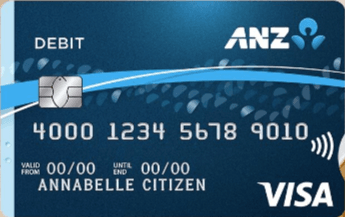

With an ANZ Access Advantage account, you get a flexible everyday bank account that offers unlimited transactions. The Access Advantage doesn't charge a monthly fee if you deposit at least $2,000 per month. You can spend the money any way you want with the linked Visa debit card.

ANZ Access Advantage Transaction Account

We currently don't have this product on Finder

- Fee Free Deposit

- $2,000

- Account keeping fee

- $5

- ATM withdrawal fee

- $0

- Overseas ATM withdrawal fee

- $5

Our verdict

Make unlimited ANZ transactions and tap and pay using your compatible phone or wearable device with Apple Pay, Samsung Pay or Google Pay.

The ANZ Access Advantage account is designed for everyday spending with a variety of different ways to pay. Make payments in store or online with the free Visa Debit Card or use Visa payWave to tap and go for purchases under $100. You can also link your account to Apple Pay, Google Pay, Samsung Pay or Garmin Pay and leave your debit card at home.

There is a $5 monthly account-keeping fee for this account. This can be waived if you deposit $2,000 a month, and it’s also waived if you’re a full-time student or you’re under 21. That being said, there are a lot of transaction accounts in the market with no account-keeping fees and no deposit conditions to meet.

You can make free ATM withdrawals at all ANZ, CBA, NAB and Westpac ATMs in Australia. This account does charge overseas ATM withdrawal fees and international transaction fees, so keep this in mind if you plan to do a lot of overseas travelling with this card.

Pros

-

Apple Pay available with linked ANZ Visa Debit card

-

Ability to personalise graphics on your linked Visa debit card

-

$0 Minimum deposit requirement

Cons

-

Minimum $2,000 deposit required every month to get the $0 monthly fee

-

international transaction fees apply

-

$5 Overseas ATM Withdrawal Fee

Details

Key details

| Product Name | ANZ Access Advantage |

| Monthly account fee | $5 |

| Card access | Visa |

| Own network ATM fee | $0 |

| International ATM Fee | $5 |

| International transaction fee | 3% |

| Monthly deposit required to waive account fee | $2,000 |

| Contactless Payments | Apple Pay, Google Pay, Samsung Pay, Garmin Pay |

Eligibility

| Minimum Age | 12 |

| Joint account availability | Yes |

| Minimum opening deposit | N/A |

| Residency status | Permanent Australian residents with an Australian address |

"This account isn't anything flash - a $5 monthly fee is kind of a letdown compared to others in the market. But if you opt for a home loan with ANZ, you can add this account as an offset for just $10 per month, which is less than the annual fee for a bunch of other loan products with offsets. Plus ANZ still has a brick-and-mortar presence (at least in Sydney) which has been useful when I have needed to expedite some things and live chatbots just weren't cutting it. "

Sources

Your reviews

Alison Finder

Editorial Manager, Money

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Sarah Megginson Finder

May 17, 2024

Hi Lena,

You’ll need to contact ANZ for customer support, you can reach them on 13 13 14.

Best of luck!

Louise

October 13, 2023

What is the interest rate for 7 months on $200,000

Angus Kidman Finder

October 18, 2023

Currently this account pays 0.01% on amounts between $50,000 and $99,999, and 0.02% on amounts above that. Those rates are not fixed and can change. This is a transaction account so interest isn’t a key feature – you might want to compare high-interest accounts to find other options. Hope this helps.

Show more Show less

Jose

July 16, 2023

Hi,

Please can you tell me how much the fees are for opening a term Deposit of $100.000.00 with earning interest of 4.75% for 12 months?

I will appreciate your important information.

Thank you very much.

Kind regards

Hi, please tell me how much the fees are for opening a term Deposit for 12 Months at an interest-earning of 4.75% p.a.

I will appreciate your valuable information.

Thank you very much.

Kind regards

Show more Show less

Alison Banney Finder

July 21, 2023

Hi Jose, there are no fees to pay when opening a term deposit account.

MA

February 20, 2018

Can I link a Citibank Online Saver account with an ANZ Access Advantage account?

May Finder

March 12, 2018

Hi MA,

Thanks for your question.

I’m afraid that it’s not possible to link your Citibank Online Saver to ANZ Access Advantage. You may have to open an ANZ Online Saver, ANZ Progress Saver or ANZ Term Deposits savings accounts then link it to the ANZ Access Advantage instead.

Cheers,

May

Show more Show less

DT

January 03, 2017

Hi,

I will be studying in Melbourne soon and I was wondering if depositing a lump sum (way more than the AUD2000.00 minimum), will it still be charged the monthly fee? Even if the remaining amount left in the account is more than AUD2000.00?

Also, is this a simple bank account or savings account?

Do you guys offer a savings account for international students that will not be charged when one draws money from ATMs?

Also, where are your closest ATMs for Carlton, Melbourne?

Show more Show less

Clarizza Fernandez Finder

January 06, 2017

Hi DT,

Thanks for your question.

The monthly account fee is waived if you deposit $2000 per month. It will not count the remaining amount from the lump sum. However, if you are a full-time student, you can request with ANZ to have the monthly fees waived.

This is also an everyday transaction account, not a savings account. You may be interested in taking a look at our student account page to review your options. Some of these accounts charge no ATM fees provided you withdraw from ATMs within the same bank network.

I hope this helps.

Regards,

Clarizza

Show more Show less

Lena

February 27, 2024

I lived in Australia for 1 year and used this card. However, I returned to my country and I still pay the $5 fee per month. How can I stop the fees from my contry?