Key takeaways

- Spinal fusion is a major operation and can cost over $50,000 in the private system.

- Spinal fusion can be covered by Medicare or with private health insurance.

- The operation is controversial, with critics calling is 'expensive, dangerous and ineffective'.

What is a spinal fusion?

Spinal fusion is surgery which permanently connects two or more vertebrae in your spine, thereby stopping motion between them and reducing pain. During the operation, your surgeon places bone (or a bone-like material) between the space in the two spinal vertebrae. Metal plates are often used to hold the vertebrae together, so they can heal as one solid structure. Spinal fusion surgery usually takes between 3 and 7 hours, using general anaesthetic the whole time. The typical hospital stay is between 2 and 7 days.

You might need spinal fusion for:

- Spinal weaknesses. Your spine can become weak and unstable as a result of conditions such as severe arthritis in the spine or specific injuries.

- Herniated disk. After the removal of a herniated disk, you might need a spinal fusion.

- Spinal deformities. Spinal fusion is often used to treat spinal deformities such as scoliosis.

Must read: Possible dangerous of spinal fusion

Does Medicare cover spinal fusion?

In the public system, Medicare will cover the cost of medically necessary spinal surgery. You can find spinal surgery items within sub-group 17 (spinal surgery) of group T8 (surgical operations) on the Medical Benefits Schedule (MBS). Item numbers 51011 to 51171 cover various spinal surgery operations, including spinal fusions. Costs vary depending on the surgery and surgeon but for a rough guide, item number 51013 has a fee of $2,430.55.

In a private hospital, Medicare will also cover 75% of the MBS fee, with you and your private health care provider paying the rest. Fees in the private sector tend to be significantly higher than the public system, however.

How does private health insurance cover spinal fusion?

You should be able to find cover for spinal fusion with all silver tier hospital policies under back, neck and spine. Silver-tier policies cost from around $24 a week. Most policies come with a 2-month waiting period, or 12-months if you have relevant pre-existing conditions.

Hospital treatment with private health insurance for back, neck and spine usually covers the investigation and treatment of the back, neck and spinal column, including spinal fusion. This includes sciatica, prolapsed or herniated disc, spinal disc replacement and spine curvature disorders such as scoliosis, kyphosis and lordosis.

Compare health insurance that covers spinal fusions

Here are a few policies from Finder partners that cover back, neck and spine in their treatments. All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder Score - Hospital cover health insurance

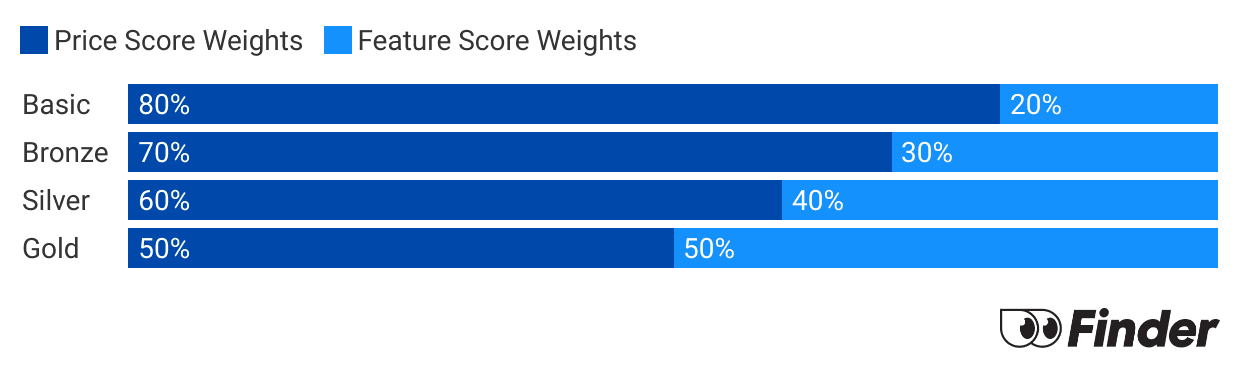

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

How much does spinal fusion surgery cost?

Spinal fusion in the private system without insurance costs from $25,000 to $58,000+. Surgeon's fees tend to be the main expense (from $14k to $35k+) but costs like hospital admission and anaesthetists also contribute. Here are some of the estimates we were able to find:

| Source | Cost | Notes |

|---|---|---|

| Medibank | $42,226 | Medibank's cost estimation comes from claims data from partner hospitals. It doesn't include additional out-patient costs. |

| HCF | $24,219 - $48,458 | HCF's cost estimate varies based on a range of gap options and whether a partner hospital is used. |

Out-of-pocket costs for spinal fusion

Before you agree to any complex procedure, make sure your health provider will cover you. Ask them about potential out-of-pocket expenses, such as consultation and anaesthesia fees. Be sure to ask for the MBS item number from the surgeon as well. That way, you'll have a good idea of any out-of-pocket expenses.

If you choose to go private, it's likely your health fund will have a No Gap scheme. Always ask the surgeon you use if they are participating in the scheme; this will keep out-of-pocket expenses to a minimum. Doctors' fees can vary significantly so it's smart to ask them about their fees before commencing treatment.

Because spinal fusion is a complex procedure, you may encounter out-of-pocket costs for an orthopaedic surgeon, specialist consultations, assistant surgeon, anaesthetist, pathologist and radiologist. Ask your health insurance provider about costs for these services before surgery.

- Extras only: $44

- Basic: $105

- Bronze: $152

- Silver: $179

- Gold: $260

Sources

Ask a question

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.