Key takeaways

- Gold level policies cover dialysis for chronic kidney failure, along with some silver policies.

- Policies start at about $175 per month*and all have a 12-month waiting period, so consider buying now if you have chronic kidney failure.

- Medicare can cover kidney dialysis, but the current benefit for home dialysis is just $130.85 (for up to 12 claims per year).

How much is private health insurance with cover for kidney dialysis?

Below you can find sample quotes from Finder partner funds. All policies include treatments for chronic kidney failure. All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder survey: Which conditions have Australians made hospital claims for?

| Response | Female |

|---|---|

| Dialysis for chronic kidney failure | 0.38% |

Finder Score - Hospital cover health insurance

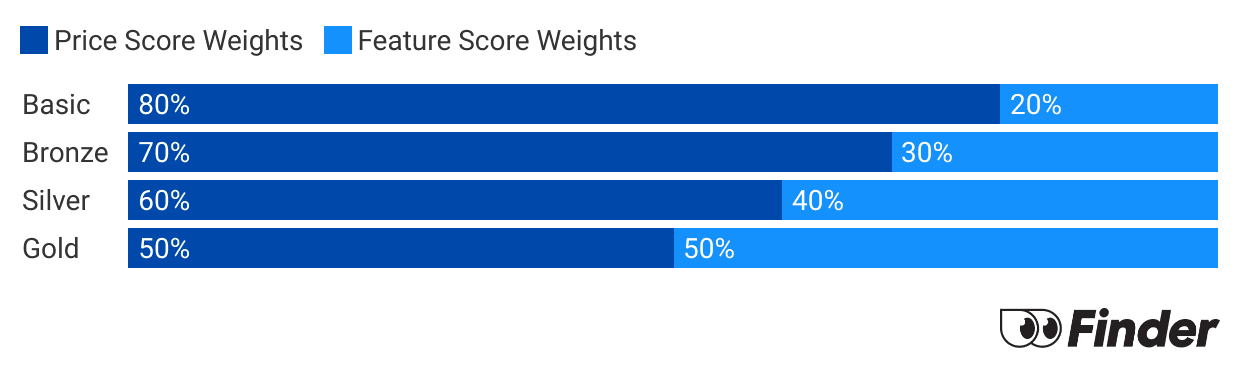

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

What is a kidney dialysis?

A kidney dialysis is a type of treatment that's used when a patient develops end-stage kidney failure. Dialysis helps to return the body to balance by preventing waste, salt and water from building up in the body. It also helps to maintain a safe level of chemicals in your blood and helps to control blood pressure.

How can I cover the cost of chronic kidney disease and dialysis treatment?

There are a number of ways for you to potentially receive benefits for chronic kidney disease and dialysis, both through the public and private health systems.

- Medicare. The government-funded universal health system includes dialysis treatment in the Medicare Benefits Schedule (MBS).

- Medicare Chronic Disease Management Plan (CDM). If you are suffering from kidney disease for six months or more and require ongoing, structured care, your GP may suggest a CDM plan, and you may be eligible for rebates to cover the ongoing cost of your treatment.

Below you can see the various types of dialysis treatment and surgical procedures covered by Medicare.:

- Dialysis for chronic renal failure

- Haemodialysis

- Haemofiltration

- Haemoperfusion

- Peritoneal dialysis

- Surgical procedures

- Explorative kidney surgery

- Private health insurance. The amount of cover you receive for kidney related treatments will depend on how comprehensive your hospital insurance is:

- Top hospital policies must pay a benefit for all procedures covered under the MBS, which includes dialysis.

- Medium hospital policies may include dialysis treatment and renal surgery but will only pay a restricted benefit.

- Basic hospital cover generally excluded dialysis treatment and renal surgery.

You can use the table below as a quick reference for seeing which levels of health insurance fully and partially cover, or exclude, kidney related treatments:

| Kidney treatment | Top hospital | Medium hospital | Basic hospital |

|---|---|---|---|

Dialysis for chronic renal failure:

|

|

|

|

Surgical procedures:

|

|

|

|

Compare health insurance in just a few clicks

Frequently asked questions

Sources

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.