Key takeaways

- Cataract surgery is covered by Medicare, but waiting lists reach up to and over a year.

- The cost of private cataract surgery without insurance can be $4,000 to $6,000 for one eye.

- Private health insurance for cataract surgery can help cover the cost, from $42 a week.

What is cataract surgery?

Cataract surgery is used to treat cataracts that have advanced and are affecting a person's eyesight and quality of life. The surgery involves removing the clouded eye lens and replacing it with an artificial lens.

Depending on the surgeon and your individual circumstances, the procedure may be performed on both eyes at the same time or on one eye at a time with a few weeks for recovery in between procedures. Cataract surgery is one of the most commonly performed surgical procedures in Australia, with over 75,000 performed in 2022-2023, according to the Australian Institute of Health and Welfare (AIHW).

Is cataract surgery covered by Medicare?

If you need cataract surgery then Medicare will pay for you to get it done in a public hospital. You'll need to start by seeing your GP, then a specialist, then get scheduled for surgery. There may be some out-of-pocket costs at this stage if your providers don't bulk-bill, but it will generally be minimal.

Unfortunately, there are notable downsides to getting Medicare treatment for cataracts:

- The waiting times for surgery are long - often over a year.

- You won't have a choice in your surgeon.

- Medicare won't pay for the cost of premium lenses, which can correct some vision issues. These generally run a few thousand dollars on top of your surgery.

Public surgery waiting times for cataract surgery

In Australia's public system, you'll need to wait until a surgery place is available to you, which generally takes months. In 2022-2023, the median waiting time was 133 days, a little over 4 months. Unfortunately, about 12.5% of patients had to wait over a year for public surgery.

What's really bad is these numbers are getting worse. The COVID-19 pandemic didn't help, but even before 2020 the waitlists were growing at a really alarming rate. In 2018-2019, the median wait time was 84 days or just shy of 3 months, with only 2.1% of Aussies waiting over a year for surgery.

Part of the increase is certainly an ageing population. But that's not everything - the federal government hasn't kept up Medicare funding to match the health needs of Australians, according to critics including the Australian Medical Association.

Cataract surgery with private health insurance

If the public system doesn't quite cut it for you, you can get cataract surgery in the private system. You could pay for it out of pocket, but more likely you'll get care with a private health insurance policy. There are a few pretty big upsides to private care:

- Minimal waiting times for surgery. Private hospitals can typically operate quickly once you have a referral.

- You'll have your choice of surgeon and hospital.

Of course, there is one significant downside - private health insurance costs money. Of course, health insurance has a lot of other benefits, so you may already have a policy in place that covers what you need. Even if you do, there are often extra out-of-pocket costs you'll need to pay for your surgery.

How much does insurance for cataract surgery cost?

To cover cataract surgery, you'll need a relatively comprehensive policy. Cataract surgery has to be covered under all gold tier policies, but it is also covered by some silver plus tier policies as well.

- Gold tier policies start at around $61 a week*. They'll cover every government mandated treatment category, including cataracts. They're great if you want the best cover money can buy.

- Silver policies don't all cover cataract surgery, but there are some 'silver plus' policies that will cover it on top of the standard set of silver tier treatments. These policies start around $42 a week*.

Why are cataract policies so expensive? Well, with cataract surgery being so common, the cost of insuring people for cataract surgery is also high. This is because a given person is more likely to claim on it than they might be on a less common treatment type, such as podiatric surgery, for example.

*Prices are based on a single 30 year-old in NSW earning less than $101,000 a year.

Compare health insurance that covers cataract surgery

You can find a health insurance policy that covers cataract surgery from around $42 per week. Here are some policies that cover cataract removal from Finder partners. All have a 2-month waiting period before you can claim, or 12 months if it is a pre-existing condition. All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder Score - Hospital cover health insurance

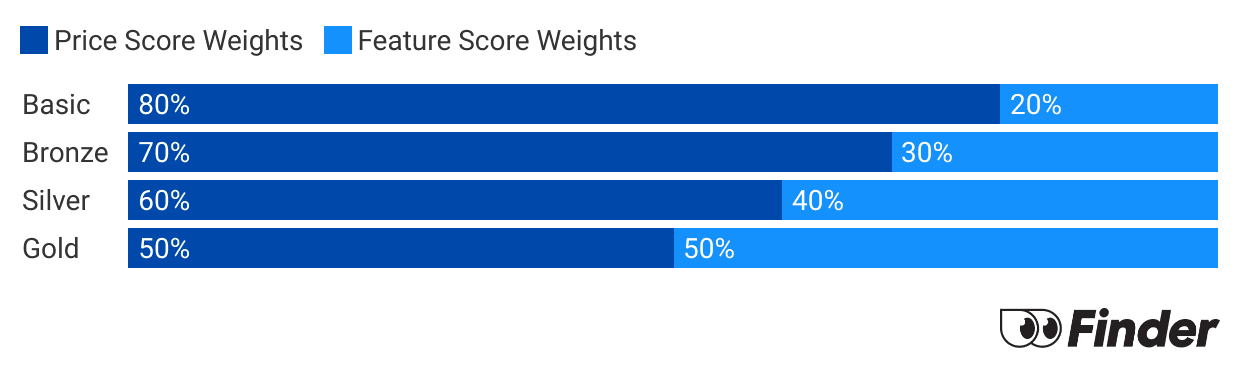

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

How much does cataract surgery cost?

The total cost of cataract surgery can range from $4,000 to $6,000 per eye without insurance. The final price varies on a lot of factors though. It's fairly rare to get private cataract surgery without insurance, but it does happen. You also might end up paying some out-of-pocket costs, even with private health insurance.

Below are a few of the data-based estimations of the current price of cataract surgery without insurance, as well as the typical out-of-pocket cost for cataract surgery that you'll pay.

- Medical Costs Finder data shows a typical price for cataract surgery to be around $4,400 for a single eye. It found about 56% of patients had no out-of-pocket costs for regular cataract surgery. For those that did pay a gap, the typical cost was about $450. However, it ranged from $110 all the way to $1,500.

- HCF: HCF's cost calculator estimates a total service cost of $5,923 and an out-of-pocket cost of $733, plus your policy excess. This is assuming you use a HCF participating private hospital and doctor for treatment.

- Medibank: Medibank's estimation for the cost of cataract surgery is $4,146, with a typical out-of-pocket cost of $370, plus your policy excess. This is assuming you use a Medibank participating private hospital and doctor for treatment.

If you're not with Medibank or HCF yourself, the Medical Costs Finder figures are probably the most useful, as it has the biggest database of costs. Also note the price of surgery on 2 eyes won't necessarily be double the cost of a single eye, as there are a few efficiencies that you only need to pay for once. For example, hospital accomodation and anaesthetic.

Frequently asked questions

Sources

Ask a question

10 Responses

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.

Are there any medications that someone is on that will prevent this procedure from happening?

Hi Karl,

Thanks for your inquiry.

Please note that we are a comparison website and general information service. Only a qualified ophthalmologist will be able to tell you if there is a medication to prevent Cataract surgery. It’s best to consult with a medical expert to give you a personalized answer regarding this matter.

I hope this helps.

Kind regards,

Bella

Hi! I would like to know how much it cost for an eye laser. I’m on an age pension, is there any Medicare rebates? I’m 66 years old and my wife is 60 years old . Is there any discounts? Thank you for helping us with answers. Andrew

Hi Andrew,

Thank you for reaching out.

The price depends on what type of eye laser procedure you wish to have. The amount ranges from $2,200-$6,200 depending on the procedure and the hospital or surgeon who will conduct the treatment. You may compare laser eye surgery costs in Australia

The discount will depend on the hospital where you wanted to have the treatment if they offer such for those who are on age pension. You can also reach out to Human Resources to check your eligibility on the rebate and how much can you get based on the procedure that you will have.

Hope this helps! 😊

Kind Regards,

Mai

Can pensioners still have cataract surgery free of charge in NSW? And approximately, what would be the waiting time?

Thanks,

Tony

Hi Tony,

Thank you for getting in touch with Finder.

I can’t find the exact answer to your question. However, our page mentioned that pensioners may be eligible for discounted surgery at private hospitals, depending on the hospital. Medicare will pay for a portion of the surgeon and anaesthetist fee. Seniors on the pension without insurance typically pay less than $2,000 per eye. Kindly reach out to your provider to obtain more info on cataract surgery.

I hope this helps.

Thank you and have a wonderful day!

Cheers,

Jeni

Hi,

How much would cost for the visitor from overseas? I have no Medicare.

Thanks

Hi Ani,

Thanks for getting in touch with finder. I hope all is well with you. :)

If you are planning to have cataract surgery in Australia, it won’t matter whether you are from another country or not since the price would still remain the same. As our page mentioned, the cost starts at $2,500 per eye. It may be lower or higher, depending on your condition as well as where you will get your surgery done.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers,

Joshua

After Medicare contribution and pension, what is the cost for me?

Hi Colleen,

Thank you for getting in touch with finder.

As mentioned on this page, the total cost of cataract surgery varies depending factors such as the surgeon, the type of lens used and individual circumstances. I suggest that you speak to your ophthalmologist and insurer for the price as well as possible cost of the surgery for you.

I hope this helps.

Please feel free to reach out to us if you have any other enquiries.

Thank you and have a wonderful day!

Cheers,

Jeni