Pros

- Cheaper when you first take out a policy.

- Good for people who don't want life insurance long term.

Cons

- It usually costs more long-term.

- It can become unaffordable as you get older.

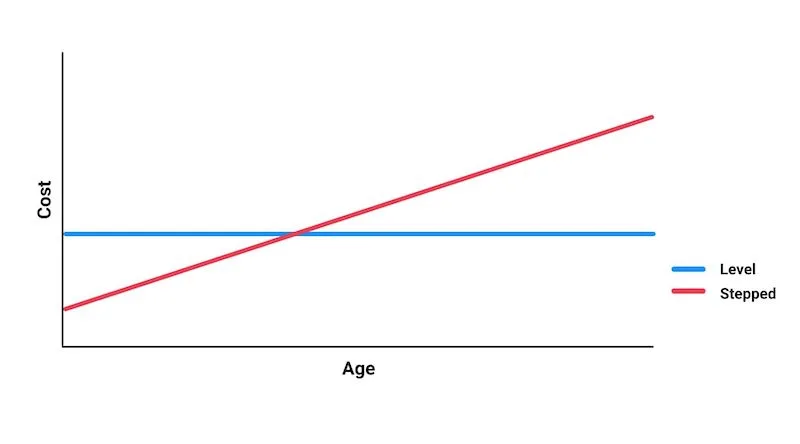

When you take out life insurance, you'll often be given a choice between stepped premiums and level premiums. Since level premiums never increase, they're usually better over the long run — you don't need to worry about them going up. Stepped premiums, on the other hand, often work better over the short term because they won't increase that much.

Stepped premiums will generally increase with your age e.g. every year at the "policy anniversary" your premium is re-calculated.

Level premiums will remain the same despite your age e.g. you'll usually pay more in the beginning but it will even out over time.

Here's a side by side example of a hypothetical stepped v level annual premium over 10 years. As you can see, stepped premiums generally start out cheaper but in the long run, it's likely to cost you more.

| Age | Stepped premium | Level premium |

|---|---|---|

| 31 | $145.96 | $200 |

| 32 | $159.86 | $200 |

| 33 | $173.77 | $200 |

| 34 | $187.67 | $200 |

| 35 | $215.47 | $200 |

| 36 | $222.42 | $200 |

| 37 | $229.37 | $200 |

| 38 | $243.27 | $200 |

| 39 | $243.27 | $200 |

| 40 | $250.22 | $200 |

| 10 year average | $207.13 | $200.00 |

| Total premium to age 40 | $2,071.28 | $2,000.00 |

Stepped level premiums are based on a sample profile from NobleOak Premium Direct Life Insurance in February 2019. Level premium is made up for illustrative purposes.

Stepped premiums increase over time as you age. The older you are, the more likely that your health may deteriorate and therefore, your premiums (under stepped structure) will increase significantly, especially once you're older than 50 years.

Level premiums don't increase as you age. Instead, your rates will be calculated based on your age at the time of application and locked in at a fixed rate for the duration of your policy.

| Key differences | Stepped premiums | Level premiums |

|---|---|---|

| Do payments increase? | Yes. Premiums are reviewed and calculated on a yearly basis on every policy anniversary. | No. Premium rates remain the same, with a small increase each year due to indexation to keep up with inflation (usually around 5% or higher than the CPI). |

| Is it more expensive as I get older? | Yes. Your premiums will increase significantly once your reach age 50 and over. | No. Your premiums stay the same no matter your health or age. |

| Who is it suitable for? | Those who have limited disposable income and are looking to secure short-term life insurance cover. | Those looking to secure long-term life insurance cover. |

Hybrid premiums are the middle point between stepped and level premiums.

Hybrid premiums cost more at the beginning of the policy than stepped but lower than level premiums. Premiums increase until the policy reaches a predetermined age when the premiums level off.

Once this happens the premiums are higher than level but are lower than stepped.

We currently don't have that product, but here are others to consider:

How we picked theseLife Insurance is a little complicated and a lot overwhelming. That's why we made the Finder Score, to make it easier to compare Life Insurance products against each other. Our experts analysed over 30 products and gave each one a score out of 10.

But a higher score doesn't always mean a product is better for you. Your situation is unique, so your policy choice will be too. Don't think of Finder Score as the final word, but as a good place to start your life insurance comparison.

You pay the same price as buying directly from the life insurer.

We're not owned by an insurer (unlike other comparison sites).

We've done 100+ hours of policy research to help you understand what you're comparing.

Financial literacy advocate Pascale Helyar-Moray on what women do to avoid losing out to higher costs.

Was your life insurance application denied? This article looks at the top reasons why your application might have been denied and what you can do to get the right cover.

Find out how the underwriting process actually works if considering taking out cover.

Ever wondered how much more life insurance for smokers costs in Australia? Learn about how smoking and vaping can impact your policy.

Find out how smoking will impact what you pay for life insurance, and what you can do to have your premium reviewed.

Not sure what life insurance is? We take you through the basics of life insurance with our easy to understand guide.

Read our guide to updating life insurance beneficiaries and making sure your money goes to the right people.

Depending on the applicant and the type of life insurance policy, there may be no medical tests required.