Compare Delphi Bank savings accounts

If you have big plans for your financial future Delphi Bank can help you get there.

Operating under the Bendigo - Adelaide Bank umbrella, you get the best of both worlds with Delphi Bank. Australians have the security and confidence that a big bank provides combined with the personalised services that only a smaller bank offer.

On February 21, 2022, Delphi Bank started offering Bendigo Bank products to their customers to align further with Bendigo Bank's vision. Delphi Bank has been a part of Bendigo and Adelaide Bank since 2012.

Delphi Bank was formed in 2012 when Adelaide and Bendigo Banks acquired Bank of Cyprus Australia. Through them, members are able to save for a number of different needs. They offer savings products for big investors, young kids, and Australians who are trying to stay on budget. With access to an extensive ATM network and online banking features, you won't miss the big bank name with Delphi Bank.

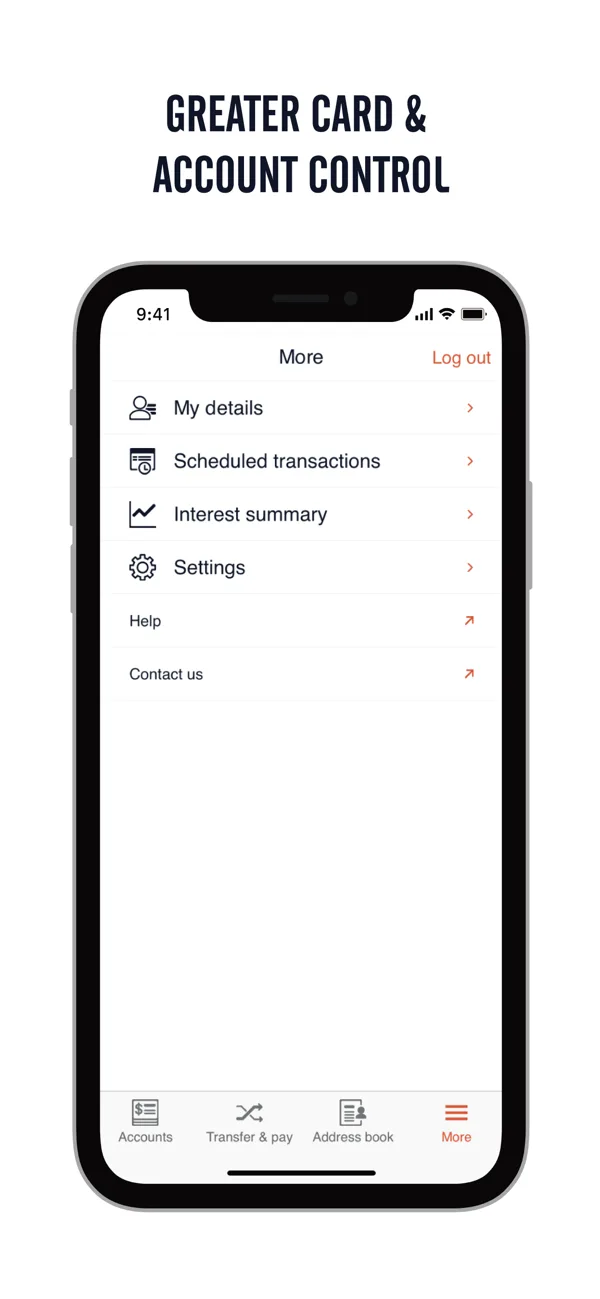

The Delphi Bank internet facility saves you time by letting you bank wherever you are and whenever you need to so long as there is a connection to the web close by. With security measures that are equal to the highest standards in the industry you can rest assured that your money and activities are secure.

In order to use the features of Delphi Bank's internet banking you will need to register for the service first. This is as simple as filling in a form and dropping it off at a local branch so that they can set up the account and issue you a special code for access.

| Login Page | Accounts | Useful Tools |

|---|---|---|

|  |  |

For any of the accounts offered by Delphi Bank you will either need to visit a branch to apply, or fill out an online form for a representative to contact you. If you do decide to stop by a branch, you should take with you identification documents such as your passport, driver's license and a current utility bill. They will also ask for your tax file number (TFN) or exemption code, which you can choose not to provide. The age requirement will be determined by the type of account you are opening, as will the opening deposit requirement.

Explore how the typical Australian uses their debit card in our detailed guide to debit card statistics.

Learn about Up and Volt in this guide as well as the difference between a digital bank and a neobank.

International bank accounts combine a lot of different benefits into one package, so read on to see if opening an international account is right for you.

Want to open a trust account to provide for your child or grandchild’s financial future? Here’s what you need to know.

You generally need to be 18 to open a new bank account online, and 14 to get a debit card in your name. Here are your options when you're a teenager.

The best bank account will help you manage your everyday spending with low fees and easy access to your money. Check out our Top Picks curated by experts.

When used wisely, a debit card provides you with great flexibility when it comes to handling your everyday financial needs.

ME Bank is an online bank that offers a high interest savings account and fee-free everyday bank account. See ME's accounts and latest rates here.

Get the right bank account for you and take advantage of student offers to cut fees and maximise perks.

Digital wallets may be the way of the future – read about what your future options could be.