Looking to sign up to nib health insurance? Combined hospital and extras policies start at around $85 a month. Plus, nib regularly offers discounts and savings when you sign up. Hooray!

Other offers and benefits for nib members

There aren't the only benefits available to nib members. As well as these limited-time offers, perks include:

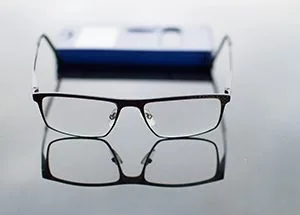

nib First Choice Optical

Health insurance

You can get discounts on a range of glasses and lenses at a nib First Choice Optical Centre.

Specsavers

Health insurance

nib has a partnership with Specsavers that gives you access to a range of discounts on single-vision glasses and lens options.

Direct debit discount

Health insurance

You get a 4% discount off the price of your health cover when you pay by direct debit.

Under 30s discount

Health insurance

If you are under 30, you will get up to 10% off nib Hospital policies.

Sources

Ask a question

More guides on Finder

-

nib extras only Health Insurance

See if nib's extras only plans provide what you need.