You pay the same price as buying directly from the income protection insurer.

We're not owned by an insurer (unlike other comparison sites).

We don't ask for your phone or email.

We've done 100+ hours of policy research to help you understand what you're comparing.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseThe lowdown on Finder Score

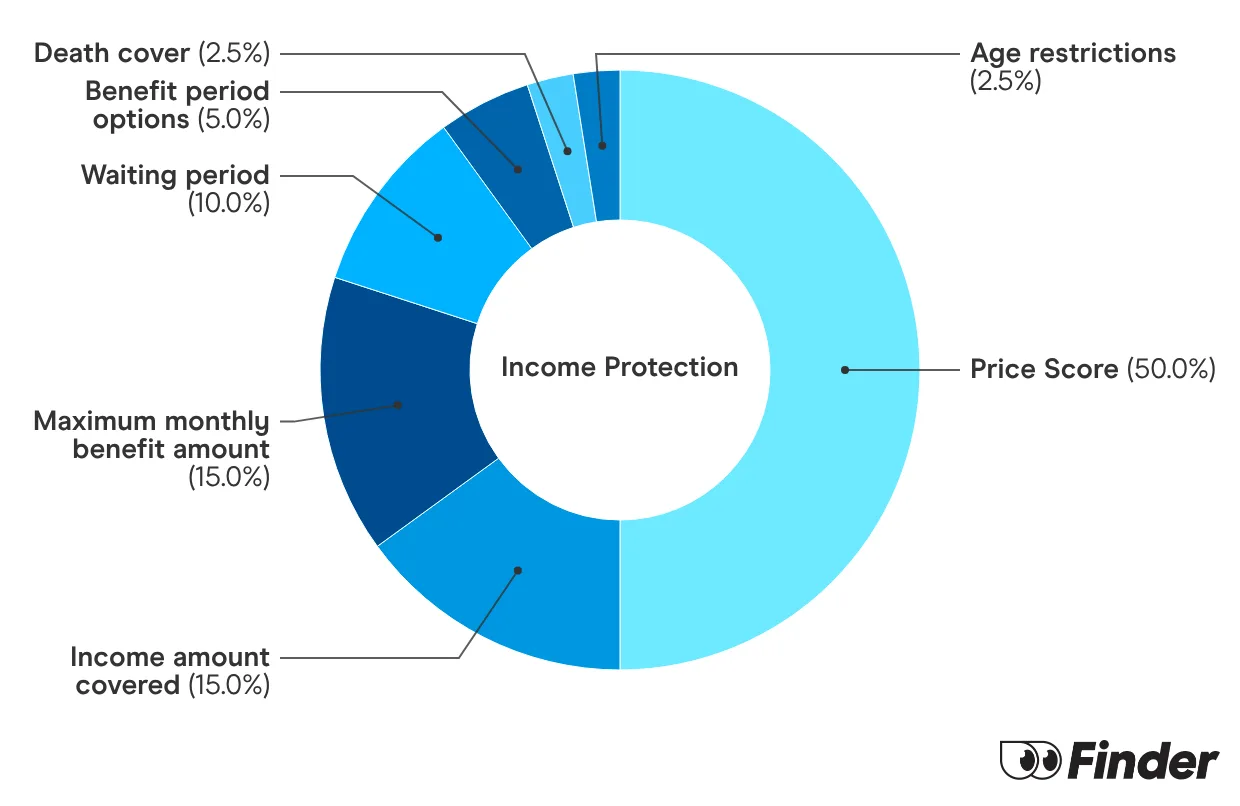

We assess 12 products and score each product a score out of 10, based on their pricing and key features.

The higher the Finder Score the better the product. We assess products for their pricing across multiple personas and eight features.

The Finder Score methodology is designed by our Insights team and reviewed by our editorial team. We review the products objectively. Commercial partnerships do not affect the scores.

Remember that Finder Score is just one factor to consider. Look at other aspects like fees, features, benefits and risks to make sure a product is suitable for you. Double-check details that matter to you before applying or buying.

Speak to an insurance specialist to help you find personalised cover

What is income protection insurance?

Income protection insurance is a policy that pays a portion of your lost income if you are unable to work because of a disability, illness or injury. This provides a crucial financial safety net, helping you cover essential bills and ongoing expenses so you can focus on your recovery without financial stress.

Most insurers will pay up to 70% of your pre-tax income. They'll also set a maximum benefit, usually around $10,000 monthly. The payouts from income protection can help you meet regular expenses, such as your mortgage or rent and groceries. It can also maintain your family's lifestyle while you focus on your recovery.

How does income protection insurance work?

With income protection, you get an ongoing cash benefit after a successful claim. It lasts until one of the following occurs:

- You can return to work

- Your benefit period ends

- You reach an age when you can no longer renew your policy

The benefit period is the maximum amount of time you can receive payments. In most cases, this is for 1, 2 or 5 years. Some insurers offer a benefit period until the age of 65. These policies will cost more.

You can only claim income protection after you've passed the waiting period stated in your policy. It starts from the day you file your claim and it can be 14, 28, 60 or 90 days.

Tip: The longer your waiting period, the cheaper your policy will be. However, choose with care as you'll need to have enough money to support yourself for the duration of your waiting period.

Pros and cons of income protection

Weighing up the pros and cons of income protection is a helpful way of working out if it's right for you. Take a look below.

Pros

- Peace of mind. Money is one of the major causes of stress in life. Income protection can't guarantee all your money worries will go away, but it can take care of one of our biggest concerns: what happens if I can't work? It lets you focus on getting better, not how you'll pay your next bill.

- Short-term help that stops long-term problems. Income protection is for those scary times when you're temporarily unable to work. It's short-term financial help that ensures your money worries don't become a long-term problem. If you can rely on income protection, you don't need to worry about alternative ways of paying your bills, like selling your car, picking up a second job when you can return to work, or relying on high-interest loans.

- Easy to claim. You don't need to prove permanent disability to work; just that you're temporarily unable to perform your duties.

- Good for small business owners. If you run your own business, income protection insurance is very helpful security if an illness or injury strikes and stops you from working.

Cons

- Can be trickier if you have a pre-existing medical condition. Sometimes it can cost you more if you have a pre-existing medical condition and in some cases you won't be covered if you need to take time off due to that.

- More expensive for different occupations. You'll likely have to pay a little more if you work in a high-risk job where injuries are more likely to occur.

- Waiting periods. Income protection policies generally have a waiting period - usually around 30 - 90 days - before it begins to pay you, so you may have to fall back on sick pay until the waiting period is over.

Here's what some experts had to say

3 ways to buy income protection insurance

Direct

Do some research and buy directly with an insurer.

Retail

Seek advice from a broker who'll build you a policy.

Super

Get basic cover in your super fund.

How much does income protection cost?

We gathered quotes from a selection of products using the criteria below to give an indication of price.

Remember, price is just one part of the picture. Consider other factors such as fees, features, benefits, risks and overall suitability for your needs. Always review the details that matter most to you before making a final decision.

Smoker

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseNon-smoker

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseLearn more about income protection insurance

Our income protection insurance guides can help you compare and understand what cover option is right for you.

Some more helpful stuff

Income protection insurance: A beginner's guide

Learn the key points about how income protection works.

How does my job affect my income protection?

Tradies are well aware of the dangers of their work. Find out how insurers see things.

Is income protection insurance tax-deductible?

Here's why income protection is often (but not always) tax deductible.

Is income protection worth it?

A balanced look at how income protection can protect you.

The latest income protection deals and discounts

We put together a list of deals and sign-up offers below to help you save:

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseRead our income protection reviews

Want to find out more about a specific insurer? We've reviewed over 20 of them. Here's a bunch of the most popular ones:

If the brand you're looking for isn't here, check out our directory.

Why you can trust Finder's income protection insurance experts

You pay nothing. Finder is free to use. And you pay the same as going direct. No markups, no hidden fees.

You pay nothing. Finder is free to use. And you pay the same as going direct. No markups, no hidden fees.

You save time. We spend 100s of hours researching income protection insurance so you can sort the gold from the junk faster.

You save time. We spend 100s of hours researching income protection insurance so you can sort the gold from the junk faster. You can trust us. We say it like it is. We aren't owned by an insurer and our opinions are our own.

You can trust us. We say it like it is. We aren't owned by an insurer and our opinions are our own.

Frequently asked questions

Sources

Read more on Income Protection Insurance

-

HCF Income Protect Insurance

Wondering if HCF Income Protection Insurance is right for you? We break down what’s covered, what’s not and whether it offers good value.

-

TAL Income Protection Insurance review

Learn the built-in benefits of TAL income protection to understand how it could work for you. Compare features and get a quote today.

-

Sick leave Australia: What you’re entitled to and when

Find out why income protection is an important tool to combine with your entitled sick leave.

-

Cost of income protection in Australia

Income protection costs can range from around $50 to $160+.

-

Sole trader income protection insurance

Income protection for sole traders provides financial support, via a monthly payment, if you’re unable to work due to illness or injury.

-

Income Protection Insurance vs Mortgage Protection

Does income protection provide the same thing as mortgage protection? Read on and compare.

-

Suncorp Income Protection Insurance Review

Receive income cover for illness or injury with Suncorp Income Protection.

-

Income protection insurance calculator

Find out how much your income protection insurance policy will pay out in the event of a claim. Receive quotes for income protection and apply securely.

-

NobleOak Income Protection Insurance review

NobleOak has been offering personal insurance solutions direct to Australians for over 137 years. Discover the benefits and features available on the NobleOak Income Protection policy and make a secure enquiry for cover.

-

Best income protection, Australia

Looking for the best income protection insurance but not exactly sure where to start? Compare the Finder Awards 2025 insurance winners.