Finder Score - Home Insurance

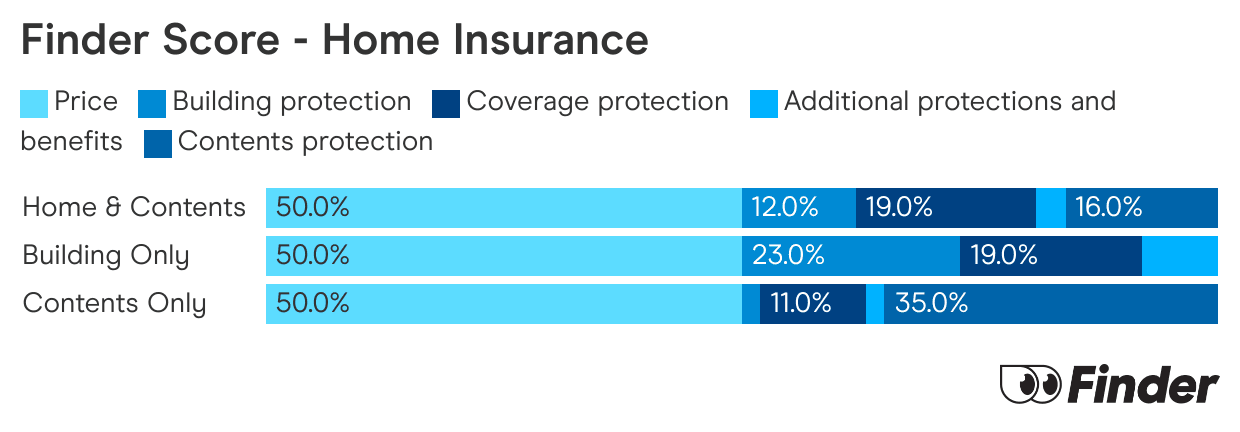

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

What is shed insurance?

Shed insurance covers your shed and the things you keep in it against damage or loss from a whole range of scenarios, including theft.

The good news is that most home, building and contents insurance policies treat sheds and other permanent outdoor structures – garages, pergolas, granny flats – like they're part of the home. This means that you can get the same levels and types of cover for your shed as you can for your main house.

Some policies will cover the shed itself, some just the things you keep in it, and some will cover the shed plus its contents.

How do I get shed insurance?

The first step is to include your shed and what's in it when you're tallying up your assets and choosing or tweaking your insurance policy. You'll have various home/building and contents insurance policies to pick from, and they'll cover your shed and its contents in various ways.

The policy that's right for you (and your shed) will depend on your situation. A suburban homeowner will have different needs to a renter who's using a landlord's shed for storage.

Why is it a good idea to get covered by home insurance?

- When you crunch the numbers, the value of what's in your shed might surprise you. Lots of the things we tend to keep in sheds – vintage furniture, power tools, lawn mowers, dusty sports equipment – can qualify as valuables.

- If you're a homeowner, you might have invested heavily in your garden and the shed itself, and storm, tree and other structural damage can be a big expense.

- Being outside and separate from the home can make your shed more vulnerable to break-ins, not to mention the elements.

What does shed insurance cover?

- Home and building policies will cover the structure of the shed, providing cover from things like storms, theft and fires.

- Contents policies will cover the things you keep inside the shed, protecting them from the same things as above.

- Combined home and contents policies can cover the shed as well as the things you keep in it.

For any valuables that you're keeping in your shed, such as a ride-on mower or an expensive bike, check the limit that the policy pays out. If the item's actual value exceeds the limit, then you can look into specified contents insurance as a way to increase the limit.

What doesn't it cover?

If you use your shed as part of your business or mainly for business purposes, your home and/or contents policy might not treat it as part of your home. Be sure to check this and ask about alternatives so your business won't affect your coverage.

FAQs

Sources

More guides on Finder

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.