Key takeaways

- The cost of building a house depends on the size and design of what you're building, as well as the materials you use.

- If you're building in a city you might also benefit from cheaper construction costs on average.

- Building a prefab home can be a cheaper way to build property, but it can also be harder to find a loan for this.

How much does it cost to build a house per square metre?

The variation in square-metre building costs can be huge, but ballpark figures can help you estimate the costs you might expect.

We've done some research to help you estimate your building costs and obtain construction finance.

According to BMT Tax Depreciation Quantity Surveyors, the following estimates could help you budget for a house build, based on 2025 construction costs. But bear in mind there are different estimates if you're building a unit or townhouse.

| Home size | Low level finish ($/m2) | Medium level finish ($/m2) | High level finish ($/m2) |

|---|---|---|---|

| 3-bed home (single story) - weatherboard | $1,921 | $2,150 | $2,660 |

| 3-bed home (single story) - brick veneer | $2,047 | $2,280 | $2,723 |

| 3-bed home (single story) - full brick | $2,127 | $2,363 | $2,954 |

| 4-bed home (single story) - weatherboard | $2,697 | $2,882 | $3,597 |

| 4-bed home (single story) - brick veneer | $2,866 | $3,001 | $3,777 |

| 4-bed home (single story) - full brick | $3,205 | $3,662 | $4,035 |

| 3-bed home (2 story) - brick veneer | $2,134 | $2,359 | $2,909 |

| 3-bed home (2 story) - full brick | $2,214 | $2,490 | $3,054 |

| 4-bed home (2 story) - brick veneer | $2,909 | $3,288 | $3,816 |

| 4-bed home (2 story) - full brick | $3,215 | $3,691 | $4,030 |

| Architecturally designed residence | $4,267 | $5,462 | $7,641 |

Based on the above cost per square metre, this would put the average building price at:

- From $462,000 upwards for a 3-bedroom home

- From $648,628 upwards for a 4-bedroom home

What factors affect the cost of building a house?

Land and location

General manager of Brisbane-based construction and development company kalka, Drewe McCredie, says: "Land is the first prime factor in the overall cost of the home with respect to the budget and, in the majority of cases, will determine the budget for the house build."

The nature of the block – whether it's flat or sloping, for example – will also affect the total cost. "Each state also has its own varied rates for taxes, insurances, and certification processes and fees. Building outside of a metropolitan area will also affect the cost for out-of-area allowances for additional travel," McCredie says.

Height

McCredie says that it will generally cost more to build a two-storey home than a one-storey home as there are additional items required to build a second-storey home, including an additional floor system, stairs, scaffold, fall protection equipment etc. that are not necessarily required for a single-storey house build.

Materials

From brick and brick veneer to a lightweight clad such as weatherboard, the materials used in the construction of your home will have a big impact on the total cost.

"The approximate costs of a brick veneer vs a fibre cement sheet clad are going to be about on par," McCredie explains. "The different range of bricks and also type of mortar colour will increase the cost of the brick component, and some bricks are approximately three times the cost of your entry-level brick. Lightweight cladding is also in a similar comparison."

Trades

Trades also play a part in the cost of your build. "Brick trades typically have different rates for upper or lower bricks, and also single- and double-height bricks. Lightweight-clad trades generally have a single rate for each cladding type," McCredie explains.

Then there are the other trades you need to get your house to move-in status: plumbers, electricians, tilers, painters, plasterers, renderers and even landscape gardeners.

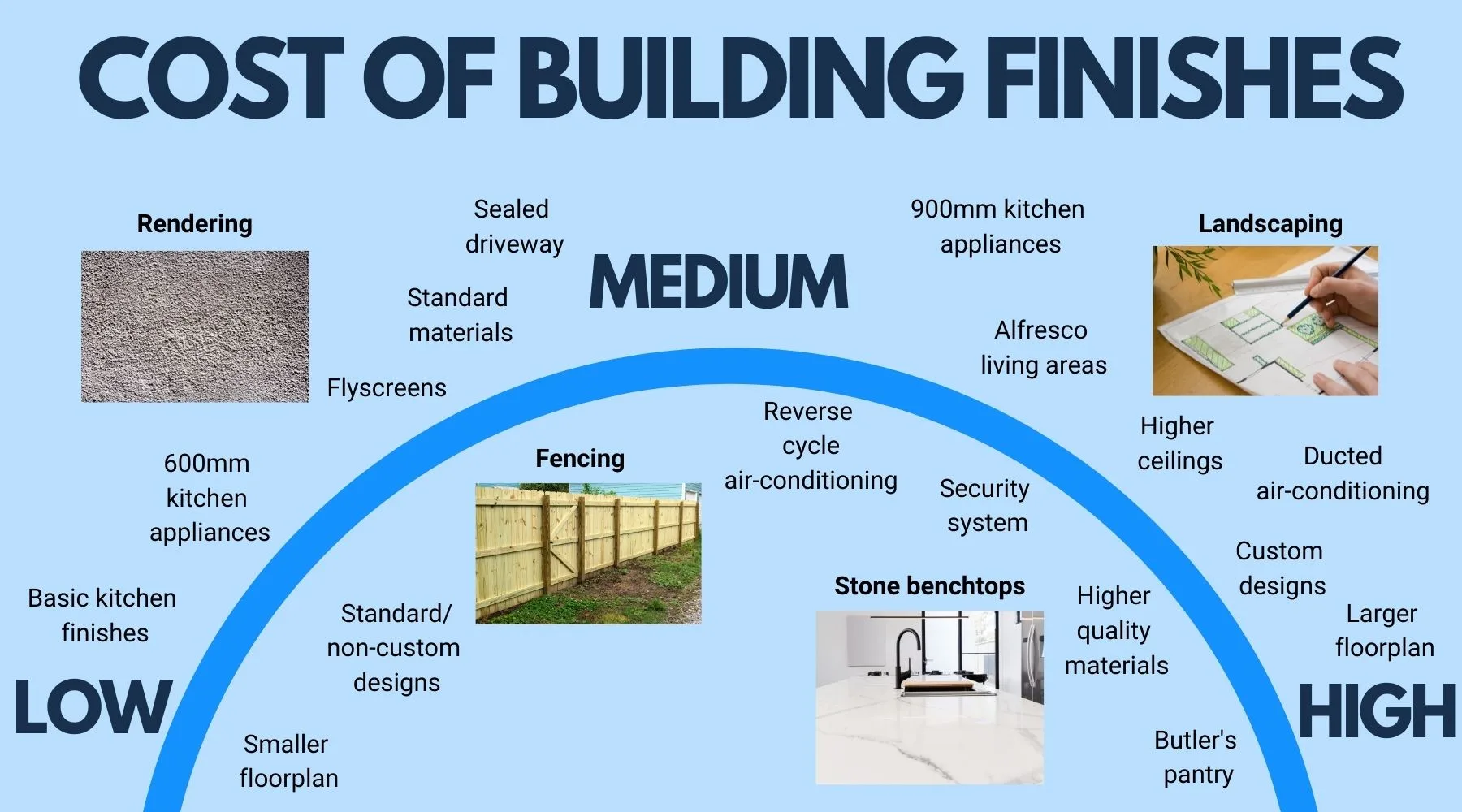

How the finishes impact the cost of your build

How to choose a builder

The builder you choose to complete your construction project is the next factor that can have an impact on the overall price. Builders can vary not only in the type of work they specialise in (for example, custom-built homes vs display homes), but also in how much they charge for their work. It's essential to obtain quotes from several builders to get an accurate idea of building costs, as well as which builder offers the best value for money.

"The best way [to choose a builder] is to look at the builder's price compared to others' prices and the inclusions list from the core of the house to the ceiling. Keep a lookout for site costs as they can vary from builder to builder; however, do not pursue the cheapest site cost quote – very often you will be asked to pay the difference in the future."

How much does it cost to build a kit home?

If you're looking for a low-cost option when building a house, you might want to consider a kit home (also known as a modular home or prefabricated home).

These homes are designed and built off-site, and then the materials are delivered by truck to your block of land for assembly.

According to HiPages, the average prefab home costs between $2,500 and $3,000 per square metre.

Total costs for building prefab homes could be:

- $100,000+ for a small, basic build

- $150,000+ for a medium build with higher quality finishes

- $300,000+ for a large build, custom design and superior finishes

What you need to know about building a kit home

Kit homes can be cost-effective, allowing owner-builders to do much of the work themselves, and come in a wide range of designs. However, there are several factors that can affect the cost of a kit home.

- The model. A four-bedroom kit home costs substantially more than a one-bedroom kit home. The floor space of your chosen design has a big impact as does the number of bathrooms and other spaces (e.g., a study).

- The cladding option. Brick, weatherboard, render and more are available.

- The site. Sites that are difficult to access or that require levelling could result in increased costs.

- What's included in the package. Some kit-home prices you see quoted online will include nothing but the bare shell of a home, while others will include everything from air conditioning to floor coverings.

Are kit homes really cheaper than standard homes?

Prefabricated homes can be cheaper to build than standard homes, but it really depends on how you choose to build them.

For example, getting a builder to put the kit home together will cost a lot more than if you do most of the work yourself. But you still have to consider the cost of paying various trades (plumbers, electricians) to get your home to the point where it's ready for you to move in.

The key to deciding whether a kit home is the most affordable option for you is to make sure you're fully aware of what's included in the package and what you'll have to pay extra for. You may need to pay for soil testing, laying slabs and any finishes you add yourself.

Can I get a loan for my kit home?

How do you get finance to build your house?

If you need to borrow money to build your home, you'll need to apply for a construction loan.

These loans can be set up to allow you to purchase a vacant block of land first and then build on that land within a set timeframe or to fund the construction of your home if you already own the land.

Unlike a regular mortgage, where the lender gives you access to a big lump sum when you take out the loan, a construction loan is set up a little differently. The lender calculates the total amount you will need to borrow to pay your builder, and then allows you to access portions of this amount at specified times to pay your builder throughout the construction process. These loan withdrawals are known as progress draws and are a predetermined percentage of the total mortgage amount.

The lender will typically set a timeframe, such as one year, for the construction of your house and probably only require you to make interest payments while your home is being built. Once construction is complete and the builder has been paid, you will start making full principal and interest repayments.

Want to start building?

Lean more about construction loans and compare finance options now.

Frequently Asked Questions about costs of building a home

Sources

Ask a question

More guides on Finder

-

Home loan cashback offers

Home loan cashback deals can help you refinance to a cheaper interest rate and get a lump sum cash payment. Compare the latest deals and check your eligibility today.

-

South West Slopes Bank home loans

A community credit union operating in the south west country area of NSW, helping you find the right home loan.

-

The Capricornian home loans

Compare home loan rates from The Capricornian, a credit union in Central Queensland.

-

Pacific Mortgage Group home loans

Your guide to home loan products available from Pacific Mortgage Group (PMG).

-

Greater Bank home loans

Check out home loans from Greater Bank and apply today.

-

ME home loans

ME is an online lender with a simple range of products, including the Basic Home Loan and the Flexible Home Loan. See their rates and fees here.

-

ING home loans

Thinking about getting a home loan from ING? Compare rates and learn more about this lender.

-

loans.com.au home loans

loans.com.au is one of Australia's leading online only lenders with a range of products that have great features and low costs.

-

Community First Bank home loans

Community First Bank is a credit union that offers home loans in addition to other financial products.

-

Best Home Loan Rates Australia

Learn how to compare rates to find the best home loan and start saving money on your mortgage today.