No-gap optical is an attractive benefit offered by some extras health insurance policies. It means you don't have to pay anything towards your new glasses, as long as they don't cost more than your annual limit.

If you have a $200 annual limit, and your new specs also happen to cost $200, you can walk away with a fresh prescription - for free!

Not all health insurers offer no-gap optical, but we've rounded up a few with limits ranging from $100-$250 so that you can compare policies at a glance.

Compare extras only policies that cover optical

Below are a few Finder partners that cover Optical in their extras policies. We've displayed the yearly limit, and they will have either a 2 or 6 month waiting period. They also include other benefits such as dental or physiotherapy. All prices are based on a single individual with less than $101,000 income and living in Sydney.

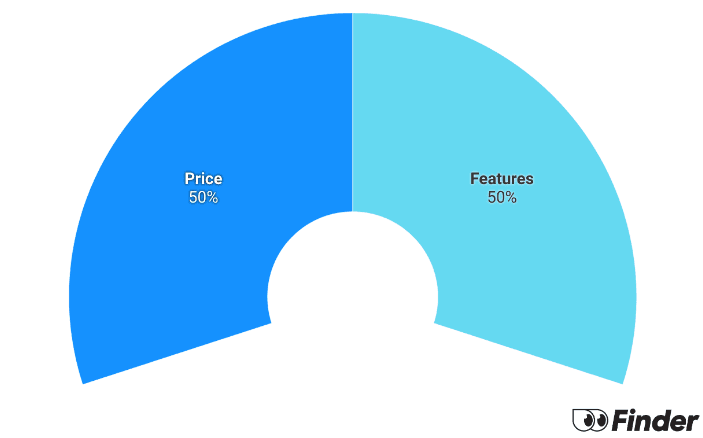

Finder Score - Health Insurance Extras

Each month we analyse over 10,000 extras insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare extras cover a bit faster.

We want to compare apples to apples, not apples to apple pie. It doesn't make sense to compare a top extras policy with coverage for hearing aids and braces against a policy designed only for dental. So we've separated all the extras policies on the market into pools and categories. Once in their pools and categories, each product gets a price score and a features score, which are then combined to give the Final Score.

Optical services and health insurance

Extras cover is available in several levels (basic, medium and comprehensive) and generally covers ancillary services such as optical, dental and physio up to set annual benefit limits.

What is the medical gap and how do I avoid it?

If a doctor charges a higher fee than the Medicare Benefit Schedule (MBS) fee for a service, the medical gap is the difference between the MBS fee and the doctor’s fee. This amount will have to be paid either by your health fund or by you.

In the case of optical services that are not listed on the MBS, the medical gap is the gap between what an optometrist charges for lenses and frames and what your private health extras cover will pay towards them.

To avoid having to pay any medical gap, you need to be with a health fund that has a no-gap scheme. A no-gap optical scheme is one where a health fund agrees to cover the medical gap if members go to a preferred optometrist or an optical dispenser with which the health fund has an arrangement. These practices charge capped prices that have been agreed upon with the health fund for a select range of lenses and frames.

Which health funds have a no-gap optical scheme?

Here are Finder's partner health funds that offer a no-gap optical option:

Table last updated April 2021

- Extras only: $44

- Basic: $105

- Bronze: $152

- Silver: $179

- Gold: $260

More guides on Finder

-

Are vaccinations covered by health insurance?

While COVID-19 vaccinations are free in Australia, other vaccines with out-of-pocket costs can be covered by private health insurance with some extras policies.

-

Health insurance for chiropractic treatment

Get discounts on your chiropractic treatment with private extras cover.

-

Health insurance for remedial massage

Remedial massage can help ease pain from general wear and tear as well as specific injuries. This treatment isn’t covered by Medicare but is included in private health insurance extras cover. Find out how private health insurance can cover you for remedial massage therapy.

-

Health insurance for blood pressure monitors

Find out when blood pressure monitors will be covered by Health Insurance and what you stand to receive in a claim.

-

Travel vaccinations and health insurance

Before you travel it's crucial to protect your health from risks found in popular destinations. Learn how extras health insurance can help pay for them.

-

Health insurance for physiotherapy

Physiotherapy services can be beneficial at any life stage, so it could be worth considering and comparing extras health insurance that can cover the cost of this type of treatment.

-

Optical health cover

Optical health cover can ensure you get the care you need to protect your eye health. Compare health insurance policies with optical cover.

-

Health insurance for non-PBS pharmaceuticals

If you're wondering what pharmaceutical costs are covered by private health insurance, we've got a guide to health cover for non-PBS pharmaceuticals here.

-

Health insurance for laser eye surgery

finder.com.au explains how the private and public health system in Australia handles optical procedures and services.

-

Health insurance with gym benefits

This guide takes a look at private health insurance in relation to gym membership and other health-related services.