Key takeaways

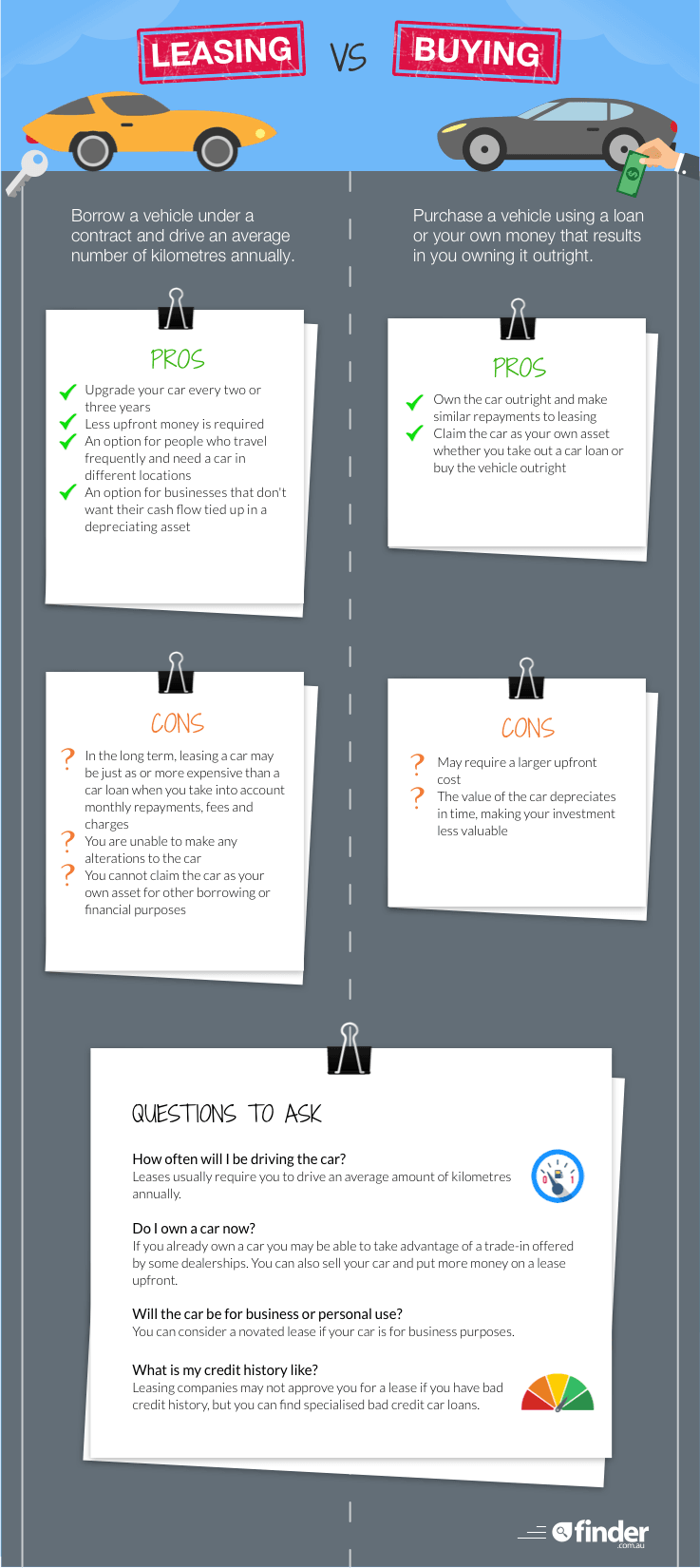

- Leasing a car can be cheaper in the short-term and you can upgrade the car every few years, but you won't own anything.

- Buying a car gives means you own the asset and you can sell it later if you need to. You pay more upfront but probably save in the long run.

- Before deciding between leasing or buying, factor in your total costs including fees, taxes and depreciation.

"To lease a car, or to buy a car, that is the question."

If you can't decide between buying or leasing a car, then our guide will help you.

What is the difference between leasing and buying?

The key difference between buying and leasing a car is ownership of the vehicle, but this could be a positive or negative depending on your situation.

In general, leasing will offer more flexibility and likely cost less. Buying a car will likely to be more expensive, but could give you greater stability and the benefits of ownership.

Leasing a car gives you access to a vehicle for an agreed period, which can be for personal or business use, or a combination of the two. You will generally make regular payments over the course of the lease and may have the option to buy the car, or starting leasing a new vehicle, at the end of the lease term.

Buying a car involves you purchasing a vehicle so that you own the vehicle outright. You can either make your purchase using a car loan, which can be paid off in a period of up to seven years, or by buying the vehicle using your own savings. You are then free to use the vehicle as you wish, as well as sell it.

Buying vs leasing: Pros and cons

| Pros | Cons | |

|---|---|---|

| Leasing |

|

|

| Buying |

|

|

What financing options are available for cars?

- Secured personal loan. A personal loan that is secured works by you using the car as a guarantee in order to finance it. This is less of a risk for the lender as they can sell the car should you default on the loan. These loans generally have lower rates and fees and are offered as a fixed or variable rate option.

- Unsecured personal loan. An unsecured personal loan can not only be used to finance a vehicle, but can also be used for any other purchase you wish to make. These loans are flexible but they usually come with higher fees and rates because it is a risk to the lender.

- Dealer finance. If you purchase a car from a dealership then they will most likely have a financing option they are able to offer you. It's best to do your research before you sign up as dealer financing usually comes with inflated rates and high fees. Dealer finance usually comes with a balloon payment at the end that is designed to lower your ongoing repayments.

- Novated lease. A novated lease is basically a lease agreement between you, your employer and the lease provider. Some of your lease obligations are transferred to your employer and as such your car is treated like a company car for tax purposes. This type of lease can save you money by allowing you to access benefits such as GST discounts, income tax savings and savings on the cost of running the car.

Compare your leasing and car loan options

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for car loans

To make comparing car loans even easier we came up with the Finder Score. Interest rates, fees and features across 200+ car loan products and 100+ lenders are all weighted and scaled to produce a score out of 10. The higher the score, the more competitive the product.

Frequently asked questions about leasing or buying a car

Sources

Ask a question

29 Responses

More guides on Finder

-

Car loans for pensioners

On a pension but need a new car? There are still many choices if you know where to look.

-

Compare car loans for classic cars

Want to buy a classic car but don't have the ready money? There are still financing options available for classic vehicles. Find out what loans you have to choose one and which one will work best for you.

-

Car loans for casual workers

You can still get a car loan even if you work casually, and there's a range of loans for you to choose from. Find out here how you can get finance for your next car and which loan might be best for you.

-

Quick car loans

You don't need to wait to get car financing. Some lenders can approve you instantly and send your funds on the same day. You can also consider pre-approval. Find out all the ways to get a quick car loan in this guide.

-

How long will it take for your car loan to be approved?

Read our guide to the approval times for popular lenders and how the application process works.

-

Tesla Superchargers Map: Where you can charge in Australia

Find out the extent of Australia's Tesla Supercharger network with our complete map of every charging station.

-

Can you pay off your car loan early?

Repaying your car loan early can save you money, but some lenders impose restrictions and charge additional fees.

-

Compare car loans for students

Ready to get behind the wheel of your own car? Find out how you can get a loan as a student.

-

How to find the best caravan loan in Australia

Don't buy a new caravan until you've read this guide. Find out exactly what financing options are available and how to compare your caravan loan options to find the right loan for you.

-

Used car loan rates Australia

You can still get a car loan if you want to finance a used car. Find out how you can get a used car loan and see what rates are available for the used car you want. Learn how to best compare lenders and apply for your loan today.

Query : Lease or Finance

If I want to lease a $40000 car for 3 years for business use will this be treated as a loan as compare to Finance

If I Finance $30k with balloon payment of 10K at the end of 5 years what is my actual loan amount

$30K or $40K

I Want to know this as I will need a home loan 2years down the track.

what is the right approach to lease or to finance

Hi Rahul,

Thank you for your inquiry and sorry for the delay.

1. If I want to lease a $40000 car for 3 years for business use will this be treated as a loan as compared to Finance?

Well, that depends on the type of car leasing you would choose. You can either go for “operating lease”, “finance lease” or “fleet management”. These three options are well-explained from the link above.

2. If I Finance $30k with a balloon payment of 10K at the end of 5 years what is my actual loan amount $30K or $40K

As to the actual loan amount, this will depend on the company/lender you go with, their interest charged to the loan, and the term. You might also add to the total loan amount the fees involved in the loan. You can learn more and compare your car loan without balloon payments.

3. What is the right approach to lease or to finance?

As we’re a comparison website, I’m afraid we can’t really suggest or recommend, as it entirely depends on your business financial situation. Both leasing or financing have pros and cons, so it’d be best to consider the financial factors as well as your business needs. The above article gives helpful advice about going for a lease or buying (including through loan financing) your business vehicle.

Hope this helps.

Cheers,

May

I have salary packaged the full amount possible. Am I still able to get tax benefits if I choose to lease a vehicle.

Hi,

Thanks for your inquiry.

Yes, you are still able to get tax benefits when opting for Novated Lease. This type of lease can save you money by allowing you to access benefits such as GST discounts, income tax savings, and savings on the cost of running the car.

Hope this information helped.

Cheers,

Arnold

I work for a mining company who offer novated leases (employee contribution method) to employees.

There are two companies nominated to manage the lease arrangements.

I have found a suitable vehicle and have had quotes for lease finance from financiers not connected with then novation management companies for this vehicle.

According to the information that is available from the novation management companies on their website, there appears to be no restriction on where the vehicle is financed. In other words, it appears that I can source cheaper finance from a finance company and have the vehicle lease novated through a management company.

According to the Novation management company representative, finance can only be arranged through them and not from an outside source.

Is this correct? Are novation management companies finance companies also or do they pressure consumers into taking their finance option?

Hi Steve,

As you enter into the novated lease agreement in your own name you should be able to choose the financier. The lease is a financial responsibility and if you change employers you’ll become responsible for the repayments, so it’s important to select a financier you’re happy with. However, your employer may only offer novated leases through these specific providers. It would be best to talk directly with your employer and explain that you’ve selected a different leasing company.

I hope this helps,

Elizabeth

The company I work for as a sales representative offers novated leases. With a novated lease, you don’t pay the GST with the purchase of the car, so there is a saving there. I get a reasonably good car allowance as part of my salary, and currently have a loan, and pay all the other running costs out of my own salary. I do a PAYG tax variation so that I get the tax benefit upfront each week. With this way, you can only claim the interest part of the loan, and then claim depreciation and other running costs, which varies year by year.

Which works out better between a Novated lease, and the above method of loan for someone who uses the car for 95% business use?

Many thanks

Darren

Hi Darren,

Unfortunately, I’m unable to offer you personal advice, so I can’t advise you either way. However, it really would depend on a number of factors which would work out better for you cost-wise. These include running costs, your car allowance, etc. We have a few tools on finder that can help, including a novated lease calculator, but you may want to get some tax advice in this matter.

Thanks,

Elizabeth

I’m about to start a 7-month stay in Australia as a visiting academic, with my family of 4.

Is it a good idea (and will I get approval) to lease a car for that period or should I directly look into buying 2nd hand?

Thanks in advance

David

Hi David,

Unfortunately, I can’t give you personal advice because it really depends on your personal financial situation, but it may help to break down the costs of each option to work out what may work best for you.

In terms of buying a car, there are several costs involved and you will also need to factor in insurance. If you wish to learn more about the expenses and costs of getting a car, please read our buying a car guide. With car rental, these costs will be factored into the rental cost. You may also be able to save with car hire coupon codes. Car-sharing services such as GoGet are another option to consider.

I hope this information helps,

Elizabeth