Key takeaways

- Unfortunately, at more than $8,000 per cycle, IVF and fertility treatment is not cheap.

- Both Medicare and gold tier health insurance can help pay for some IVF treatments.

- Policies cost $242 a month and can cover anaesthetists and doctors fees, counselling appointments and some IVF drugs.

Health insurance for IVF and other fertility treatments

We researched Finder partners to compare the hospital policies that offer cover for IVF and reproductive services (for example other treatments such as GIFT.) The options below have a 12 month waiting period.

Finder survey: Why do people have hospital insurance?

| Response | Female | Male |

|---|---|---|

| For pregnancy cover | 3.07% | 1.04% |

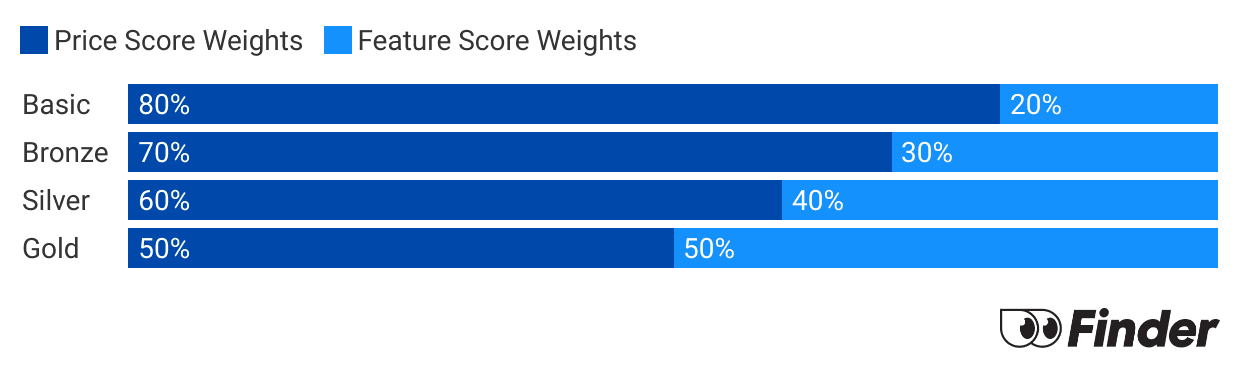

Finder Score - Hospital cover health insurance

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

All prices are based on a single individual with less than $101,000 income and living in Sydney.

"My partner and I went through IVF for our first child. We found the treatment was split into two buckets, your IVF specialists costs and the day surgery for the egg retrieval. The whole cycle cost $12,000, the Medicare Rebate offered us the most back at $5000. Insurance did give us a small rebate back of around $1000 but we mostly got the cover for pregnancy should we be successful as both treatments are covered under a Gold Tier policy. There's a 12 month wait period too, so you have to plan early!"

How does Medicare treat IVF?

As long as you have a referral from your GP, Medicare will cover a portion of your IVF for as many cycles, or rounds of treatment, as you need. Most IVF centres are privately run and you will have most of your treatment in their private outpatient facilities and, to a lesser extent, their private day hospitals.

Even though it takes place in a private clinic, Medicare will give you a rebate for many aspects of your IVF treatment even if you don't have private health insurance. By the time it's all said and done, your rebates per IVF cycle will be about 50% of the total cost.

How much does Medicare pay for IVF?

All of the services covered by Medicare are listed in the Medicare Benefits Schedule (MBS). The MBS describes the individual inpatient and outpatient services they cover, along with a dollar amount that equals what Medicare will pay for that service in a public facility. This is called the schedule fee.

But since you’ll be in a private facility, they will only pay a portion of the schedule fee, and even then, only for some services (for example, Medicare will help pay for a doctor to collect your eggs, but they won’t pay anything for you to freeze them).

You’ll be responsible the entire cost of services Medicare doesn’t cover, a portion of the cost of services that Medicare only partially covers, and any additional fees or premiums the clinic decides to charge.

How does private health insurance cover IVF?

Even though Medicare covers a decent chunk of your costs, private health insurance can be an important source of additional cover. Here's where it can help:

- Your inpatient services. You know those services that Medicare only covers a portion of? Your private hospital cover will take care of that remaining amount, as long as it is Medicare-approved and you’re being treated as an inpatient (plus it covers related costs like anaesthesia, doctor's fees, accommodation fees and prescriptions that aren't part of the pharmaceutical benefits scheme.

- Other prescriptions. If you need any prescriptions as an outpatient, and these aren't part of the pharmaceutical benefits scheme, your private extras policy will cover a percentage of those.

- Any inpatient services related to complications. If you come down with a complication due to IVF, such as ovarian hyperstimulation syndrome (OHSS) and you need hospitalised, your insurance will cover you in a private hospital with the doctor you choose.

- Childbirth. This isn't technically part of your IVF treatment, but if you use private health insurance for IVF, then you'll most likely also have pregnancy cover. By the time you're ready to give birth, this lets you choose your own obstetrician and hospital, and gives you your own private room.

How much does IVF cost?

A standard IVF cycle can cost anywhere from $9,000 for a normal IVF cycle to $14,000 if you need to have your ovulation induced and you're using a frozen egg (that’s before any refunds or private cover). These rates include consultations, treatments, medications and fees.

The following tables estimate your out-of-pocket costs for one IVF cycle using data from provider IVF Australia.

Cost of IVF before hitting the Medicare Safety Net Threshold

| Treatment | Total Cost | Medicare rebate | Estimated out-of-pocket costs |

|---|---|---|---|

| Normal IVF cycle | $9,974 | $4,788 | $5,051 |

| Frozen embryo transfer (FET) | $3,797 | $1,391 | $2,354 |

| Ovulation Induction (OI) | $700 | $0 | $700 |

Cost of IVF after hitting the Medicare Safety Net Threshold

Since IVF isn't always successful the first time around, you may end up going through multiple cycles and that will push your costs even higher. If you end up having multiple cycles in the same calendar year, Medicare may increase your rebate for the rest of the year if your total out-of-pocket expenses have reached a point called the Medicare Safety Net Threshold (MSNT).

| Treatment | Total Cost | Medicare rebate | Estimated out-of-pocket costs |

|---|---|---|---|

| Normal IVF cycle | $9,974 | $5,344 | $4,484 |

| Frozen embryo transfer (FET) | $3,797 | $1,498 | $2,259 |

| Ovulation Induction (OI) | $700 | $0 | $700 |

Source: IVF Australia. Based on prices from 17 Aug 2018

What inpatient IVF procedures does private insurance cover?

The table below lists the three most common IVF procedures that you could have as an inpatient (usually at your private IVF clinic's day hospital). Private health insurance will pay the amount in the right-most column plus a percentage of any anaesthesia and doctor's fees, per IVF cycle, up to your benefit limit.

Some women have had up to 8+ cycles before falling pregnant, so these contributions from private health insurance can really add up, especially when you combine them with any of the other forms of cover private health offers.

| IVF service | Medicare Item Number | Description | Medicare Schedule Fee | Amount covered by Medicare in a private setting | Amount covered by your private insurance |

|---|---|---|---|---|---|

| Egg collection | 13212 | The doctor collects mature eggs during your menstrual cycle, usually when you're sedated. | $365.50 | $274.15 | $91.35 |

| Transferring embryo to uterus | 13215 | The doctor places the fertilised egg into your uterus. There is usually no pain or sedation required. | $114.60 | $85.95 | $28.65 |

| Preparing frozen embryos | 13218 | For those using fertilised eggs from a previous menstrual cycle, this is the extra prep work needed to get you ready, including thawing the embryo and manipulating your hormones to mimic a menstrual cycle. | $818.35 | $613.80 | $204.55 |

Source: MBS Online, 4 June 2021

What are the other types of fertility treatments?

Although it is the most well-known, IVF isn't the only form of fertility treatment available. Here are some of the others.

- Intrauterine Insemination (IUI). IUI, sometimes called artificial insemination, is much less invasive than IVF because the fertilisation happens inside your body rather than outside of it. Doctors or nurses collect sperm from your partner or a donor, isolate the strong sperm and then put in your body.

- Gamete Intra Fallopian Transfer (GIFT). GIFT is similar to IVF, except that after the eggs are removed and combined with the sperm outside of your body, they are implanted into your fallopian tubes to fertilise inside your body. Reaching the fallopian tubes requires surgery and is becoming less and less common as the success rates of IVF continue to increase.

- Zygote Intra Fallopian Transfer (ZIFT). ZIFT is a combination of IVF and GIFT. As with IVF, the eggs are fertilised outside of the body but unlike IVF and more like GIFT, the fertilised egg (sometimes called a zygote) is placed into the fallopian tube via surgery as opposed to the uterus. As with GIFT, ZIFT is becoming less and less common.

- Intracytoplasmic Sperm Injection (ICSI). ICSI is a form of IVF that is most commonly used to help overcome male infertility. The difference is that with normal IVF, the egg is combined with hundreds of thousands of sperm and everything is left to fertilise as normal (albeit outside of the body). With ICSI, a single sperm cell is injected with precision into the egg for fertilisation. The fertilised egg is then implanted into the uterus as per normal IVF.

What isn’t covered by Medicare or private health insurance?

Neither Medicare nor private health insurance will cover the following procedures related to IVF:

- Ovulation induction. This is where you take medication to encourage egg growth in your ovaries. Not all women will need this.

- Freezing and storing embryos or sperm. You only need to have these done if you plan on having IVF at a later date, but want to preserve viable eggs and/or sperm beforehand.

Questions you should ask before choosing an IVF clinic

If you're considering IVF or other fertility treatment, here are are some questions you should ask any potential clinic:

- What credentials and training do their staff have?

- Are they members of any recognised associations or medical bodies?

- What is their overall success rate?

- What is their success rate for the procedure you are considering?

- What are their clinic and lab hours (can be important if you are working)?

- Can they freeze extra embryos for later use?

- What does each cycle cost, including drugs?

- Do you have to pay up-front or can you pay in instalments?

- Are counselling services available?

- Do they have patients you can speak with who have completed their program, successfully or otherwise?

FAQs about health insurance for IVF and fertility treatment

Sources

Continue reading:

More guides on Finder

-

How much does IVF cost in Australia?

A single IVF treatment typically costs over $8,000 in Australia. Here’s how Medicare and private health insurance can help.

-

Cost and health insurance options for C-sections in Australia

Your guide to C-sections and how they're covered by private health insurance and Medicare.

-

Public vs private pregnancy

Pregnant and unsure whether to have your baby in a public or private hospital? Here’s your guide on how to choose where to give birth.

-

Adding a baby to your health insurance

Want to add your children to your private health insurance policy? Here’s what you need to do.

-

Newborn baby health insurance

Make sure your newborn is protected by your health insurance policy.