status changes to permanent, you are subject to interstate driving rules.

- The interstate license rules for permanent visas apply when you are officially a resident of that state, regardless of whether you are in it at the time.

- If your overseas license expires during your visit, you should apply for a local license.

- While every effort has been taken to ensure the accuracy of this information, you should check for information specific to your situation and location at the relevant website.

Best car insurance for backpackers

Most backpackers plan on doing quite a bit of driving on their trip, so it's worth considering getting cover for the following:

- Roadside assistance: If your car broke down while driving across Australia and you'd have no friends or family here to help you then roadside assistance should be high on your list when looking for features to consider in a car insurance policy.

- Bad weather: Anyone who isn't from Australia is in for a shock when they see how quickly the weather can turn on its head. Having storm cover, hail damage, fire and flooding is great to have if you will depend on your car while travelling.

- Contents inside the car: Backpackers with cars usually keep most of their belongings inside their car when moving across the country. If you have any expensive items – phones, laptops, clothes, passport – getting cover for them might be a wise choice.

- Accidents: Comprehensive cover is the only policy that will actually protect your car in an accident. If your car is very cheap, this might not be a concern to you. However, even if it is, repairs could be expensive, which a comprehensive policy could help cover.

- Hitting an animal: It's actually very common for cars to hit kangaroos on Australia's more remote roads. This can do serious damage to your car, so it might be worth making sure it's covered in your policy.

- Baby boomers: $104

- Gen X: $132

- Gen Y: $172

- Gen Z: $188

Backpacking on a budget? Here's how to find a cheap car insurance policy

"There's a number of ways to reduce your car insurance premium so you can save your cash for making memories. 1. Increase your excess: The higher your excess, the lower your premium will be. 2. Restrict drivers: Only let drivers over the age of 25 behind the wheel. This will make your premium cheaper. 3. Look for sign up discounts: Most providers have a sign up discount for new customers — this can help you save hundreds"

Compare car insurance policies

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFAQs

Sources

Ask a question

2 Responses

More guides on Finder

-

Cheap Car Insurance Australia

Here's a guide to getting affordable car insurance that will still cover the essentials.

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Do demerit points affect your car insurance?

Your guide to demerit points and how they affect your car insurance.

-

Bank of Queensland Car Insurance Review

Bank of Queensland car insurance offers three levels of cover, flexible premium payment options and a lifetime guarantee on repairs.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Best Car Insurance Australia

Explore our analysis and see how you can find the best car insurance for your needs.

-

Comprehensive car insurance in Australia

Compare cover from a range of car insurance providers and find out some of the things you will be covered for under a comprehensive policy.

hi, how can I find a car insurer that will cover me whilst on working holiday visa subclass 417?

Thank you :)

Hi Becky,

Once you know what car you’ll be driving and where you’ll be staying, you should be able to start getting quotes. If you’re unsure about how to answer any of the questions in the forms online, you can always give the insurer a call and they’ll be able to help you.

Good luck!

Peta