Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseKey takeaways

- Fixed rate home loans let you lock in an interest rate for a period of time. Your repayments do not change during the fixed period.

- When your rate is fixed you may be unable to make extra repayments and it can be costly to refinance.

- Every month Finder picks the top fixed rate home loans offered by our partners, determined by interest rates, fees, deposit size and other factors.

Finder's best fixed rate home loans

Every month, our home loan experts analyse 1000s of home loan rates in our database to find our best home loan picks using the Finder Score. The score considers each loan's interest rate, fees and features, as well as the type of loan (investor, owner-occupier) and the rate type to give you a simple score out of 10.

- Best 1 year fixed rate home loan: BankVic Fixed Home Loan

- Best 2-year fixed rate home loan: BankVic Fixed Home Loan

- Best 3-year fixed rate home loan: Easy Street Fixed Home Loan

The best loan for you may differ from our picks, so always research widely when comparing. Check out our monthly best home loan rate picks to see more of our top picks.

What is a fixed rate home loan?

When you take out a home loan to buy a home or investment property, you can choose between 2 interest rate types: fixed and variable.

With a fixed rate you will lock in an interest rate for a set period, usually between 1 and 5 years (though it can be up to 10 years). Because the interest rate won't change, your repayments will stay the same for the fixed period.

Ask your lender or mortgage broker about 'rate lock guarantees' before you apply for a fixed rate, as the fixed rate(s) can change between application and documentation.

Should I fix my home loan rate?

The decision to fix your rate depends on your own circumstances and doesn't just come down to locking in the cheapest rate possible.

With a fixed rate you'll miss out on lower rates if they fall, but you'll be in a good position if rates start rising. It's impossible to know what rates will do over the long term though.

Fixed rates are really good for borrowers who want the certainty of knowing they can afford their repayments, particularly if they're expecting a change in circumstances (like starting a family and taking parental leave).

Pros and cons of a fixed rate home loan

Pros

- You can avoid any future rate rises, although that can be hard to predict.

- You have certainty around what your repayments will be despite any rate changes.

- In the current market, fixed rate loans are offering the lowest rates.

Cons

- You often can't make extra repayments or changes to the loan without paying penalties. If you exit the loan early, you will pay a break fee.

- If variable rates drop, you won't benefit from lower rates.

- Most lenders don't offer fixed home loans with 100% offset accounts.

What's the difference between fixed rates and variable rates?

- Fixed rate: Your interest rate won't change while you're in the fixed rate period.

- Variable rate: Interest rates can change at any time. Most variable rates have fallen twice so far in 2025.

- Fixed rate: Exiting the loan during your fixed period will incur break costs.

- Variable rate: There are no additional fees for exiting a variable rate loan early (by refinancing, selling or paying off the loan early).

There is often a difference in the rates offered, but that difference will depend on the current market, which you can see below.

If you decide to fix your interest rate, keep in mind that it is very difficult to "beat the bank" (that is, lock in a rate that is lower than the variable rate for the duration of the fixed term, thereby paying the bank less for your loan over the full fixed term period).

Fixed versus variable rates: What are the differences?

How do I find the best fixed rate home loan?

Finding the best fixed rate home loan is really about working out what you need, and finding a suitable loan with a low rate. To help you lock in the best fixed rate deal, start by considering these 5 factors:

Your property plans

If you're not sure how long you might be in the property, you should think twice about locking into a fixed rate home loan because of the expensive break costs.

Interest rates

As with any home loan, a lower rate is going to save you money. But it's not the only consideration and you might end up saving more money by using a variable loan that allows extra repayments or has an offset account.

Other fees

Always pay attention to a loan's fees, especially annual or ongoing fees. These can quickly add up and cancel out all the benefits of the lower interest rate.

Fixed rate period

Fixed rate borrowers have to choose terms between 1 and 5 years. Most loans give you multiple options, with different rates for each. In some markets the shorter loan terms have lower rates, but in other markets it is the other way around. So be sure to compare thoroughly.

Loan repayments

If you want to make extra repayments into your loan to chip away at the loan principal as quickly as possible, then a fixed rate loan may not be the best option as extra repayments are often not allowed on these types of loans.

How long should I fix my rate for?

Most lenders offer fixed rate terms between 1 and 5 years. While there are no differences between how the loans work with different terms, the interest rates will be different.

1- and 2-year fixed rates

Shorter term fixed rates are usually the most competitive. This isn't always the case, however. In some markets lenders will have lower rates for longer terms. This is particularly the case when lenders are expecting rates to fall: they will try to lock borrowers at the current market rates for longer.

Fixing for 1 or 2 years is a good option for borrowers who think they may want to sell their property, refinance or pay off their loan in a few years.

The downside with shorter fixed terms is that if rates are low you only get the fixed benefit for a short time.

3-year fixed rates

3 years is often a good balance between a reasonable length of time and a competitive rate (some of the best fixed rates on the market at the moment are for 3 year terms). 3-year fixed rates tend to be quite competitive while giving you just a bit longer on a stable rate.

4- and 5-year fixed rates

Fixing for 4 or 5 years is quite a long time and market rates can vary quite a lot in those years. These rates are often much higher than other fixed rates, and are less popular with borrowers. But if you think you've found a really good loan, don't anticipate needing to exit the loan early and really value knowing exactly how much you'll pay, a 4- or 5-year fixed rate loan is an option.

"When buying my first home, I decided to go with a fixed rate so I could have security over how much I would have to pay back each month. I was lucky to lock in a fixed rate, just before the rate rises started. I was able to find a bank that also gave me an offset account – this helps me reduce my interest over time. When my fixed rate ends, I'm tempted to lock in another fixed rate to have that consistency in mortgage repayments."

What to ask your bank before fixing your home loan

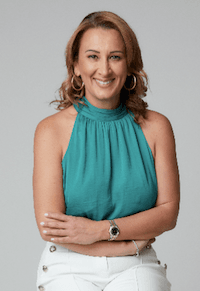

Nancy Youssef is an award-winning finance broker and mentor.

Nancy Youssef, founder of Classic Home Loans, says there are questions to ask your bank or lender when fixing your home loan.

"There may be partial offset accounts available with some lenders for fixed rates, and although they are not 100%, they can be partially offsetting your savings. This is a niche with some lenders and not available with the majority," she says.

"There are also lenders who do allow additional repayments on fixed rates. And if you need to reduce payments for a period of time to interest only instead of principal and interest, some lenders will do it quite quickly as a variation to the contract, whereas others (especially in the current landscape) will need this submitted as a new credit application. If your situation is a little complicated or out of the ordinary, a conversation with your broker or bank is a good idea."

Can fixing be cheaper even after paying break costs?

Breaking a fixed rate loan to refinance to a lower rate can be expensive. But if your repayments get significantly lower after ending your fixed rate loan, you could still end up saving money in the long run.

This is more likely the case in an environment where interest rates have been falling, when you could find newer fixed rates at a lower rate than you're currently paying.

At the moment, with rising interest rates, the break costs may make it less cost effective.

Example:

Say you have a 3-year fixed rate loan with 1 year left on the fixed period.

You fixed your rate at 6.00% and you have $400,000 remaining on your loan. The loan term is 30 years.

Because rates are lower now, you could find a rate of 4.80%. This is 120 basis points lower.

By using the lower rate you can get a rough estimate of your loan break costs.

The difference in your original fixed rate versus the new offer can stand in for the more complicated difference in funding costs (for a more comprehensive guide on break fee costs see here). The difference is 120 basis points, or 1.20%.

The following is the basic break fee calculation:

- Loan amount ($400,000) x fixed period remaining (1 year) x rate difference % (0.80%) = $4,800

Assuming that your break cost is $4,800, as in our example above, consider the potential savings if you switched to a much lower rate from a different lender. Let's say you break your old loan then get a variable rate loan with a rate of 4.80%.

In this scenario, you would pay the break fee but your repayments would shrink.

| Old loan | New loan | |

|---|---|---|

| Loan amount | $400,000 | $400,000 |

| Interest rate | 6.00% | 4.80% |

| Monthly repayment | $2,399 | $2,099 |

| Monthly saving | N/A | $300 |

| Yearly saving | N/A | $3,600 |

| Break cost | $4,800 | N/A |

In this situation it would take 16 months for you to make back the cost of the break fee.

More fixed rate home loan questions

How the Finder Score brings you the best fixed rate home loans

Every month, our home loan experts analyse over 1000s of home loan rates from 120+ lenders in our database to find our best home loan picks.

The score considers each loan's interest rate, fees and features, as well as the type of loan (investor, owner-occupier) and the rate type to give you a simple score out of 10. In the fixed rate category, we only look at loans which offer fixed rates of 1, 2, 3, 4 and 5 years.

The Finder Score methodology is designed by our insights and editorial team. We review products objectively. Commercial partnerships do not affect the scores.

The best loan for you may differ from our picks, so always research widely when comparing.

Why you can trust Finder's research

1000+ rates compared

Analysis from the experts

Picks updated monthly

What is Finder Score?

The Finder Score crunches 7,000 home loans across 120+ lenders. It takes into account the product's interest rate, fees and features, as well as the type of loan eg investor, variable, fixed rate - this gives you a simple score out of 10.

To provide a Score, we compare like-for-like loans. So if you're comparing the best home loans for cashback, you can see how each home loan stacks up against other home loans with the same borrower type, rate type and repayment type. We also take into consideration the amount of cashback offered when calculating the Score so you can tell if it's really worth it.

Sources

Ask a question

22 Responses

Read more on Home Loans

-

4-year fixed rate home loans

Compare 4-year fixed rate home loans from lenders big and small. Learn if these loans are right for you.

-

10-year fixed mortgage rates

While getting a 10-year fixed rate home loan might be a good idea if you want to keep your repayments the same over the next decade, you will pay more if interest rates drop.

-

Fixed rate interest in advance home loans

Save on interest rates and enjoy tax savings with fixed rate interest in advance home loans.

-

Why 30 year fixed mortgage rates don’t exist in Australia

Thirty year fixed rate home loans don't exist in Australia, unlike in the US where they're very common.

-

5-year fixed rate home loan rates in Australia

A competitive 5-year fixed rate home loan will see your repayments stay the same for a large chunk of your home loan.

-

Compare 3-year fixed rate home loans

A fixed-rate home loan can offer you stability and peace of mind. Find out if a three-year fixed rate home loan is right for you.

-

2-year fixed rate home loans

Enjoy the stability of knowing your repayments won’t change for 2 years.

-

Compare 1-year fixed rate home loans

Find a competitive 1-year fixed interest rate home loan. Compare your options and apply today.

-

Fixed home loan break cost – how much does it cost to end a fixed loan?

Early repayment adjustment, also known as a break fee, is charged when you end a fixed loan contract. Learn how banks calculate these fees.

Want to refinance have a investment property through SMSF want to get another,are rates exspected to go up soon and what term should i fix

Hi Bradley,

The decision to fix your interest rate, or stick with a variable rate, depends on many factors. Rates may rise, but variable rates are often competitive compared to fixed rates. And these loans are easier to refinance too.

It’s worth seeking professional advice from a mortgage broker to get personalised advice and options.

If you do not have a preferred lender yet, you can view our guide on Refinancing Home Loans to see your options.

Use the comparison table to compare and choose. Then click the Go to Site button to learn more and to apply.

Don’t forget to check the product terms and conditions, and eligibility requirements to make sure that it would suit your needs.

I hope this helps!

Regards,

Richard

Are there any banks that will loan to a single mother receiving parenting payment and Family tax benefits A & B as well as weekly child support. I also have 2 thirds of the total value of the property as a deposit so for me it is more financially viable than to continue renting?

Hi Lauren,

Thanks for your inquiry. There are home loan options for single parents like you. Most lenders will only accept certain types of Centrelink payments and may not take the whole amount of your payment so carefully review the eligibility criteria of the loan before applying to increase your chances of approval. Read up on the terms and conditions and product disclosure statement and contact the bank should you need any clarifications about the policy.

Regarding renting, this will ultimately depend on how your monthly income goes and how long you can afford to pay rent.

A mortgage broker is the best person to reach out to see your options for home loans. They can give you a multitude of options according to your situation. In the meantime, to give you an idea of how your monthly repayments will go, you can use our home loan eligibility calculator.

Hope this helps and reach out to us again for further assistance.

Best,

Nikki

I am already in fixed plan for 3 years. 1 and a half years have passed can I change my plan or my bank?

Hi there,

Thanks for the question.

Borrowers can leave a fixed rate home loan early, but doing so can come with expensive break fees. You can read our fixed-rate home loan break costs guide to learn more.

I hope this helps,

Marc

if buying a brand new home in Brisbane ,do I still have to pay stamp duty? and iam a first home buyer

Hi Waleed,

Thanks for your inquiry.

First home buyer schemes vary between each state and territory nationwide, you may use this article on your state-by-state guide to the First Home Owners Grant.

Stamp duty is also something that varies by state and territory country-wide, please see our page on how to work out your stamp duty for further information.

To get the most accurate information it would be best to contact your local state revenue service.

Regards

Jodie

Just wanted to ask all the things that need to be considered when getting a home loan. The things I can think of are

Application fee

On going fees

Off set accounts

What other things are there.

Sharon

Hi Sharon,

Thanks for the question.

It’s great to see someone serious about home loan comparison.

I would also add to this list:

– Interest rate

– Comparison rate

– What type of interest rate you’d like e.g fixed, variable or split

– Can you make extra repayments on your loan (important if you fix in a rate)

– What level of customer service you need

We have written a detailed guide on all of these factors in our home loans guide.

I hope this helps,

Marc