Key takeaways

- Endometriosis treatment is covered by Medicare to some extent, but not all expenses are covered.

- If you opt for private health insurance, endometriosis is covered on bronze policies under gynaecology.

- Even with private health cover, there can be out of pocket expenses but there are ways to know what you're up for in advance.

Endometriosis is a condition that affects a woman's reproductive organs. 1 in 10 Australian women suffer from endometriosis, while on average, diagnosis can take between 7 and 10 years. If left untreated, it can lead to infertility.

Fortunately, getting cover is easy and can be found on all Bronze policies if you choose to go private. This guide helps you look at both Medicare and private health insurance cover, so if you need help, you don't have to worry about large medical bills.

What is endometriosis?

Endometriosis is a condition in which tissue that normally lines the inside of your uterus grows outside the uterus.

During ovulation, the endometrium thickens. This means that displaced endometrial tissue continues to thicken, break down and bleed every menstrual cycle. However, it becomes trapped as it has no way to exit the body. As a result, fibrous scar tissue can develop over time on the lining inside the abdomen causing the uterus, ovaries, fallopian tubes and bowel to stick to each other.

Endometriosis can be very painful, particularly during menstruation and fertility problems can develop if the condition is left untreated.

Finder survey: How many Australians think hospital insurance is worth it?

| Response | |

|---|---|

| Somewhat | 38.17% |

| Yes | 34.89% |

| No | 26.94% |

How does private health insurance cover endometriosis?

As of 1 April 2019, endometriosis is covered under all Bronze categories, thanks to government reforms. You will find cover for endometriosis under gynaecology. The changes are part of the government's attempt to make women's health care more widely available and affordable. You can find cover for around $21 a week with a Bronze policy.

Most private health insurers will cover surgery and theatre fees as well as things like medication you receive while in hospital and accommodation. It will cover you for any benefit that Medicare covers and you will also likely receive cover for any prescription medication you need.

Unlike Medicare, you also get to choose your own doctor and hospital. This can be important for many since endometriosis is such a difficult condition to diagnose.

If you do need surgery for endometriosis, you will likely know well in advance. This can be beneficial as it means you can calculate costs to keep them to a minimum. You can work out your estimate by doing the following:

- Speak to your gynaecologist and surgeon about cost estimates.

- Make sure your surgeon is part of your insurance provider's preferred list, if it has one.

- Inquire about extra costs. You may need to go under general anaesthesia.

- Check your policy's gap cover to help reduce or eliminate out-of-pocket expenses.

- Ask for your Medicare code and give it to your insurer.

How does Medicare cover endometriosis?

For surgical operations such as laparoscopic surgery, Medicare will cover 75% of the fee as listed in the Medicare Benefits Schedule (MBS). If you aren't with a private health insurer, you will have to pay the remaining 25% out of your own pocket.

The fee listed on the Medicare Benefits Schedule for endometriosis-related surgery is $1,242.65, which means you could be looking at a bill of around $300 if you're treated as a public patient in a private hospital. Medicare will also pay benefits towards therapeutic procedures.

If you receive medication for endometriosis, there is a good chance it will not be listed under PBS medication, meaning it will not be subsidised by the Australian government, which may lead to large out-of-pocket expenses.

What are the symptoms of endometriosis?

Endometriosis is usually most painful when you have your period but for many women, the pain is there all the time. While the main symptom is pelvic pain, cramping is also common. It's common that pain will increase over time.

Common symptoms of endometriosis include:

- Painful periods

- Pain during sexual intercourse

- Pelvic pain

- Ovulation pain

- Pain in you lower back and thighs

- Pain with bowel movements or urination

- Reduced fertility

- Nausea, fatigue, diarrhoea or constipation

Although the extremity of your pain is a strong indication that something is wrong, you can still have advanced endometriosis with little pain, or mild endometriosis with a lot of pain. It can often be mistaken for pelvic inflammatory disease (PID) or ovarian cysts.

How do you diagnose endometriosis?

Diagnosis of endometriosis can be difficult. An internal pelvic examination is not usually successful so you may need to go to a gynaecologist. Diagnosis can include:

- Laparoscopy. This is a surgical procedure where a slim medical instrument with a camera is used to examine your pelvic organs for signs of endometriosis. It is performed under general anaesthetic.

- Ultrasound. This is usually done by pressing the ultrasound device against your abdomen.

- Colonoscopy. This is usually done if the endometriosis is affecting your bowel.

What does treatment for endometriosis involve?

Endometriosis doesn't have a known cure but is treatable with medication, hormone treatment or surgery. Often, you will need hormone therapy as well as surgery.

Medication

It's often the case that in mild cases, you may simply be prescribed anti-inflammatory medications such as Ponstan, Naprogesic or Nurofen to reduce swelling and pain. Most medications are included in the PBS but over-the-counter drugs like paracetamol are sometimes an effective solution for less severe cases.

Hormone treatment for endometriosis

Because endometriosis is exacerbated by the menstrual cycle, there are a range of hormone therapy options available that can help improve the condition. These include:

- Progestins

- Gonadotrophin-releasing hormone (GnRH) agonists

- Oral contraceptive pill

With any hormone treatment, it's important you're well informed about any side effects, so make sure you discuss it with your doctor well in advance.

Surgery for endometriosis

Surgery for endometriosis is also common. Options can include:

- Laparoscopic surgery: The most common surgery. A slim tube called a laparoscope, which has a camera on the end of it, is inserted into the abdominal cavity with a small incision and any adhesions and irregular tissue associated with endometriosis are removed.

- Laparotomy surgery: This is complex surgery that is usually done when laparoscopy surgery will not adequately resolve the issue.

- Hysterectomy: This is an option if other treatment has not worked and endometriosis is having a severe impact on your quality and standard of life.

- Bowel surgery: This is usually required if endometriosis has developed in your bowel.

What is surgery recovery time?

Depending on the severity of your condition, laparoscopic surgery takes from 30 minutes to 6 hours. You can usually go home after laparoscopic surgery but you may need to stay overnight in hospital if you have pre-existing health conditions or have severe endometriosis.

Other surgeries, such as laparotomy surgery, will always require an overnight stay, though it's usually longer. It can take between two and six weeks to get back to normal and daily tasks around the house can be difficult for the first few weeks.

What do you have to be careful with when claiming for endometriosis?

It's vital you make sure you know exactly what you're covered for. It is sometimes the case that you won't be covered for surgeon's fees. This can include the operating theatre costs, time spent on surgery, any complications that may arise from the surgery and more. Be careful as some insurers will claim they cover endometriosis-related procedures but will only cover specific item numbers. This is why you should check to find out exactly what's covered before taking out a policy.

What is covered with each tier?

While some may only be looking for cover for endometriosis, which can be found with a Bronze policy, it's worth remembering this doesn't include pregnancy or fertility-related services. For many suffering from endometriosis, infertility can become an issue. If this is the case, you might want to consider Gold level cover which includes birth and pregnancy as well assisted reproductive services such as in-vitro fertilisation (IVF).

How much can I expect to pay for private health insurance?

Here is a small breakdown from Finder partners to give you an idea of how much you can expect to pay. Prices quoted are based on a single policy for a person living in Sydney, earning less than $101,000.

Finder Score - Hospital cover health insurance

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

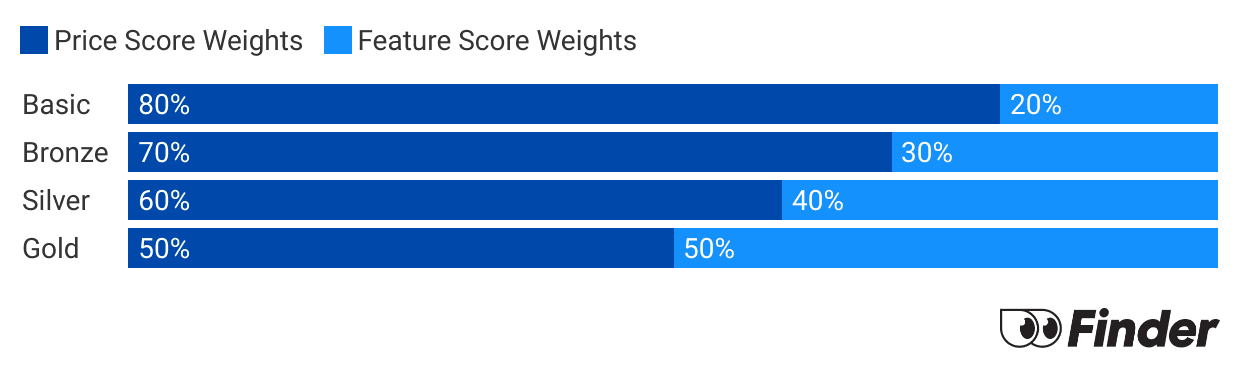

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

Pros and cons of treatments

Here are some things worth considering when looking at what treatment for endometriosis suits you best.

| Pros | Cons | |

|---|---|---|

| Over-the-counter drugs |

|

|

| Steroid medications |

|

|

| The contraceptive pill |

|

|

| Laparoscopy |

|

|

| Hysterectomy |

|

|

What are the success rates like for treatment?

The likelihood of endometriosis recurring after surgery is around 20% at 2 years and between 40% and 50% at 5 years. Because it can be an issue that is likely to recur even after surgery, it's a good idea to consider private health insurance to keep costs down.

Sources

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.