Key takeaways

- Sleep apnoea is a disorder that affects up to 2.5 million Australians.

- Private health insurance does cover sleep apnoea treatment across basic, bronze, silver, silver plus and gold policies.

- Alternatively, Medicare also covers sleep apnoea diagnosis and treatments, including sleep tests and CPAP therapy.

What is sleep apnoea?

Sleep apnoea is a disorder that occurs when a person's breathing is repeatedly interrupted during sleep. It can be a serious affliction as it restricts the body of its regular oxygen levels, and can impact long-term health in some cases. According to Rosedale Medical Practice, approximately 2.5 million Australians have been diagnosed.

What are the symptoms of sleep apnoea?

An 'apnoea' is the time when your breathing stops, and it can last anything from 10-90 seconds. While it is often hard to distinguish sleep apnoea from other sleeping problems, there are a few recognisable symptoms that you will feel consistently:

- Waking up choking or gasping

- Waking up with a sore or dry throat

- Loud snoring

- Sleepiness or lack of energy during the day

- Headaches, especially in the morning

- Forgetfulness and mood changes.

If you suspect you may have sleep apnoea, it's important to speak with your GP. They may refer you to a sleep physician for a test, known as a sleep study. This can confirm if you have sleep apnoea, or another sleep problem such as insomnia or narcolepsy.

Did you know?

80% of sleep apnoea cases go undiagnosed. If you've noticed any of the above symptoms or would say you're a "bad sleeper," it may be worth booking an appointment with your GP.

How does Medicare cover sleep apnoea?

Before you can receive a Medicare rebate for a sleep study test, your doctor will need to make sure you are eligible by asking a series of approved screening questions. This is in order to make sure you definitely have a sleep disorder and are not being misdiagnosed.

Medicare may also cover Continuous Positive Airway Pressure (CPAP) therapy if you've been diagnosed with sleep apnoea. Your doctor will determine if you are eligible for CPAP based on how effective they feel the therapy may be in your situation.

Although Medicare will cover some of the costs, you'll still have out-of-pocket expenses. These can add up each time you receive care.

How does private health insurance cover sleep apnoea?

Treatment options vary depending on your insurer, but generally private health cover can help with the following:

- Taking part in an overnight sleep study at a hospital or clinic, in order to properly diagnose sleep apnoea.

- As well as diagnosis, you'll get to choose your own doctor and hospital.

- Some policies will pay a benefit towards the high cost of purchasing a CPAP machine and masks, if your doctor recommends CPAP therapy.

- Taking part in an overnight sleep study at a hospital or clinic, in order to properly diagnose sleep apnoea.

- As well as diagnosis, you'll get to choose your own doctor and hospital.

- Some policies will pay a benefit towards the high cost of purchasing a CPAP machine and masks, if your doctor recommends CPAP therapy.

- More comprehensive cover could help with alternative treatment, such as nasal surgery or a tonsillectomy.

Some policies may cover a home sleep test. According to SleepFoundation.org, the accuracy of home sleep tests for apnoea can range from 68% to 91%.

It's also worth remembering you should always get the Medicare Benefits Schedule (MBS) number from your doctor. This lets you know exactly what you'll pay, so you are able to budget well in advance of treatment.

Compare health insurance with sleep apnoea coverage

We crunched through the policies and here are some policies from Finder partners that offer a benefit for sleep apnoea or sleep studies. To compare even more funds, use the free tool below the table. All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder Score - Hospital cover health insurance

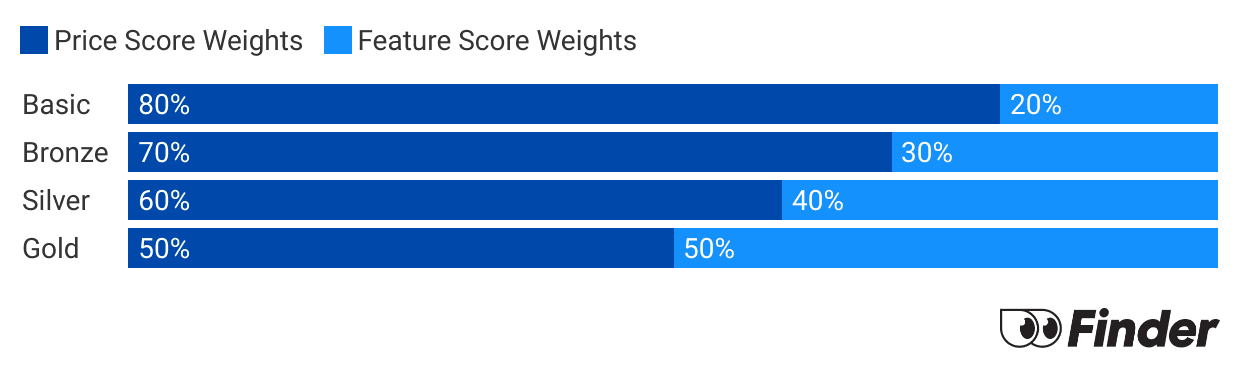

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

Frequently asked questions

Sources

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.