Much of the new home construction that takes place in Australia nowadays is done by property developers. When land is released by the government, developers acquire that land and build the necessary infrastructure to turn it into a residential area. They then either build homes and sell them to homebuyers, or they sell blocks of land. This allows buyers to select land and then build a home on top, customised to suit their tastes.

The house and land are often purchased together but as separate contracts: one for the land and then another to build the home. And you need loans for both.

Getting a home loan for a house and land package

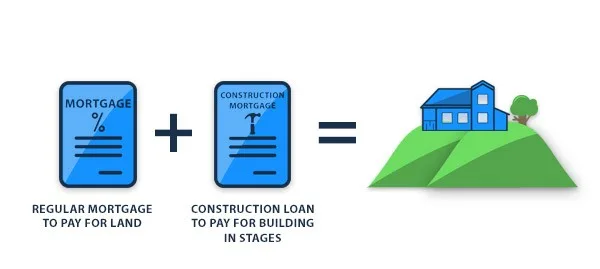

Financing for house and land packages can be split into 2 parts: buying the block of land and then building the home. While it’s possible to take out a separate loan with different lenders for each part of the process, the most common approach is to bundle the land purchase and the home construction together with the one lender.

In most cases, the land can be purchased with a straightforward mortgage loan, which most Australians are familiar with. Once settlement occurs on the land, you then take out a construction loan to finance the building of the house.

You can apply for these loans through a lender or talk to a mortgage broker. Keep in mind that some lenders may not offer construction loans.

How do home loans for house and land packages work?

With a house and land package, the regular mortgage applies to the vacant block of land you are purchasing. It works just like any other normal home loan: you have a deposit and you borrow the rest. Your lender then charges you interest and you make regular repayments to pay down the principal and the interest.

Once the land purchase has been settled and a mortgage has been registered on the title, the second part of buying a house and land package involves taking out a construction loan to finance the new home build.

The construction loan process

Construction loans are set up a little differently to typical home loans. Rather than borrowing a lump sum, construction loans allow you to draw down money in staggered instalments at set stages of the construction process – for example foundations, frame and brickwork, lockup and completion. These draw-down amounts are fixed when you apply for a loan, so you will need to supply fully costed construction plans to the lender before your loan will be approved.

Along the way, you will only pay interest on the amount you draw down from the loan. But once construction is complete and the builder has been paid, the full mortgage will be in force and you will have to pay interest on the entire amount.

Construction loans usually require you to build within a specified time frame, such as 1 or 2 years.

Finding the right loan

The good news is that it’s not really any harder to obtain financing for a house and land package than it is to take out an ordinary home loan. These types of loans are offered by banks and non-bank lenders across Australia, with most people choosing to bundle an ordinary mortgage and a construction loan together with the same provider.

If you want to buy a house and land package and create your dream home, compare the interest rates, fees and features on offer from a wide range of lenders. This will help you find the most affordable home loan for your house and land package.

Tips for buying a house and land package

When searching for a house and land package, be sure to do the following:

- Visit multiple developments. Look at as many new developments and blocks of land as you can and get on a waiting list if the market is competitive.

- Research the developer and builder. Make sure the developer has a track record of delivering new homes as promised. Visit previous developments if possible and check out display homes.

- Research the surrounding area. Many new developments are on the fringes of city suburbs with fewer shops, schools and public transport. Some developers make big claims about new train stations and schools coming soon, but keep in mind that nothing is certain until it is actually built.

- Check your builder's credentials. The builder must be licensed and have insurance. Again, check their track record and previous work if possible.

- Work out exactly what you're looking for. After visiting a few sites and display homes you should have a clear idea of what you want and don't want in a house. A big part of buying land is tailoring the home construction to your needs. So communicate with the builder and get a very clear understanding about what is included and not included in the project.

Compare construction loans

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseWhat is Finder Score?

The Finder Score crunches 7,000 home loans across 120+ lenders. It takes into account the product's interest rate, fees and features, as well as the type of loan eg investor, variable, fixed rate - this gives you a simple score out of 10.

To provide a Score, we compare like-for-like loans. So if you're comparing the best home loans for cashback, you can see how each home loan stacks up against other home loans with the same borrower type, rate type and repayment type. We also take into consideration the amount of cashback offered when calculating the Score so you can tell if it's really worth it.

Ask a question

2 Responses

More guides on Finder

-

Home loan cashback offers

Home loan cashback deals can help you refinance to a cheaper interest rate and get a lump sum cash payment. Compare the latest deals and check your eligibility today.

-

A guide for first home buyers

Use our complete first home buyer guide to make your first home purchase as stress-free as possible.

-

South West Slopes Bank home loans

A community credit union operating in the south west country area of NSW, helping you find the right home loan.

-

The Capricornian home loans

Compare home loan rates from The Capricornian, a credit union in Central Queensland.

-

Greater Bank home loans

Check out home loans from Greater Bank and apply today.

-

ME home loans

ME is an online lender with a simple range of products, including the Basic Home Loan and the Flexible Home Loan. See their rates and fees here.

-

ING home loans

Thinking about getting a home loan from ING? Compare rates and learn more about this lender.

-

loans.com.au home loans

loans.com.au is one of Australia's leading online only lenders with a range of products that have great features and low costs.

-

Community First Bank home loans

Community First Bank is a credit union that offers home loans in addition to other financial products.

-

Best Home Loan Rates Australia

Learn how to compare rates to find the best home loan and start saving money on your mortgage today.

Hi, we own an old house right out no finance on it and it needs to be knocked down and re build. However we don’t have a deposit but we have equity with our daughter newly purchased house in which we have borrowed over a mil dollar in home loan to secure our daughter dream. My wife and I have our names with our daughter in her new house deeds. What is the best option to have our old house to be built?

Note: Our current bank lender is keeping both the old house and my daughter house deeds.

Thank you,

Robert

Hello Robert,

Thank you for your inquiry.

We have a full-guide about home renovation and the different lending products you may take advantage from such as construction loans. Please take note that although some of them may still require some deposit (around 5-10%), they may be the most suitable option in the long-run in terms of interest repayments and by consideration of your capacity to pay.

You may consider pre-approval with your current bank or speak to a mortgage broker to get into the numbers of knowing how much you need to spend versus your renovation goals.

Hope this helps.

Cheers,

Jonathan