- A new loan with a lower rate to pay off other debts.

- Can be used for personal loan debt, credit card debt or a mix of debt.

- Pay around 12% p.a. up to 7 years. Some fees may apply.

- Accepted debt amounts of $2,000.

Key takeaways

- Debt consolidation can minimise your repayments if you have multiple debts.

- There are 3 key ways you can consolidate your debts.

- You may still be able to consolidate your debt if you have bad credit – but it might cost more.

What is debt consolidation?

Debt consolidation is where you move multiple debts into one single debt.

It involves opening another credit account to pay off your existing debt. It means that instead of multiple repayments, you just have the one new account to repay. One account means one repayment date to remember, and ideally fewer fees and interest. If done right, it can also help you pay off the loan faster.

3 ways to consolidate your debt

- Transfer debt to a new card with 0% interest rate.

- Better for credit card debt, but if personal loan amount low enough it might be ok.

- Pay 0% for around 2 years. Some fees may apply.

- For debts of $500 to $8,000.

- Use the equity in your home as a line of credit to pay off debt.

- Used specifically for legal costs, but you might be able to get a portion for personal reasons.

- Pay about 5% for as long as you need. Fees may apply.

- For debts of $40,000.

When should I consider debt consolidation?

- You have multiple debts with different fees. These could include debts from credit cards, personal loans, car loans or student loans.

- You're struggling to make repayments for the different debts you owe.

- You're looking for a cheaper way to pay off your debts.

- You find that keeping track of all your debts is confusing and/or overwhelming.

Comparing your debt consolidation options

1. Debt consolidation loans

For personal loan debt

This is one of the most common ways people choose to consolidate or refinance their existing personal loan debt.

Take out a new personal loan, one with lower interest and fees than your current loan. By paying off the higher interest debt, you can bring down your total repayments and save money.

For credit card debt.

This may be a good option if you don't mind paying interest or you have more than a few thousand dollars' worth of debt and you're unlikely to move the full amount to a new credit card.

Apply for a lump sum to cover your credit card debt and use that money to pay off your card's balance. In exchange, you receive a regular payment structure and longer payment terms.

For personal loan and credit card debt.

You can apply to consolidate both personal loan and credit card debt at the same time with a new personal loan. It is likely you have a higher total amount of debt, so this option may work best. But don't forget to factor in any early repayment or exit fees, as this can add up across multiple accounts.

2. Balance transfer credit cards.

For credit card debt.

This is the most common way to consolidate credit card debt. You basically have to apply for a new card and move what you already owe onto it. You can take advantage of low or 0% interest offers to pay off your debt.

For personal loan debt.

Not as common, but you can find a handful of credit card providers (Virgin Money, Qantas Money and Coles) which allow you to balance transfer personal loan debt.

You can still take advantage of promotional 0% p.a. Interest rates for set periods, but once that has finished the rate will revert back to the standard rate (usually above 20% p.a.).

It's also important to note that most credit cards only allow you to transfer about 80% of your approved credit limit. This means that even if you're approved for a $10,000 credit limit, you may only be able to transfer $8,000.

For personal loan and credit card debt.

You can apply to consolidate both personal loan and credit card debt at the same time on cards from the providers listed above. Make sure the balance transfer limit is high enough for this to work.

3. Refinancing through your mortgage.

For personal loans, credit cards, and both.

If you have a mortgage, you have the option of taking out a home equity loan to consolidate and pay off your other debts. This option should only be used if you can be disciplined with your repayments and can build back your equity relatively quickly.

It will function as a line of credit, where you'll pay for what you borrow, not the entire credit limit given to you. This option can seem cheaper as home loans offer lower rates. But it is risky, difficult to manage and has no end-date. This can offset any savings earned with higher interest in the long run. Make sure you do the calculations to see if this option is economical. Interest, upfront fees and ongoing fees may be applicable.

What are the benefits of debt consolidation and what should I be aware of?

The benefits:

- Save money. By rolling all your debts into one account, you'll be paying one fee and one interest rate. This will likely reduce how much you're paying for fees and interest.

- Simplify your debts. You will have one monthly repayment to make, one lender to deal with, one set of fees to track and one rate of interest to remember.

- Pay off your debts. Instead of multiple credit accounts, you maintain a single account. You get to pay off your debts, avoid defaulting and, in the worst case, bankruptcy.

Be aware of:

- Confusing jargon. Watch out for certain "debt consolidation solutions" that are actually a Part 9 Debt Agreement. This is basically a form of bankruptcy and will have long term repercussions on your credit score.

- High rates and fees for bad credit borrowers. If you have a bad credit score, you're likely to be charged higher rates and fees.

- Paying more each month. Before you apply, calculate how much your new repayments will be to compare with what you're paying now. You may end up with higher repayments, like if you're consolidating credit card debt and have only been meeting the minimum repayments. Higher repayments may be ok if you can afford it and it means you pay off the debt faster.

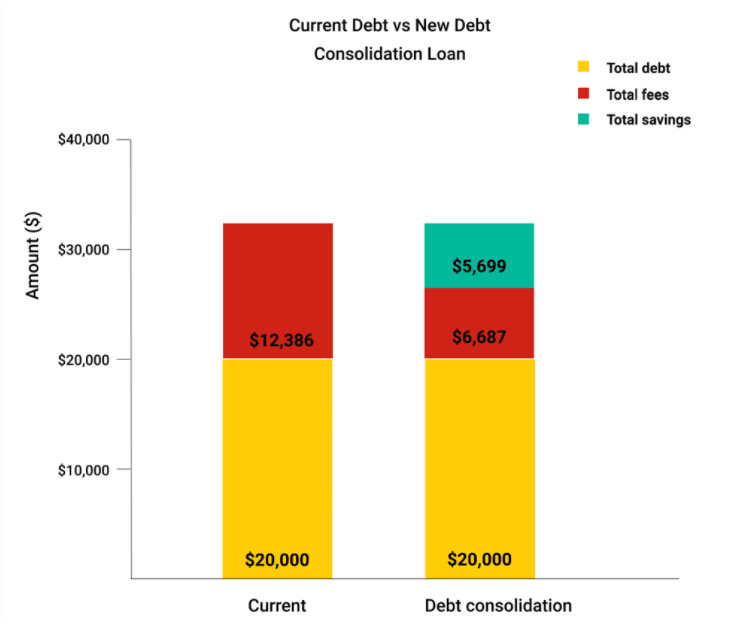

Must read: Say you have $20,000 worth of personal loan debt you wish to consolidate.

Let's say you've found a debt consolidation loan for the $20,000 debt you owe.

The new loan charges 11.99% in interest over 5 years, and doesn't charge a monthly fee. This means your monthly payments work out to $455. You would have paid $6,687 in interest.

By consolidating your debt and choosing a product with a lower rate and fees, you could save $5,699 in total. How much you can save will depend on your risk profile and eligibility, so be sure to compare your options and read the fine print.

5 things to consider before consolidating your debt

1. What you owe.

Make a list of all your debts and write down how much you owe. You can do this by signing into your online accounts or checking your current credit products on your credit report. You can check your credit report for free here.

2. How much you're paying in interest and fees.

The rationale of debt consolidation is to reduce what you're paying in interest and fees. Check what you're currently paying to ensure the new debt consolidation account is actually less.

3. Your eligibility.

Debt consolidation has its benefits, but there's no guarantee you'll be eligible. There is also no certainty that you'll be approved for the full amount needed to cover your debts. Check the minimum eligibility criteria, your credit report and the minimum and maximum borrowing limit of the option you're considering. If in doubt, ask the provider directly.

4. Whether an exit fee or penalty apply to any existing credit accounts.

Some personal loans may charge you a penalty to repay your loan early. This could offset any savings you make with a debt consolidation loan. If a fee applies to your loan, you need to ensure you're still able to save with the new loan.

5. Your credit history.

Your credit score tells the lender what kind of borrower you are and whether you're likely to make your repayments on time. They will consider your score to assess whether you're a risky borrower. Check your credit score and make sure the information in it is accurate. It will also give you an idea of your financial position and likelihood of receiving another loan.

How can I consolidate my debt if I have bad credit?

While having bad credit can limit your options, debt consolidation is still possible. It may involve entering into a Part 9 Debt Agreement, but not necessarily. You may also end up paying higher interest rates and fees.

- An unsecured personal loan with a specialist lender. Some lenders offer large, unsecured personal loans for people with bad credit. Interest rates are higher than with standard personal loans, but you may still be able to reduce what you're currently paying.

- A Part 9 Debt Agreement. Debt Agreements are a form of bankruptcy. It is an option for people with large debts that they are unable to repay. The financier will negotiate with lenders on your behalf and your debts won't accrue more interest. However, this agreement will be listed on your credit file for 5 years from the date you enter into it. This can have long-term consequences for your credit score and ability to get credit in the future.

What happens if my application is rejected?

If your application is rejected, here's what you should do:

- Wait 3-6 months before applying for another loan. Applying for multiple loans in a short period of time can affect your credit score. Waiting before reapplying may lower your risk of rejection

- Before reapplying, look into why your application was rejected. If your credit score played a role, you can work on improving your score. Paying your bills on time and building your savings can help. Your credit report gets updated every month, so good financial habits can help improve your score.

- Keep an eye on your credit report (you can access it for free) and once you're in the clear, you can consider applying again.

- Consider paying off your small debts so that you won't have to apply for a large loan. It may be easier to get approved for smaller amounts.

Compare Debt Consolidation Personal Loans

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFrequently asked questions about debt consolidation

Sources

Ask a question

51 Responses

Read more on Personal Loans

-

Salt and Lime Debt Consolidation Loan

Looking to consolidate your debt? Salt and Lime offers fee-free loans, same-day funding, and the ability to earn discounts on your interest over the life of the loan. Apply today.

-

Insolvency vs bankruptcy

Want to understand the differences between personal insolvency and bankruptcy and what both of these terms mean for your financial future? Find out here.

-

What are the consequences of bankruptcy in Australia?

This guide will take you through the consequences of bankruptcy so you can decide if it's the right option for you.

-

Debt negotiation

What is debt negotiation and how can it help you? Find out here.

-

Fox Symes Debt Consolidation Solutions

If you're juggling multiple debts and struggling with your repayments each month, a debt consolidation loan from Fox Symes may be an option for consider. Find out what's involved with its debt consolidation personal loan in our guide and if its right for you.

Want to consolidate debt of around $50000

Can someone help us

Hi Cheryl,

Thank you for reaching out to finder.

It looks like we are on the correct page to check on a panel of lenders who could assist you on your query.You may choose, depending on the debt that you have on the three tabs located on the page for Debt consolidation loans, Balance transfer credit cards for personal loans or Home Equity refinance. Kindly review and compare your options on the table displaying the available providers. Once you have chosen a particular provider, you may then click on the “Go to site” button and you will be redirected to the provider’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you.Hope this helps!

Cheers,

Reggie

Need help have bad credit and currently owe $50,000 in personal loans and credit cards. Need to consolidate loans into one payment not sure how this is done

Hi Darren,

Thanks for reaching out to Finder.

Even if you have bad credit, it’s not completely impossible to find lenders who can help you consolidate your debts.

You may compare lenders offering bad credit debt consolidation loans. You can click on the “Go to site” button of your preferred lender to be redirected to their website where you can learn more about their loan offer and start your loan application.

Before applying for any loan, please review the eligibility criteria and read through the terms and conditions to see if it best suits your needs.

I hope this helps.

Cheers,

Charisse

I am looking someone to help me get the low rate personal loan to pay off my credit cards and the money I borrowed from friends. So that I can have one fix repayment coming out every fortnight.

Hello Neil,

Thanks for reaching out to Finder.

This page provides a list of lenders that can help you consolidate your existing debt. You can use our comparison table above to help you find the right lender. While we don’t provide a specific product recommendation, you can use the table to narrow down your options. Simply, enter the amount you need to pay off your existing card and your friend followed by your repayment term then press “Calculate”.

You can click the name of the lender or the “More info” link to be redirected to our review page and learn more about the lender’s loan offer, rates, and requirements as well as the pros and cons of using their loan service. When you are ready, you may then click on the “Go to site” button and you will be redirected to the lender’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Cheers,

Gru

Hi Gru,

Thank you for reply. I understand these options. But I was looking for someone who helps me apply for loan. I don’t know which financial institution to choose to get guaranteed loan. Also I have few personal questions that are related to my current financial situation.

Is there anyone I can talk too?

Hello Neil,

Thanks for reaching out to Finder.

Finding a personal loan can indeed take a lot of time, effort, and stress.

If you prefer to speak to someone who can take your personal circumstance into account and offer you a range o

f borrowing options, you may consider using a personal loan broker. Personal loan brokers are handy for those with complicated situations or poor credit scores, who are typically rejected by traditional lenders.Please also feel free to view these pages to guide you and check if something would be suitable for you:

Avoid Personal Loan Rejection

Bankrupt Loans

Personal Loan Credit Card Debt

To increase your chances of approval, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. You can also contact the provider if you have specific questions.

Cheers,

Gru

I am trying to find out how I go about consolidating my credit card and personal loans into one payment but not sure how to go about it

Hi Kerrie,

Thank you for your inquiry.

It’s important to consider your options carefully. How much debt do you have and does it include loans and credit card accounts? Make sure you will be able to bring across all your accounts to consolidate. Please check our debt consolidation page for your available option.

I hope this information has helped.

Cheers,

Harold

recently discharged bankrupt 2 months ago.have 3 cash advances money3 total 520 p/week need a car and consolidate debt, 7000 owing on loans need about 8000 for car earning 1300 p/w permanent employment.

Hi Glenn,

Thanks for your question.

Please check the list of bankrupt loans featured on our website so you can explore what options might be available for you. Please review the criteria, details of the loan product and contact the lender directly to discuss your loan options and eligibility.

Cheers,

May

Hi Glenn, what is in page link?

Hello Rickky,

Thanks for your comment! :)

It is the list of lenders who can offer loans for bankrupts.

Hope this clarifies.

Cheers,

Jonathan