Why compare energy with Finder?

We know our stuff. Our experts review hundreds of plans each month. It's hard work, but we love it.

You can rely on us. We update plan data on dozens of providers daily, and we're constantly fact-checking.

We're here to help. We've helped millions of Aussies find cheaper energy. That's pretty powerful.

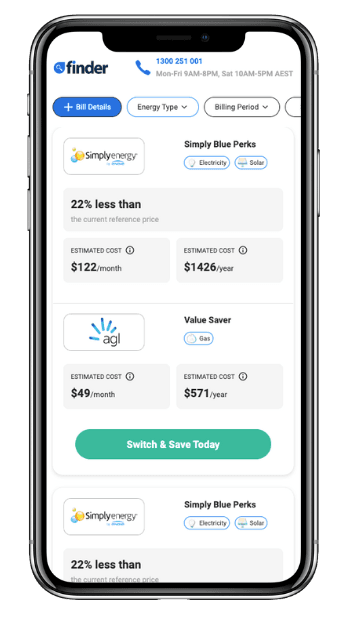

How energy comparison works

Step 1

Give us some details about your home and what you're looking to switch. We need these details so we can figure out what plans are available for your address.

Step 2

Check out the plans on offer! If you're thinking of switching providers it's a good idea to have you most recent bill so you can compare.

Step 3

Sign up online with your chosen offer. Switching gas or electricity is super easy. Your new provider does all the hard work, but will call if there are any issues.

As seen on...

Our guide to energy plans

Why should you compare energy plans?

You've probably heard this a million times already over the last couple of years but it still holds true - the days of setting and forgetting about energy plans are long gone.

Set a calendar reminder to compare your electricity and gas plan every 12 months, if not twice a year, so you're not unnecessarily giving providers your hard-earned cash.

Besides the obvious, a few other reasons to compare plans include:

- Benefit periods on a plan, usually discounted rates, tend to last 12 months.

- Your provider could move you to a default offer if you don't negotiate a new plan before the existing one expires. Default offers are usually more expensive.

- You're moving house. A new location might mean your current provider may not offer the best prices in the area.

- Your provider has alerted you of a price hike.

Can everyone switch energy providers?

If only the energy market in Australia wasn't so convoluted. But here we are.

Most people living in the following states will be able to switch energy providers as long as they don't live at a property within an embedded network:

- New South Wales

- The Australian Capital Territory

- Victoria

- South East Queensland

- South Australia

- Tasmania (electricity only, but a small pool of providers to choose from)

- Western Australia (gas only)

Electricity prices in the Northern Territory and regional Queensland are regulated so while they're both open to competition, the choice of providers is almost non-existent.

The government fully regulates power in WA so who you're with will depend on your location.

Which energy providers do we compare?

Finder compares some of the most popular energy retailers across the different states and territories. You might want to scroll past if you're in a state or territory where you can't switch providers.

Electricity providers in Australia

- 1st Energy

ActewAGL

AGL

Alinta Energy

Amber Electric

ARCLINE by RACV

Aurora Energy

CovaU

Diamond Energy

Dodo Energy

Energy Locals

- EnergyAustralia

ENGIE (formerly Simply Energy)

Ergon Energy

Flipped Energy

Globird Energy

Horizon Power

Indigo Power

Jacana Energy

Kogan Energy

Lumo Energy

Momentum Energy

- Nectr

Origin Energy

OVO Energy

Powershop

RAA Energy

Red Energy

Rimfire Energy

Sumo Energy

Synergy

Tango Energy

Gas providers in Australia

1st Energy

ActewAGL

AGL

Alinta Energy

ARCLINE by RACV

Aurora Energy

CovaU

- Dodo Energy

EnergyAustralia

Energy Locals

ENGIE

Globird Energy

Kogan Energy

Lumo Energy

- Momentum Energy

Origin Energy

Powershop

Red Energy

Sumo

Tango Energy

Tas Gas

As you can see from the two lists, there are a bunch of retailers that offer both electricity and gas plans. These are called dual fuel providers. However, you will be billed separately so the idea of going with the same provider for convenience is a little bit stretched.

Besides that, it's always best to compare electricity and gas plans separately since you might get the cheapest rates for both fuel types from different providers.

How much does should I be paying for my energy bill?

This is a great question given our research has found energy bills to be the third most stressful household expense for Australians.

Depending on which state you're in, electricity bills can range from around $296 to $509 per quarter and gas bills can vary between $181 to $344 per quarter.

We also track the average electricity and gas bill across Australia each month. You can keep it bookmarked to see if you're overpaying at any given point.

How do energy prices work?

A common theme between both electricity and gas plans is your initial breakdown of charges. Before we dive into that further, go get your latest electricity and gas bills so we can go through the details together.

Supply charges vs usage charges

Supply charges: This is the daily cost you pay to have electricity and gas supplied to your property. The fixed cost is set by the energy distributor servicing your area.

Usage charges: This is the cost paid for how much energy you use. The higher your usage, the more you'll end up paying. It'll show up on your energy bill as cents per kWh such as 23c/kWh or some providers might express the rate as $0.23/kWh.

Electricity tariffs

Usage charges for electricity can vary depending on the type of electricity tariff you're on.

Single rate or flat rate tariff: The usage charge will stay the same regardless of what time or day you use electricity.

Time of Use tariff: The usage charges will vary between peak and off-peak hours. Some electricity plans will also have a separate rate for the shoulder period, which falls between peak and off-peak hours. And lastly, usage rates can vary between weekdays and weekends as well as seasons. You need a smart meter or time of use meter to get on this tariff type.

Controlled load tariff: Usage charges will only apply to certain appliances such as an electric hot water system, pool pump or underfloor heating. A separate meter is required to get on a controlled load tariff.

Demand tariff: On this tariff type you will pay the usual supply and usage charges plus a demand charge. In a nutshell, demand is a measure of how much electricity you use at a point in time (normally peak hours), like when you have multiple appliances running at the same time. Your demand charge will be calculated based on the highest amount of energy you've used at one time and can vary month-to-month and with seasons. A smart meter is required to get on a demand tariff.

We know electricity tariffs can get confusing. So if you're still scratching your head, go deep dive into our whole separate guide on tariffs. It'll seem nerdy but your bank balance will thank you later.

Renewable energy

Australia is in the midst of a renewable energy transition with goals to reach net-zero carbon emissions by 2050. Critics believe this is coming at a cost to Australians but we'll avoid getting into the politics of it all.

If you're worried about your own carbon footprint or want some info on solar, keep reading.

Carbon neutral plans and GreenPower

It's easy to confuse the two but they're vastly different.

- Carbon neutral plans: Your energy provider will offset the carbon emissions that result from your electricity or gas usage. Some electricity plans will mention they're 100% carbon neutral, others offer it as a feature for a small fee.

- GreenPower: Your electricity retailer can't exactly feed in renewable energy straight from the generator to your home. This is where GreenPower comes in. It's a government-managed program that allows energy retailers to purchase renewable energy based on your usage, anywhere between 10% to 100% (or in increments set by your retailer). The program aims to increase the amount of renewable energy in the grid.

Something to consider when comparing energy is that not every provider will offer a GreenPower add-on or a carbon neutral plan.

Rooftop solar

As of April 2024, rooftop solar accounts for 11.2% of Australia's electricity supply and continues to grow at a rapid rate. In fact, many Aussies are turning to solar due to the soaring cost of energy or to support clean energy (or both).

Wondering if solar will be a good return on investment? You can use our solar payback calculator to find out.

Most importantly though, seek out advice from certified professionals and also friends and family who have been through the process. Doing everything on your own will seem daunting, plus it's plenty of money so you want to take steps to avoid dodgy solar installations.

Solar plans

Already a proud member of the solar community?

We know feed-in tariffs have gone soft in the last few years but that doesn't mean it's not worth comparing the best feed-in tariffs available from different providers.

In the guide we've just linked, we also talk you through tips on finding the right solar electricity plan for your household. We discuss whether it's better to opt for a higher feed-in tariff rate at the cost of a more expensive usage charge.

Rebates and concessions for energy

Energy rebates and concessions, available through either the state or federal government, can give you some much-needed support.

They usually cater to low-income households, people with different medical needs such as those on energy-intensive life-support machines, pensioners, seniors and more.

The easiest way to check whether you're eligible for a rebate or concession is to call your energy provider. Or, as an initial first step, head you can visit your state's energy website to see what's available.

Energy bill relief from the federal government

The Labor government is offering another round of energy bill relief as part of its election promise: $150 in energy bill credit for all households, paid in $75 quarterly instalments starting from 1 July 2025.

Both instalments will be credited directly to your account - there's no paperwork needed.

Last year, every household received $300 in energy bill relief from 1 July 2024, which was also part of the federal budget.

All four $75 quarterly instalments should now have been credited directly to your account.

If you haven’t received any rebates, contact your energy provider as soon as possible.

Frequently asked questions

Sources

Read more on Energy

-

Cheap energy plans

Compare the cheapest electricity and gas plans available in your state.

-

What is the average electricity and gas bill in Australia?

Check your quarterly electricity and gas bill against the average in your state.

-

Compare gas, electricity and internet bundles in Australia

Take the hassle out of signing up with different providers by bundling your energy and internet and claiming a discount.

-

Compare gas and electricity providers in Perth and WA

Most Western Australia residents can't switch electricity providers but have a few options when it comes to gas. Find out if you can switch energy retailers.

-

Compare electricity providers in Tasmania

We’ll help you compare and find the cheapest electricity provider in Tasmania — and guide you on your gas options too.

-

Compare energy providers in SA

You have the power to switch energy plans in Adelaide and the rest of South Australia. Luckily it only takes minutes to hunt down the cheapest options with us.

-

Compare NT electricity and gas plans

Find out how the NT energy market works and compare your options now.

-

Compare energy plans in Victoria

Don’t snooze. It’ll take just a few quick clicks to start comparing electricity and gas plans in Victoria and Melbourne.

-

Compare electricity and gas providers in Canberra and the ACT

Residents of the ACT have several electricity and gas providers to choose from.

-

Ergon Energy electricity plans and review

Ergon Energy creates and provides tailored and variable power supply to around 97% of the state of Queensland.