Key takeaways

- Finding home insurance for an older home can be difficult and expensive, but not impossible.

- If you're struggling to get a quote at all, getting on the phone to an insurer to talk through the specifics can help.

- It's best to consider quotes from multiple home insurers so you can know your options.

Compare home insurance

Compare other products

We currently don't have that product, but here are others to consider:

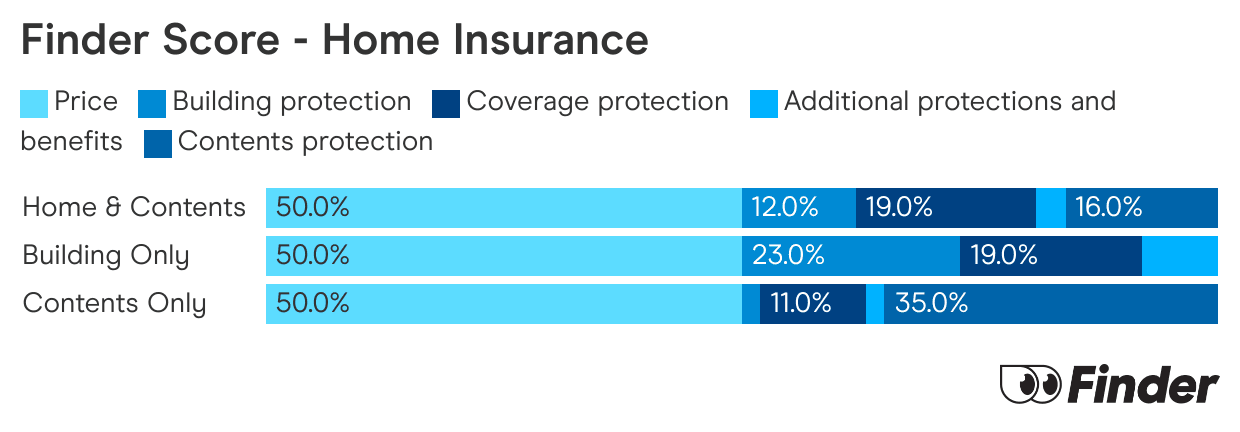

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

"I have a mid-century home that contains some asbestos, particularly in the wet areas. It's in very good condition – even builders have commented on how well maintained the property is – but a number of home insurance providers wouldn't even give me a quote. I personally found Allianz and Youi very helpful when discussing the home's age and asbestos at the time. Now when I compare cover, I always triple-check the conditions – and make sure to increase the sum insured, as the cost of replacing the property would be higher with asbestos removal."

Why are older homes harder to insure?

As a general rule, older homes present a higher risk to insurance companies. This is because:

- Older homes are more likely to suffer damage. For example, they may have been constructed with out-of-date materials that simply won't stand up to storm damage. Or the plumbing and electrical wiring may have deteriorated, which can cause expensive damage.

- Renovations. If you plan to renovate your older home, additional insurance cover may be needed and this can be expensive. Be aware that a regular home insurance policy may not cover you during renovations and it could cost you more to find a policy that offers the right coverage. At a minimum, you need to let your insurer know that you're renovating so they can discuss how extensive the renovations are and decide if your existing cover is adequate. If you do extensive renovations without telling your insurer and go to make a claim later on, it could be void.

What to keep in mind when getting insurance for an older home

- Roofing. Roof condition is one of the key factors insurers will consider when determining the cost of insurance. The age of the roof, the materials used in its construction and its current state of repair will all be taken into account. You should also be aware that claims resulting from leaky roofs caused by a lack of maintenance are commonly rejected by insurers, so you'll need to make sure you stay on top of any routine maintenance tasks.

- Wiring. If your older home is sporting an outdated electrical system, this greatly increases the risk of fire. Knob and tube wiring, common in houses more than 50 years old and especially those built before World War II, can be a particularly common cause of problems. Not only may a full house rewire be a major priority for the safety of your family, but it could also be a requirement if you want to take out home insurance.

- Plumbing. An outdated plumbing system increases the risk of flooding, so the ancient plumbing in your old home won't be seen as a feature by insurers. Before agreeing to cover you, an insurer may request that the outdated plumbing system in your home be replaced within a certain timeframe, so you'll need to factor this cost into your budgeting when working out the cost of buying the home.

- Construction. There are several other factors about a home's construction that insurers will consider when deciding whether to provide cover. For example, how secure are the home's foundations? Is there asbestos present? When was it built? It's common for insurers to send out an assessor to examine your home in person and determine the risks faced.

- Heritage-listed homes. Insuring an older home can be particularly difficult if that home happens to be heritage-listed. If a heritage-listed building is partially damaged, the cost of restoring that part of the property to match the original home can be very expensive. Many of the materials used to construct listed homes are simply not readily available, and the job may even require the expertise of specialist tradesmen, architects and other professionals.

- Wood burning stoves. From a home safety point of view, wood burning stoves and open fireplaces fall well short when compared to modern heating solutions. As a result, many policies exclude damage caused by combustion heaters and open fireplaces from cover.

FAQs

Sources

Ask a question

6 Responses

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.

My home is covered by City of Yarra Heritage Overlay HO329. My current insurer has advised that it will not provide cover. How many isurers will cover a home covered by a heritage overlay?

Hi John, we can’t provide an exact number of insurers at this stage. Unfortunately most mainstream insurers may decline to cover heritage properties, as they are more expensive or complex to repair and may require special materials. In cases like these, we recommend reaching out to an insurance broker who may be able to find you a more specialist provider. Good luck!

Could you tell me a company that will insure a 1966 Fibro House in Carnarvon please

Hi Barry,

Every insurer has a different criteria for homes they will or will not cover. Your best bet is going to be to get quotes from a few different providers and see who comes back with something that best suits your needs. If you’re struggling to find cover from anyone then it could be worth chatting to a broker as they might be able to connect you with a specialist insurer.

We are looking for home insurance for an our asbestos clad home .

Hi Richard,

Most home insurance policies won’t cover any damages or liability related to asbestos (one exception is if the asbestos is exposed due to an insured event).

However, it’s worth checking with the insurers listed on this page to see if they can provide cover for your home. If not, you may need to shop around for more specialist cover.

Regards,

James