Key takeaways

- There are many life stages where someone would want to consider life insurance, like the birth of a child or purchasing a home.

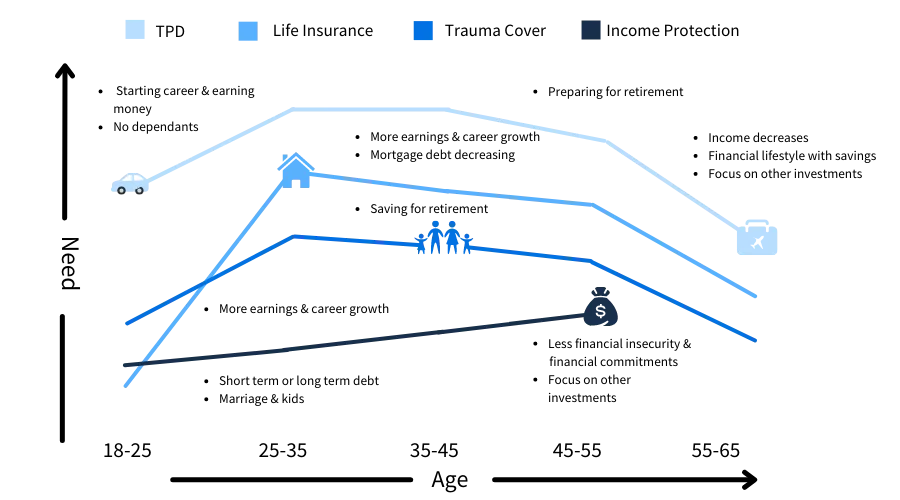

- Knowing what kind of cover you need can help you determine if or when you'll need cover.

- The amount of cover you'll need will depend on a few factors, like your age, your lifestyle and if you have any dependents.

When to think about taking out life insurance

For some, it's a no-brainer, for others, it's a head-scratcher.

Determining if or when you need life insurance is not as easy a question as it sounds. It means having to consider a time when you're no longer here or can no longer work. According to NobleOak, 60% of Australians now hold some form of life insurance or income protection insurance.

Whether you're 21 and single or 50 and married with children, different life stages call for different outcomes. Here are some of the most common life stages where people begin thinking about life insurance:

- You landed a new job. A new role with a new salary can prompt many Australians to consider income protection insurance. This allows you and any dependents to maintain your lifestyle if you were no longer able to work due to sickness or injury.

- You're self-employed. If you work for yourself, income protection can be vital, as self-employed workers don't receive workers' compensation.

- You're newly married. If you've recently gotten married, you may want to purchase life insurance to protect your spouse if something were to happen. This ensures they'd be able to maintain their current lifestyle and keep up with major bills and expenses.

- You've had a baby. Becoming a parent is a major milestone for many. But it also means you now have someone depending on you. Life insurance ensures your child can continue to live comfortably if you pass away or become seriously injured or sick.

- You've bought a house. Between mortgage repayments and keeping up with repairs, purchasing a house is a costly investment. Life insurance means your loved ones will be able to financially keep up with these financial demands.

- You're young and healthy. Younger Australians may want to get ahead and take out a policy when they're young to secure lower premiums. It can also help you avoid exclusions later on as you age and your health condition changes.

Based on where I'm at in life, what type of cover do I need?

Everybody is different and cover requirements will change based on the events you encounter at different life stages. But still, it's worth a look at a more detailed overview of key times many decide to take out cover based on their life stage.

Different types of life insurance

Here are the main types of life and income protection cover you can get:

Life cover.

Term life insurance provides a lump sum benefit to your beneficiaries in the event of death or after the diagnosis of a terminal illness. You can get this insurance as a standalone policy, or bundled with more cover options.

TPD insurance.

Total permanent disability (TPD) insurance provides a lump sum benefit if the policyholder suffers a disability as defined in their policy.

Trauma insurance.

Provides a lump sum benefit if the insured suffers a medical trauma that is specified in their policy. Most policies will cover up to 50 different conditions including strokes, cancer and heart attacks.

Funeral insurance.

Funeral insurance provides a lump sum benefit to cover funeral costs and other outstanding expenses. The maximum amount of cover that can be taken out is usually about $15,000.

Income protection insurance.

Income protection offers an ongoing benefit of up to 70% of the policyholder's regular income if they are forced to take time off work due to illness or injury. This benefit is usually paid monthly.

How much life insurance might I need?

The amount of life insurance you need depends on your personal circumstances, such as your age, and the type of cover you want. Start by coming up with an annual sum you'd need to cover your financial commitments. Some experts say the amount of cover you'd want is at least 10 times your annual salary. But it's really up to you to decide how much your family would be comfortable with based on your situation.

You could also check to see if you already hold some life cover, such as via employment benefits. See how much that would pay out to your dependents and then calculate how much extra they might need.

Don't I get life insurance through my superannuation?

Yes, life insurance is automatically added to your super account if you're over 25 and have $6,000 or more in your account. The premiums for this insurance are deducted from your super balance unless you opt out and cancel your policy. Death cover, TDP cover and income protection cover are available through your superfund.

While many Australians choose to rely on this insurance, it might not give you the flexibility you need. The major benefit of purchasing a life insurance policy directly from an insurer is that you'll have greater choice in taking out the exact type of cover you need.

It's also worth noting that paying for life insurance through your super reduces your retirement balance, which can be an issue if you have no other investments that provide passive income.

What to consider before purchasing life insurance

Before you start shopping around on life insurance, there are a few things to keep in mind. By law, life insurers are required to provide prospective customers with a product disclosure statement (PDS). This gives you an opportunity to learn everything you are covered and not covered for.

Other things to investigate during your search include:

- The waiting periods that apply before you can make a claim

- What the process is for making a claim

- What to do if you need to make a complaint about a claim or a decision

Compare life insurance quotes from more direct brands

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score - Life Insurance

Life Insurance is a little complicated and a lot overwhelming. That's why we made the Finder Score, to make it easier to compare Life Insurance products against each other. Our experts analysed over 30 products and gave each one a score out of 10.

But a higher score doesn't always mean a product is better for you. Your situation is unique, so your policy choice will be too. Don't think of Finder Score as the final word, but as a good place to start your life insurance comparison.

Frequently asked questions

Sources

More guides on Finder

-

Budget Direct Life Insurance review

Budget Direct's life insurance offers a high maximum cover limit, decent policy add-ons and competitively-priced cover.

-

Best Life Insurance Australia

Read our comprehensive guide to finding the best life insurance policy for your situation.

-

ahm life insurance review

Read our comprehensive review of ahm Life Insurance to find out if it's right for you.

-

Life insurance rewards programs

Here are some of the health reward programs and discount schemes available from Australian life insurance brands.

-

TAL Life Insurance Review

Compare TAL life insurance policies and receive a quote for cover for the different policy options available.

-

Life Insurance Deals and Discounts February 2026

Find the latest life insurance deals and discounts from Australian brands.

-

Medibank Life Insurance Review

Choose a flexible life insurance policy that meets your needs with Medibank life insurance.

-

AAMI Life Insurance Review

Compare policies on offer from one of Australia's leading general insurance providers, AAMI.

-

Is life insurance worth it?

Having the right life insurance policy is invaluable if something happens to you unexpectedly. Find out what makes your policy worthwhile.

-

NobleOak life insurance review

Looking for a direct insurance company that offers affordable, straightforward cover options? Discover the benefits of NobleOak life insurance.