Key takeaways

- Weight loss surgery is covered by all gold-tier hospital policies.

- The cheapest policies start from around $61 a week.

- Without health insurance, weight loss surgery can cost $20,000 or more.

Recent figures from The Obesity Collective have revealed that obesity rates are set to rise over the next 2 to 3 years. It’s forecasted that the number of adults living with obesity will hit 7.8 million between 2024-25 and 8.9 million by 2027-28.

For a lot of Australians, obesity can’t be chalked up to a simple lack of control of willpower. Factors such as genetics, neurobiology and underlying conditions like hypothyroidism or polycystic ovary syndrome (PCOS) can lead to drastic weight gain.

When regular diet and exercise or medications has not proven effective for weight loss, many doctors will recommend bariatric surgery. While bariatric surgery is covered under Medicare, very few hospitals will perform the procedure, prompting many Australians to consider private health insurance.

Health insurance that covers weight loss surgery

Here are a few policies that cover weight loss surgery. All prices are based on a single individual with less than $101,000 income and living in Sydney.

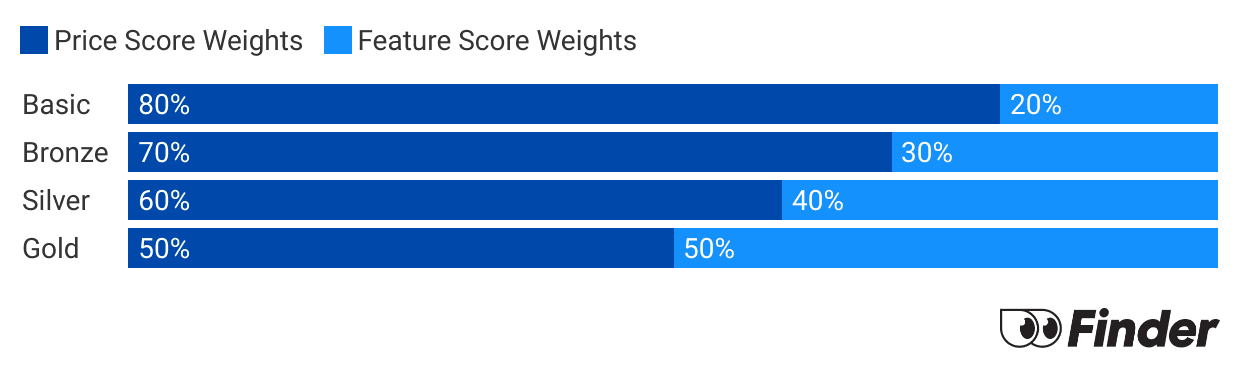

Finder Score - Hospital cover health insurance

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

What weight loss surgeries are available?

If a physician recommends weight loss surgery, it will usually be one of the following types.

Lap band (also called gastric banding)

This is where the surgeon wraps a silicone band around the top portion of your stomach, reducing the amount you can fit in your stomach.

Sleeve gastrectomy

This is where the surgeon reduces the size of your stomach by permanently removing a section of it. Like the lap band, this causes you to feel full quicker and eat less.

Gastric bypass

This is where the surgeon divides your stomach into 2 sections, then connects your small intestine to the smaller of the new stomach sections. This helps you to eat less, absorb fewer calories and react negatively to sugar.

Duodenal switch

The surgeon removes a section of the stomach (as they would with a sleeve gastrectomy) and then relocates the bottom of the stomach further down the small intestine. Like the gastric bypass, this procedure causes you to eat less and absorb fewer calories.

Liposuction

In this procedure, the surgeon puts a small tube into your body and sucks the fat out with a vacuum. Liposuction doesn't affect your appetite.

How much does weight loss surgery cost without insurance?

Weight loss surgery costs without insurance differ depending on how much the surgeon, anaesthetist and assistant charges, pathology costs and the type of procedure you undergo. Here's an overview of surgery costs in Australia based on a number of health providers we looked at.

| Surgery | Cost |

|---|---|

| Gastric/Lap band | $10,000 - $20,000 |

| Sleeve gastrectomy | $20,000 - $25,000 |

| Gastric bypass | $14,000 - $18,000 |

| Duodenal switch | $29,000 - $55,000 (average ~$33,000) |

To help lower these costs, make sure you get the Medicare Benefits Schedule (MBS) number for the type of surgery you require. Don't expect it to significantly lower the costs, though. For example, Item 31575 (sleeve gastrectomy) pays a $663 benefit. Some useful item numbers for weight loss surgery are outlined below.

See MBS item numbers for weight loss surgery

| Surgery | MBS item number |

|---|---|

| Gastric/lap band | 31569 |

| Sleeve gastrectomy | 31575 |

| Gastric bypass | 31572 |

| Duodenal switch | 31581 |

| Reversal of gastric banding/lap band | 31584 |

Can anyone get weight loss surgery?

No, it's not always possible for anyone to get weight loss surgery. This is because it's not always the best course of action for everyone. It also depends on whether you receive treatment through the public system or privately.

Medicare

To be eligible for treatment in the public system (Medicare), you need to have a body mass index (BMI) of at least 35, demonstrate that you've failed using other approaches and you'll have to undergo a psychological evaluation. You'll also have to find a public hospital that will do this sort of treatment, and there are only a few in Australia.

Private health

Private health insurers will require you to have a face-to-face consultation with a physician to determine if the surgery is necessary, and some insurers require you to have a BMI above a specific number. However, these requirements are less restrictive than Medicare and you will have more choice of hospitals.

Cover for weight loss surgery vs weight management

Cover for weight loss surgery

You'll only find health insurance for weight loss surgery with a gold-tier hospital policy. If you're not already on one, you'll want to get on one soon because there will be a waiting period, usually around 12 months.

Cover for weight management

Many extras policies cover weight management programs such as fitness classes, money off gym memberships and nutritional consulting programs such as WW (previously Weight Watchers) and Jenny Craig. This can give you a chance to learn new wellness habits pre-surgery or, in some cases, avoid having surgery altogether. Waiting periods are a lot shorter – usually around 2 months.

- Extras only: $44

- Basic: $105

- Bronze: $152

- Silver: $179

- Gold: $260

What you need to know about Gap Cover and out of pocket expenses

Gap Cover is a scheme offered by private health insurers that helps reduce or eliminate the difference between what Medicare and a health fund pay for a medical service and what a doctor actually charges. This difference is known as the “gap” and can result in significant out-of-pocket costs for patients.

For bariatric (weight-loss) surgery, surgeons, anaesthetists and surgical assistants may charge fees above the Medicare Benefits Schedule (MBS). Without Gap Cover, patients are responsible for paying this difference themselves, which can substantially increase the overall cost of surgery.

When a doctor participates in a health fund’s Gap Cover scheme, they agree to limit their fees to a set amount. This can result in either no out-of-pocket costs (a “no-gap” arrangement) or a reduced, capped gap for the patient. Gap Cover generally applies only to in-hospital medical services and does not cover hospital accommodation, theatre fees or non-medical charges.

Gap Cover can reduce the cost of bariatric surgery by lowering or eliminating out-of-pocket expenses for medical services such as the surgeon’s and anaesthetist’s fees. It also helps make costs more predictable before surgery and allows patients to compare providers who participate in Gap Cover schemes.

However, not all bariatric surgeons participate in Gap Cover, and each health fund sets its own rules and limits. For instance, Gap Cover does not cover hospital excesses, co-payments or non-MBS items, so you should confirm whether their surgeon and anaesthetist participate in their health fund’s Gap Cover scheme and what costs, if any, they will need to pay.

Out-of-pocket costs to consider for bariatric surgery

Even with private health insurance and Gap Cover, patients undergoing bariatric surgery should expect some out-of-pocket expenses, including:

Health insurance excess and co-payments

Most hospital policies include an excess, which is a fixed amount you must pay when admitted to hospital. This is typically charged once per admission and can range from a few hundred to over a thousand dollars, depending on your policy. Some policies may also include daily co-payments, which are additional charges applied for each day you stay in hospital, up to a set limit.

Initial and pre-surgery consultations

Before surgery, patients usually attend several consultations, including an initial appointment with the bariatric surgeon and follow-up visits to confirm eligibility and prepare for surgery. Medicare and private health insurance may only partially cover these appointments, meaning a gap fee is often payable. Additional pre-operative appointments with a dietitian, psychologist or physician are commonly required and may attract separate out-of-pocket costs depending on provider fees and available rebates.

Surgical and anaesthetist gaps

If your surgeon or anaesthetist does not fully participate in your health fund’s Gap Cover scheme, you may still be required to pay a capped or uncapped gap. This is usually quoted upfront and can vary significantly between providers.

Post-surgery appointments and long-term support

Post-operative reviews with your surgeon are often included for a set period, but additional appointments beyond this timeframe may incur fees. Regular dietitian appointments, psychological support and support groups may also involve out-of-pocket costs, particularly if they exceed Medicare’s annual limits or are not included in a surgical program.

Medications, supplements and additional tests

After bariatric surgery, patients typically require lifelong vitamin and mineral supplementation. These products are not covered by private health insurance and represent an ongoing personal expense. Blood tests to monitor nutritional levels are also required long-term and may involve gap payments depending on pathology billing arrangements.

Other potential costs

Additional expenses may include time off work, travel or accommodation costs if surgery is performed away from home and costs related to excess skin management in the future, which is often not fully covered by insurance.

Medications, nutritionists and gym memberships, what else is covered under private health insurance?

For many Australians looking to trim their waistline, weight loss surgery is often categorised as a last resort. Before recommending surgery, medical professionals will usually recommend alternative, low impact solutions, including medications or visiting a nutritionist to develop a personalised meal plan.

Many insurers will reimburse you a portion of your gym membership or personal training sessions if you have a referral from your GP and attend a facility your insurer partners with. You may also be able to claim back other health benefits, including nutritional coaching programs and exercise physiology. You’ll often find these listed under the diet and lifestyle benefit for extras cover.

Weight loss medications is a grey area in terms of cover, varying from insurer to insurer. Many insurers will agree to cover certain weight loss medications to a limited extent, provided they are covered by the Therapeutic Goods Administration (TGA).

Given the recent rise of Ozempic being used as a weight loss drug, many health insurers have had to reevaluate or pull back their policy’s details regarding weight loss medications. For example, HBF removed these benefits completely while halving benefits for other medications containing similar ingredients.

This was due to the fact that weight loss medication claims made up a significant portion of overall claims, despite being prescribed to a handful of Australians. Many other insurers including NIB, BUPA and Medibank have agreed to cover prescribed weight loss medication approved by the TGA.

It’s also worth noting that medications, like Ozempic, are not subsidised under the Pharmaceutical Benefits Scheme (PBS) for weight-loss use, only for treating type 2 diabetes.

FAQs

Sources

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.