Can protect permanent outdoor structures like pools, sheds and pizza ovens from physical damage

Key takeaways

- Home insurance can cover outdoor ilving areas, including permenant structures and fixtures.

- Contents insurance will cover things that aren't permenantly attached, like furtniture.

- Your outdoor structures and items need to be listed with its full value on your policy to be covered.

Protect your outdoor living area with home insurance

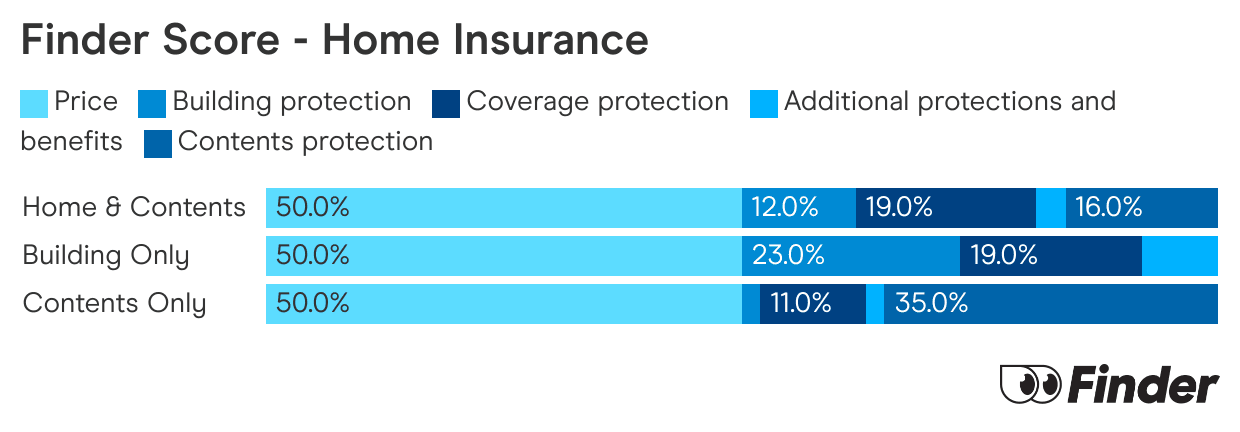

Finder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Does home insurance cover outdoor living areas?

Yes but it depends on what type of home insurance policy you have. In outside areas insurers will generally differentiate between:

- Permanent fixtures

- Things we keep in permenant fixtures like barbeques and outdoor furniture

Take a look at how each type of home insurance can cover your outdoor areas:

Can cover the things you keep in those structures and elsewhere outside like prized potted plants or a bar fridge

Provides cover for both the physical structure of your outdoor setting and the contents within it, giving the broadest protection

What's a permanent fixture?

Home insurers' definitions can vary slightly, but basically, if it's permanently attached to the property, it's a permanent fixture. Examples include:

- Outdoor kitchens (including any cupboards and drawers)

- Barbeques and cooking areas

- Pergolas and gazebos

- Decks, verandas and balconies

- Outdoor swimming pools

- Sheds and garages

- Pathways, driveways and paved and concreted areas

If one of the above is damaged or lost in an insured event, home insurance can cover it, whereas a straight contents policy won't.

Keep in mind there's a difference between:

- Fixtures, which are permanently attached to the property, like (in an outdoor kitchen) built-in shelving, light fixtures and stovetops.

- Fittings, which are freestanding and/or not permanently attached. Examples could include desk lamps, coffee tables and fridges.

Do I have to list my outdoor fixtures and items on my insurance?

Yes. Any outdoor structures, fixtures, and items you want to be covered need to be listed in your home and buildings policy. You'll also have to list the amounts they're insured to make sure you're adequetely compensated if you need to make a claim.

Because home and building insurance and contents insurance cover different things, you'll need to differentiate between permenant fixtures and their contents (including fittings) when you you list them.

What incidents will I be covered for?

With combined home and contents insurance, you can be covered for repair or replacement costs if an outdoor structure and/or its contents are damaged, destroyed or lost because of:

- Fire

- Flood

- Theft

- Storm

- Impact

- Escape of liquid from your plumbing system or water features

- Vandalism

- Theft

For example, you could be covered if:

- A barbeque or outdoor gas stove malfunctioned and caused fire damage

- A tree or branch fell and damaged a pergola, outdoor table or garden ornament

- An antique statue was stolen from your garden

You'll also have the option to include various add-ons, such as accidental damage insurance, that can broaden your cover.

When won't my outdoor living area be covered by home insurance?

Exclusions to your cover might apply if:

- You haven't listed an outdoor structure or item on your home and/or contents policy or you haven't included its full value.

- A pet damages an outdoor structure or item.

- An outdoor structure or item is damaged or lost because of something that was foreseeable and preventable (e.g. you had a backyard bonfire that got out of hand).

- An item in a garden bed is damaged or lost – home and building insurance generally ends where your garden beds start. If you have precious plants you want to insure, you can think about garden insurance.

Renovating your outdoor living area? Don't forget this!

If you're renovating an outdoor area, don't make the common mistake of forgetting to update the relevant maximum insured amounts in your policy so they'll reflect:

- The money you've spent on the upgrade

- Any new structures to be covered by your building insurance or items to be covered by your contents insurance (e.g. for a new furnished pergola and paved barbeque area)

After pouring money into a renovation, the last thing you want is for the upgraded area to be damaged and then to find you're not covered for its full value because you didn't update your policy.

Keeping the buildings, contents and all-important sums insured in your policy up to date is a key way to get the most out of your insurance.

When you do update your policy, take the opportunity to check whether you could be getting a better deal on your home insurance.

Frequently Asked Questions

Sources

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.