Rabobank offers a number of savings accounts and term deposits specifically for established SMSFs, giving your fund easy and flexible access to your money with competitive interest rates. Learn more about the different accounts available and compare your options on this page.

If you're looking for a savings account for personal use, take a look at the accounts Rabobank offers for personal customers instead in this guide here.

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseHow the Finder Score helps you find a better savings account

The Finder Score is a simple score out of 10. The higher a savings account's score, the better we think it is for the average customer.

We score each savings account in our database of hundreds based on a data-driven methodology with 2 main criteria: Does the account offer a high interest rate? And is it easy for savers to actually earn that rate?

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for term deposits

Finder Score assigns Term Deposit products a score out of 10, comparing interest rates and features, to make comparison easier. We assess over 150 products from more than 90 providers, assessing products across different terms to determine an average score per product.

Awards that Rabobank has earned

- Smart Investor Blue Ribbon Awards: Online Bank of the Year 2015

Who is Rabobank?

Operating entirely online, Rabobank is a part of the Dutch Rabobank Group. Founded in 1898, they are now one of the world's largest financial institutions with over 1,000 branches in more than 40 countries. Despite the worldwide connection, Rabobank is still an Australian financial institution, with balances of up to $250,000 guaranteed by the government.

Rabobank accounts focus on helping Australians grow their wealth through a number of different types of savings products. It offers savings accounts for personal use as well as for SMSFs.

What's Internet banking like for Rabobank?

With the Rabobank Internet Banking platform you can view your account balance and transaction histories for the last 18 months. You can use this platform to make payments to your linked account. The website uses the latest in technology to keep all transmitted data safe.

To access Internet Banking on your desktop, you'll need your DigiPass.

Mobile banking

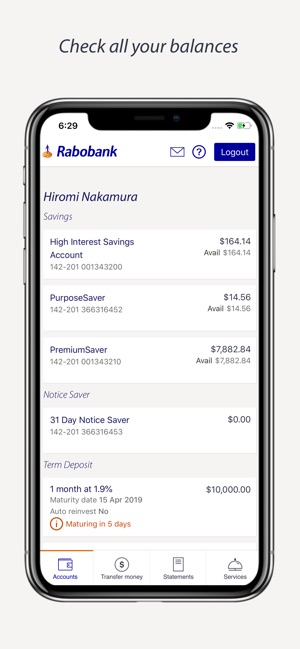

To set up the mobile banking app you need to login through your DigiPass. After you've initially set it up then you can simply use your five-digit pin to access mobile banking for future use, and manage your money on the go.

What about the mobile app?

Image Source: App Store| Login Page | Check your balances | Transfer Money |

|---|---|---|

|  |  |

What savings accounts and term deposits does Rabobank offer for SMSFs?

Here's a snapshot of the different accounts that Rabobank offers for SMSFs. For more details on the account fees and interest rates, refer to the table above where you can compare the accounts side by side. Additionally, if you'd like more information on any of the accounts, click the "More" button to read our detailed product review.

- Online Savings High Interest Savings Account SMSF. Put your SMSFs money to work. Boost your savings for four months with a competitive, introductory bonus interest rate. Once that period ends you will still be earning a competitive rate with this fee-free account.

- Online Savings Premium Saver SMSF. For SMSFs who need some encouragement to save, the Online Savings Premium Saver offers a bonus rate when you increase your balance by at least $200 each month.

- Online Savings Notice Saver SMSF (31 days). This account locks your money away and rewards your with a competitive interest rate in exchange for not touching your funds. As an additional incentive to save, your SMSF requires 31 days notice if you wish to access your funds.

- Online Savings Notice Saver SMSF (60 days). This account is the same as the previous Online Savings Notice Saver, but you're required to give 60 days notice to access your funds. However, you are rewarded with a higher rate of interest than the Notice Saver SMSF (31 days).

- Online Savings Notice Saver SMSF (90 days). This account is the same as the previous Online Savings Notice Saver, however you're required to give 90 days notice to access your funds. However, you are rewarded with a higher rate of interest than the Online Savings Notice Saver SMSF (31 days). These Online Savings Notice Saver SMSF accounts are effective options for saving your funds.

- Online Savings Term Deposit SMSF. You can lock your funds away for a term length of a few months to five years. You can't access your money until the term matures, so it's a great account to save your SMSF. The longer you lock your money away, the higher interest rate you'll receive.

Pros and cons of Rabobank's savings accounts for SMSFs

Pros

- Large variety of savings accounts available for SMSFs

- No account keeping fees charged for any of the SMSF savings accounts

- You can link any Australian bank account to your Rabobank account

Cons

- No physical branches, which can be an issue if your SMSF regularly needs assistance.

How to apply for a Rabobank savings account for your SMSF

If you think one of the Rabobank savings accounts could be the ideal savings solution for your SMSF, you'll need the following information for your application.

To apply for one of these SMSF savings accounts, you must meet the following eligibility requirements:

- Be registered. Your SMSF must be currently registered in Australia and have an Australian Business Number (ABN) for tax purposes.

- Have a bank account. Your SMSF must have a bank account in its name with another financial institution.

- Age and residency requirements. You, the authorised signatory, must be at least 16 years of age and an Australian resident for tax purposes.

During the application process, you will need to provide the following information:

- Authorised signatory details. You must provide your name, address, date of birth and contact information.

- SMSF details. Provide the name, ABN and tax file number of the SMSF.

- Existing bank account details. You will need to supply the Bank State Branch(BSB) and account number of an existing account your SMSF holds with another financial institution.

- Notice period. If you're opening one of the Online Savings Notice Saver accounts, choose a notice period of 31, 60 or 90 days.

Sources

Ask a question

More guides on Finder

-

How to make the most of the $5 trillion wealth transfer

Australian women are set to inherit the majority of the $5 trillion wealth transfer taking place over the next decade. This guide helps women over 45 understand how to manage, protect and grow their inheritance to create financial freedom and a lasting legacy.

-

Compare pension funds that give you an annual income in retirement

Compare pension funds and create a flexible, tax-effective income stream in retirement.

-

How much super should I have?

The average super balance is $154,350. Compare your super balance against the average balance for your age group to see if yours is on track.

-

Worst Super Funds

Here’s a current list of the worst-performing super funds in Australia and steps for how to switch to a better fund.

-

Retirement planning in Australia

Explore essential components of retirement planning for a secure future. Dive into the intricacies of retirement planning, covering vital elements such as investment strategies, savings goals, and risk management. Gain valuable insights to chart your path towards a secure and fulfilling retirement.

-

High growth super funds Australia

A high growth super fund invests more of your super into growth assets like shares, aiming for higher returns over the long term.

-

Best Super Funds Australia

We've analysed Australian super funds to find the best-performing super funds, the best industry super funds and the best super fund for low fees. Find the right super fund for you.

-

ING Living Super: Performance, features and fees

ING Living Super offers easy online access and a choice of flexible investment options to suit your life stage and retirement goals.

-

Superannuation for sole traders and self-employed

Self-employed super contributions are a great way to boost your retirement savings, but there are some rules. See rules for contributions and compare super funds if you're self employed.

-

Best super funds for teenagers

When you start your first job you'll need to open a bank account, a super fund and understand what your tax obligations are.