The Bendigo Bank Student Account is an everyday transaction account for full time students, apprentices or trainees. This account provides easy access to your balance, and charges no account keeping fees, no ATM fees, and offers unlimited free EFTPOS transactions within Australia.

Bendigo Bank Student Account

We currently don't have this product on Finder

- Account keeping fee

- $0

- ATM withdrawal fee

- $0

- Overseas ATM withdrawal fee

- $5

- Overseas transaction fee of transaction value

- 3%

Our verdict

An everyday bank account for Australian students with no account keeping fees and no ATM fees.

You must be a full time student, apprentice or trainee to be eligible for this account. The account has no monthly account keeping fees, which is designed to help you save while you’re studying and when you may not be earning a regular income.

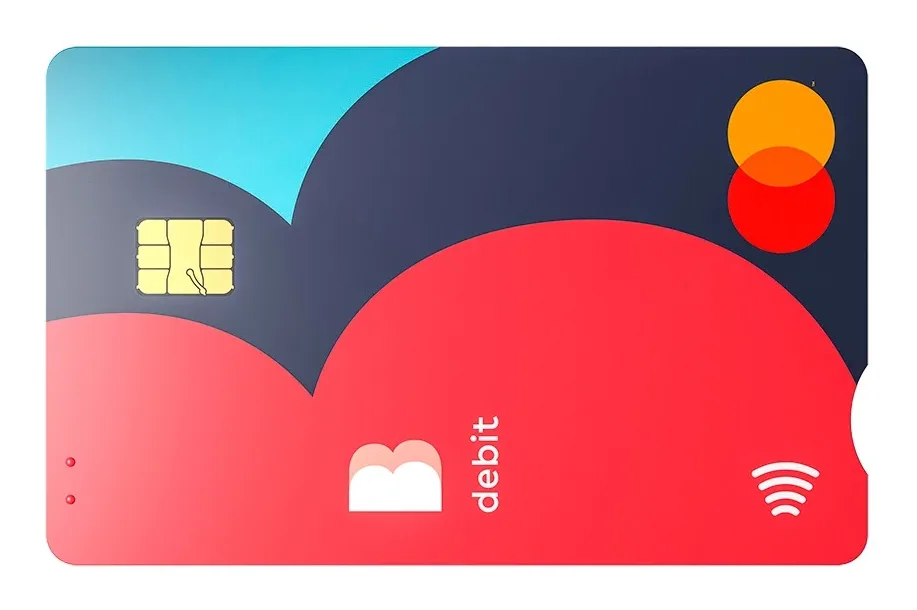

You’ll get a Debit Mastercard with this account, and you can also link your account to Google Pay, Apple Pay and Samsung Pay to make tap and go payments with your phone or watch for free.

If you’re not a student and you’re looking for a bank account with Bendigo, the Bendigo Bank Everyday account can be opened by anyone.

Pros

-

Pay no account keeping fees or ATM fees in Australia

-

Linked Debit Mastercard

-

24/7 access to funds via Internet and mobile banking

-

Apple Pay, Google Pay and Samsung Pay available

-

Personalise your debit Mastercard with an image or colour of your choice

Cons

-

Only available for students

-

Overseas ATM fee applies

Details

Key details

| Product Name | Bendigo Bank Student Account |

| Monthly account fee | $0 |

| Card access | Mastercard |

| Own network ATM fee | $0 |

| International ATM Fee | $5 |

| International transaction fee | 3% |

| Monthly deposit required to waive account fee | N/A |

| Contactless Payments | Apple Pay, Google Pay, Samsung Pay, Garmin Pay |

Eligibility

| Minimum Age | 12 |

| Joint account availability | No |

| Minimum opening deposit | N/A |

| Residency status | Permanent Australian residents with an Australian address |

Sources

Your reviews

Alison Finder

Editorial Manager, Money

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Rench Finder

June 09, 2017

Hi Anne-Marie,

Thanks for your inquiry. Please note that we are not affiliated with Bendigo Bank any company we feature on our site and so we can only offer you general advice.

A Telegraphic Transfer is a simple and direct way to receive funds electronically in most currencies to your daughter’s Bendigo Bank account.

Please note:

– The exchange rates apply for the day your funds are received by Bendigo Bank

– The remitting or any intermediary bank may deduct fees from the payment prior to us receiving the funds. This may reduce the amount you expect to receive.

– A $2 fee is charged for payments received in Australian dollars;

– A $10 fee is charged for payments received in a foreign currency.

I suggest contacting Bendigo Bank directly on 1300 236 344 or visit their official site for further info and to view their exchange rates.

Hope this information helped.

Cheers,

Rench

Show more Show less

Anne-Marie

June 09, 2017

Hi there,

My daughter is 17 years old and will be studying in Australia for a year. I would like to know what would be the banking fees for our payments made from Switzerland to her Bendigo Bank student account.

Thanks for your feedback

Anne-Marie