Key takeaways

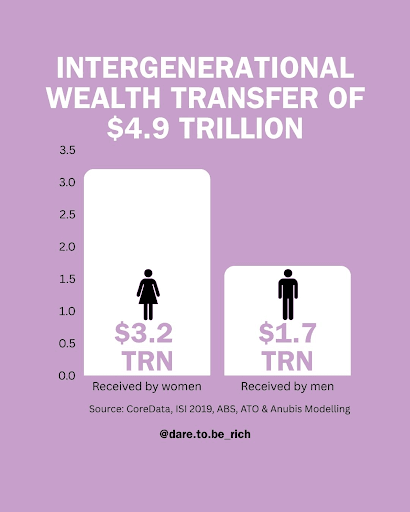

- Over the next decade, more than $5 trillion will be inherited from Baby Boomers, with women set to inherit over $3.2 trillion. This presents a significant opportunity for women over 45 to take control of their financial future.

- Research potential financial advisers or wealth manager carefully. Look for credible reviews, check qualifications and ensure they have the right licences to offer advice on investments and superannuation.

- If you're confident in managing your inheritance, consider low-risk options like high-interest savings accounts or property, or explore higher-return investments like ETFs or direct share market investments.

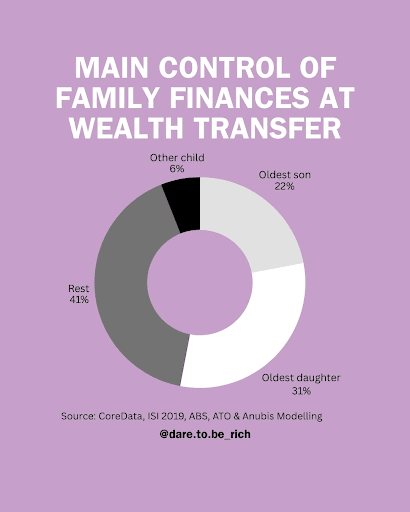

A massive handover of wealth is starting to take place right now in Australia. Over the next decade, more than $5 trillion from the Baby Boomers will be inherited by their children1. Two thirds (63%) of those heirs will be women. Why is that? Firstly, there are more women than men aged 45 or more. Secondly, thanks to changing perceptions around gender equality, inheritances no longer default automatically to the eldest son. What this means is that this demographic of women in Australia is going to inherit over $3.2 trillion2.

|  |

If you're one of these women, this is an incredible opportunity to create financial freedom and build your own legacy. However, for those not skilled in investments, it also presents some enormously challenging questions: 'What should I do with this money?' and 'Where do I start?'

If you're not familiar with the world of investments, tax or estate planning, the first step is not to panic. You're not alone in your unfamiliarity. Many women - and men - in your position are asking the same questions. The good news is, you don't need to be an expert to have control and make decisions that benefit you and your family, hopefully for generations to come.

Let's imagine that you've inherited, or are in line to inherit, wealth of some description. Everybody has a different definition of wealth - for some it's $1 million, for others it's $100 million - but regardless of the figure, let's assume this is money you want to protect, manage and grow. For the purposes of this guide, we'll assume you are going to rely on an investment professional rather than manage the inherited wealth yourself (for this, see breakout box below). Here's a simple step-by-step guide to help you get started:

1. Learn the basics of inheritance and estate laws

Australia does not have uniform inheritance and state laws across its various states and territories. While there are many similarities, differences exist in areas such as probate procedures, intestacy laws and estate taxation.

A good place to start therefore is by learning the basics of the inheritance laws that impact you. Once you've understood the essentials of your local framework, then you're well placed to understand how to protect your assets.

How to learn:

- Finder has a comprehensive summary of what is involved with estate planning, so that you're aware of the key terminology

- Check out the ATO's website for information on taxes related to inheritance

- Most qualified financial advisers or legal professionals will offer free or low-cost initial consultations. For financial advisers, you may want to consult the Profession of Independent Financial Advisers, or the Financial Advice Association of Australia. If seeking legal advice, you will want to ensure their focus is on estate planning.

Here are some trustworthy places to learn more and get advice:

- Financial Counsellors Australia: fca.org.au provides free, confidential advice on managing your money and planning for the future.

- Australian Government's MoneySmart: This easy-to-read and easy-to-understand website offers well written guides on estate planning, financial basics and much more.

- Legal Aid and Not-for-Profits: Many offer free or low-cost legal advice about wills and estates. Search to find some options in your capital city or suburb.

Another approach is to identify someone whose wealth and lifestyle you admire. At your next social gathering, ask them where they source their financial advice. Ask your contact further questions about the adviser in order to get a feel for whether you would be compatible with them. If the adviser seems right for you, ask your contact to make an introduction. If not, ask them if they know of others they could recommend.

It's always worth going into a consultation with an adviser or legal professional, having read up on the topic. This means that you'll be able to have a more informed conversation and also be able to ask some specific questions, rather than ask questions that are general in nature.

2. Research, research, research

Let's say you want to find a financial adviser or wealth manager to assist with managing your money; here are some tips for your online research:

- Take a look at the adviser's website. Does it look contemporary, or does it look a bit dated? You don't want anything too showy but you do want to get the sense they know what they're doing.

- Have a look at their customer reviews, usually available on the website, in detail. Do they talk about the qualities of the people servicing them (for example, 'they were so nice') or do they focus on the adviser's achievements ('they doubled my money in 5 years')?

- Check the year they were established to work out how long they've been operating.

- Crosscheck their ABN number, which should be available on their website, with the federal government's Australian Business Register ABN Lookup (abr.business.gov.au).

- Their Australian financial services (AFS) licence number should also be easily accessible on their site; crosscheck their licence number on the Moneysmart financial advisers register – go to moneysmart.gov.au and search 'financial advisers register'. This register can tell you where the adviser has worked, their qualifications, training and membership with professional bodies and the kinds of products they can advise on. This makes sure they're actually licensed to give you advice for superannuation – and not, for example, just provide advice on investments or life insurance.

- Also check any off-site reviews, such as those available via Google, Trustpilot or ProductReview. Do these reviews tell a different story to those on the adviser's website?

"With women set to control an estimated $3.2 trillion as part of the greatest wealth transfer over the next two decades, there is a powerful opportunity for them to shape not only their family's financial future but also the broader social impact landscape. Wealth transfer is not solely about assets - it's about values, legacy and purpose. Women can take meaningful action by engaging early and normalising conversations around wealth and its significance within the family. Whether a bequest is directed to charity or family, thoughtful planning and values-led dialogue are essential. It's also critical that women seek advisers who understand their unique perspectives and aspirations - ensuring their inheritance journey is both empowering and aligned with what matters most. "

3. Interview them

After you've completed your online research, you're now ready to have an initial meeting with the adviser or wealth manager you think might be right for you. Before the visit, make sure that you're not being charged for the session and that no advice will be given during or following it. During your meeting, ask the adviser or wealth manager a few basic questions, such as:

- Who owns your business?

- What types of clients do you advise?

- How long have you been giving advice to other clients in my position?

- What is the fee structure for any advice you may give?

- What's your investment philosophy?

- What's your attitude to risk when it comes to your clients?

- Are there any conflicts of interest I should know about?

- How and when can I expect communications from you?

- Which of your clients can I talk to as a point of reference?

Essentially you're looking for trust points. Does this person or group feel reputable? Are they a good fit for you, in terms of understanding where you're at in life, as well as from a personality perspective? What's their track record? Hopefully, the answers you receive give you a feel for whether this adviser is right for you.

In the same way you don't marry the first and only person you meet, you'll want to 'date' a few potentials to work out which adviser or wealth manager is right for you. This too is going to be a long-term relationship.

4. Cross-check

In the same way you would seek two (or more) opinions for surgery or after being diagnosed with a significant illness, it makes sense to seek other opinions when it comes to your financial future. This is a big deal! It will likely be the most important investment of time and money that you make. So what if you receive two sets of advice that are identical? Great – you can be absolutely certain you're on the right path. Ideally, one of the advisers finds a loophole or recommends another strategy that can potentially make you even better off; in this case, the money you've spent on their fee has been worth every cent. Ultimately, seeking a second (or third) opinion only yields upside.

5. Start talking with family about your wealth & future

Once you've appointed a financial adviser or wealth manager, then you need to close the loop by updating your own estate plan. It's your plan for who gets your estate and how. If you don't have one, now is a good time to start.

What to do:

- Find your will or estate plan, if you have one.

- Make sure it's up to date; it's amazing how quickly time flies and your circumstances have changed

- Consider talking with a lawyer or your financial adviser / wealth manager about how to make or improve your plan. They can help you understand what's needed.

It's also important to start talking with your family about your wealth and future as it helps reduce surprises and disagreements later. Plus, sharing your wishes ensures everyone understands and respects your decisions, meaning less likelihood of legal disputes after you've gone. As the saying goes - often the only winners from a legal dispute are the lawyers.

What to say:

- Explain your plans and intentions clearly.

- Share your thoughts about who should benefit and how.

- Encourage open dialogue - it's better to talk now than to face conflicts later

You don't need to be a financial expert to make smart choices about your money. The simple steps of education, research and cross-checking your plans should be able to provide you with a growing portfolio as well as peace of mind. This is your chance to secure your financial future, as well as leave a legacy that reflects your wishes.

For a low-risk investment, you may wish to invest it all in cash - take a look at Finder's comparison of high-interest savings accounts to work out which one is right for you.

Looking to invest your inheritance in something that delivers more growth than cash, and also gives you a steady income? Investing in property could be the answer; the Finder Property Index looks at which suburbs have the highest potential for growth.

For those who want to capitalise on the higher returns often associated with investing in the sharemarket but don't feel confident choosing which shares to invest in, then an Exchange Traded Fund (ETF) may be a good option for you. An ETF means you get access to a portfolio of stocks, even including alternative assets like bonds, property, gold and oil. To compare brokers on which asset class they offer, brokerage fees and other charges, make sure to check out Finder's ETF partners.

If you're confident of your share selection ability, and are prepared for the rewards - and risk - associated with investing directly in the sharemarket, then make sure to check out Finder's share trading partners. You'll be able to compare which region they offer, customer service awards and pricing.

FAQs

Ask a question

More guides on Finder

-

Compare pension funds that give you an annual income in retirement

Compare pension funds and create a flexible, tax-effective income stream in retirement.

-

How much super should I have?

The average super balance is $154,350. Compare your super balance against the average balance for your age group to see if yours is on track.

-

Worst Super Funds

Here’s a current list of the worst-performing super funds in Australia and steps for how to switch to a better fund.

-

Retirement planning in Australia

Explore essential components of retirement planning for a secure future. Dive into the intricacies of retirement planning, covering vital elements such as investment strategies, savings goals, and risk management. Gain valuable insights to chart your path towards a secure and fulfilling retirement.

-

High growth super funds Australia

A high growth super fund invests more of your super into growth assets like shares, aiming for higher returns over the long term.

-

Best Super Funds Australia

We've analysed Australian super funds to find the best-performing super funds, the best industry super funds and the best super fund for low fees. Find the right super fund for you.

-

ING Living Super: Performance, features and fees

ING Living Super offers easy online access and a choice of flexible investment options to suit your life stage and retirement goals.

-

Superannuation for sole traders and self-employed

Self-employed super contributions are a great way to boost your retirement savings, but there are some rules. See rules for contributions and compare super funds if you're self employed.

-

Best super funds for teenagers

When you start your first job you'll need to open a bank account, a super fund and understand what your tax obligations are.