Spriggy review: Kids pocket money app and prepaid card

We currently don't have this product on Finder

- Account keeping fee

- $5

- Overseas transaction fee of transaction value

- 3.5%

Summary

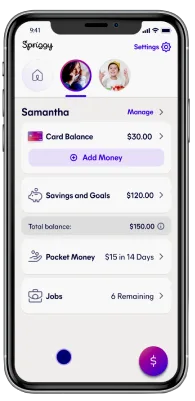

Spriggy is a secure mobile app with a linked prepaid card that helps kids aged 6-17 learn the concept of digital money.

Spriggy is a mobile app with a linked prepaid card which helps Australian parents and their kids to manage their money together and track their progress in a fun, interactive app.

You can use the app for free for the first 30 days to see how you like it. After that, the price is currently $50 per year for new members (this is a promotional offer).

Pros

-

30-day free trial available

-

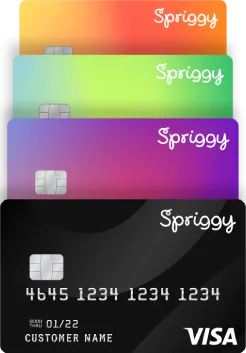

Customised prepaid debit card

-

Safe and convenient

Cons

-

3.5% surcharge for international purchases

-

Membership fee charged as annual lump sum payment

Details

Product details

| Product Name | Spriggy |

| Monthly account fee | $5 |

| Card access | Visa |

| International ATM Fee | N/A |

| International transaction fee | 3.5% |

| Monthly deposit required to waive account fee | N/A |

| Contactless Payments | Apple Pay, Google Pay |

What is Spriggy?

The app is designed for 6–17 year olds, to teach them how to manage their money before setting up a regular bank account. Instead of giving kids pocket money in the form of notes and coins, parents can transfer money to their kids via the app. This allows parents and kids to manage their money together, and track their transactions and deposits via the user-friendly app, just like a regular bank account.

The app is attached to a prepaid Visa card which the child can use to make purchases wherever Visa is accepted.

SPRK Mode

For kids aged 13 or over, Spriggy also offers SPRK Mode. This gives you and your teen extra features to create savings goals, manage money and track spending. Kids can receive income from a part-time job and use their prepaid card at ATMs.

What are the key features that Spriggy offers?

User-friendly app

Spriggy’s mobile app is easy to use, engaging and interactive, encouraging kids to take an active role in their finances from a young age. You can sign into the app as the child or as the parent.

Parents’ involvement

Spriggy enables parents to take an active role in helping their kids learn about money. While kids can take responsibility for their own spending and saving decisions, parents have complete supervision of the app.

Parent Wallet within the app

There is a separate place in the Spriggy app called the Parent Wallet. This is where your money initially goes when you transfer it from your regular bank account. Only the parent can see and access the money in the Parent Wallet within the Spriggy app, and has the ability to transfer money from the Parent Wallet to the child's card, and vice versa. This is where you can keep an eye on your kids' spending and track their savings goals.

Safe and secure

Just like a regular bank account, your money is safe and secure with Spriggy. All money is held with an Authorised Deposit-taking Institution (ADI) which is fully regulated.

Prepaid Visa card in a colour of your choice

The app offers a linked prepaid Visa card, which allows your child to make purchases online or in stores wherever Visa is accepted (including overseas!). It also offers Visa payWave and is pin-protected. Your child can select from a range of superhero-themed cards including Wonder Woman, Batman, Superman or The Flash to get them excited about their money and savings goals.

Kids who are 13 or over can withdraw money from ATMs if using SPRK Mode.

Make contactless payments

You can set up your account with Google Pay or Apple Pay to make transactions with your phone or smartwatch.

Set regular payments

Parents can set up automatic, regular payments from the Parent Wallet to the child’s card. For example, if you pay your child pocket money once a month, you can set this up as an automated transfer.

Set savings goals

Set up personal savings goals for whatever it is your child wants to save for, and track your progress together through the app.

Receive spend notifications in real time

Both the parent and the child will receive a notification in real time after a purchase has been made with the Spriggy card. The notification will let you know how much the transaction was for, and let you know the updated balance on the card.

Set Spriggy Jobs for your kids

Using the Spriggy Jobs feature, you can set regular weekly or one-off jobs for your kids to complete to earn their pocket money all within the app. You can set extra jobs for the kids to complete to give them the opportunity to earn more money, just like the real world.

Spriggy Family Groups

This features allows you to invite other family members to your 'group', so they contribute to and get involved with your kids' pocket. This means that both parents, as well as other relatives or even friends, can send money and see your kids' spending and saving, plus set them jobs and tasks to complete.

Card lock feature

You can lock the card within the app, which ensures your money is safe if the card is misplaced. Don’t worry, you can unlock the card via the app once you find it again, too!

Minimum and maximum deposits

Deposits to your child’s Spriggy prepaid card must be over $10 and no more than $1,000. There's also a transaction limit of $250 per transaction.

What are the fees and costs involved?

- Membership fee: Spriggy membership is $50 a year (promotional offer). Spriggy is currently offering a 30-day free trial so you can test it out and see if it's right for you and your kids.

- Card replacement: There is a $10 fee if you lose your card and require a new one.

- Overseas purchases: Just like a regular debit card, there is a 3.5% surcharge for international purchases as a currency conversion is required.

How to get started with Spriggy

If you’re keen to get started with Spriggy, check you meet the following eligibility requirements first:

- Age: Children need to be aged between 6 and 17 years old.

- Parents’ details: Parents need to have a working email address, Australian mobile number and an Australian bank account/debit card.

- Phone access: Spriggy can be downloaded to an Apple or Android device.

Complete the following steps to get started with Spriggy:

- Download app. Go to your app store and download the Spriggy app.

- Register for an account. Once you’ve downloaded the app, click register for an account and fill in your details.

- Set up child logins. Once you’ve created an account, you can set up the login details for your child through the app by entering a username and password.

- Activate your card/s. After creating an account, your child should receive their prepaid Spriggy card in the mail within 7–10 days. When you receive the card, you can activate it via the Spriggy app (note that you’ll need the last four digits on the card to activate it).

- Add money. You can add your bank account details to the Spriggy app when you set up the account. Once it’s set up, select “Top Up Parent Wallet” to add money. From here, you can then transfer money from the Parent Wallet to the child’s prepaid card.

How to use the prepaid Spriggy card

Your child can use the prepaid card anywhere Visa is accepted. For purchases in shops, they can tap-and-go for all purchases under $100. For purchases requiring inserting the card, or for purchases over $100, they will need to insert their card, press CREDIT, and enter their pin. Note that you can change the PIN number at any time through the app.