Key takeaways

- Underinsurance is when you do not insure your home for the right amount.

- If your home was destroyed and you were underinsured, you may not be able to afford to rebuild.

- Insurers offer a few different ways to help you avoid underinsurance.

What is underinsurance?

Underinsurance is when someone does not have adequate insurance to cover the cost of damage or loss to their home or their belongings.

When you take out home insurance, you will be asked how much you want to insure your home for – this is typically referred to as the sum insured. This is the amount it would cost to rebuild your home if it was completely destroyed.

Say for example, you select a sum insured amount of $500,000 but it actually costs $700,000 to rebuild, you would be $200,000 out of pocket if your home was destroyed by an insured event such as a fire, storm or flood.

What happens if I am underinsured?

If you're underinsured and in a position where you have to make a claim, you won't receive the full cost for the damage done. You will only receive up to your sum insured amount.

If your home is completely destroyed, this could lead to you being thousands, or even hundreds of thousands, out of pocket – if you were to rebuild it to its original condition.

In some cases, underinsurance forces people to settle for a rebuild that is smaller than what they originally had or relocate to a cheaper area.

"According to the Cordell Construction Cost Index, the minimum construction costs to rebuild a home have increased 18% from 2019 to 2022. That includes the costs of timber increasing by 20% and cost of bricklaying alone going up by 45%. Staggering increases, especially when we consider that close to every home that requires repair or rebuild will need to use services such as these."

Tips to avoid underinsurance

Use an online calculator

Your sum insured is the amount your home would cost to rebuild if it was totally destroyed. You typically need to calculate this amount yourself so it's worth using a building and contents insurance calculator like the one offered by the Insurance Council of Australia.

Create a list of all your items

"A good habit that I recommend to customers is to go around the house and list out all of the things you own and should be included in your insurance coverage," says Angelo Azar. This is a really important step if you also have your contents insured – it helps you build a much clearer idea of how much your home and all your belongings are worth.

Check what you're covered for

Check the product disclosure statement to make sure that you're covered for demolition, removal of debris and redesign costs. A comprehensive home insurance policy, such as one offered by Budget Direct, Honey and Youi, should cover these costs in addition to your sum insured (often for around 10% or 20% of your sum insured). So for example, if your home is insured for $500,000, you will receive an additional amount for up to $50,000 or $100,000 to pay for removal of debris and extra rebuilding costs. Watch out for insurers that offer a flat fee of around $15,000 for these costs, like Everyday and Aus Seniors. This may not be enough to cover the costs.

Consider a sum insured safeguard

Some insurers offer a sum insured safeguard as an optional extra. This is a safety net that provided up to an additional 30% of cover on top of your rebuild costs (your sum insured). For example, if your sum insured is $600,000 but it costs $800,000 to rebuild your home, you would be $200,000 out of pocket, unless you had a sum insured safeguard. The other alternative is total replacement cover which pays for the full rebuild costs.

Get underinsurance protection

Compare other products

We currently don't have that product, but here are others to consider:

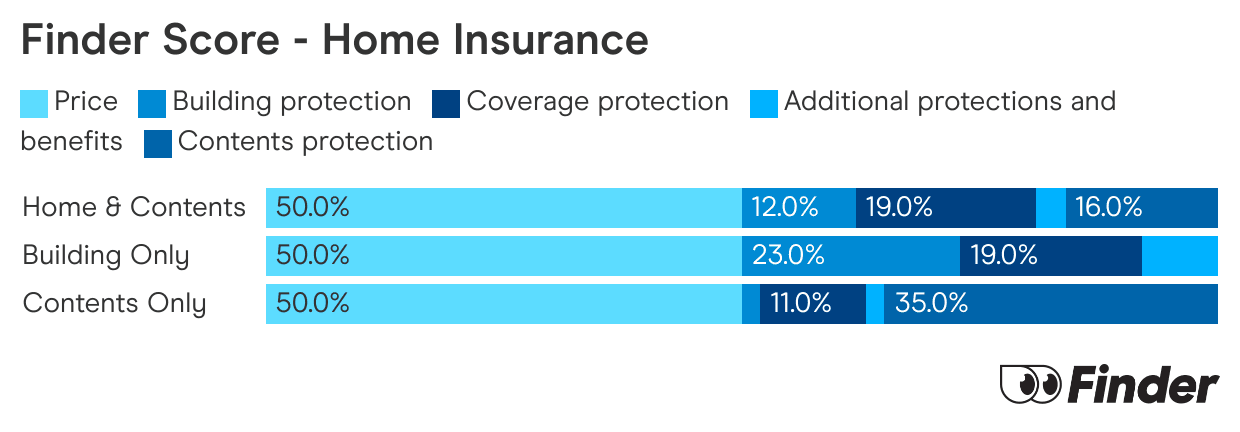

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

Frequently Asked Questions

Sources

Ask a question

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.