🔥 Hot tip

Set up direct debits so payments are made automatically. Just make sure you have money in the bank account to cover the payment.

There are a number of things you can do to improve your credit score quickly, and other things you can do to improve it over a longer period of time. Before you get started: you need to check your credit score to see what your baseline is.

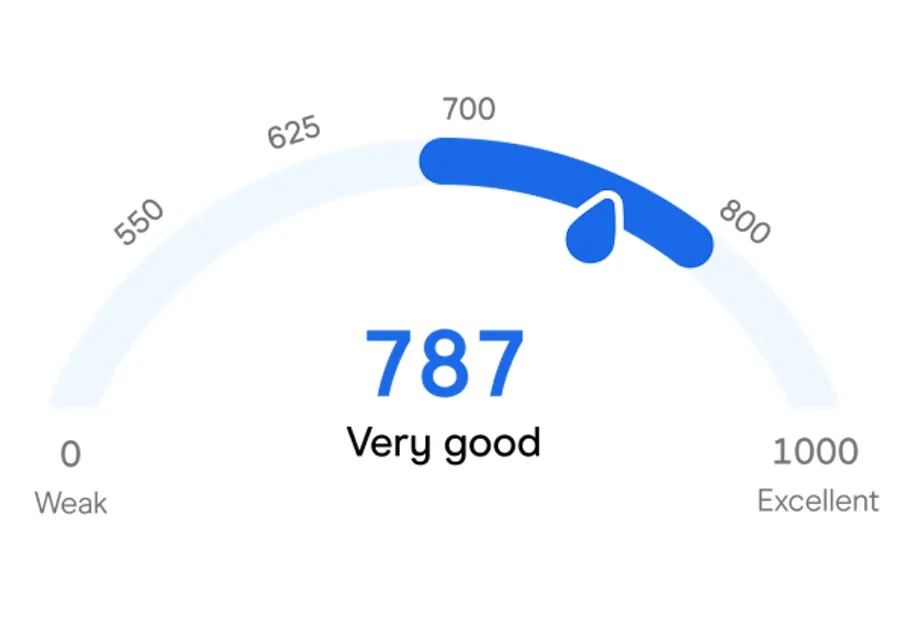

You can check your credit score for free through Finder. It takes a couple of minutes and then you'll know exactly what your score is. You'll get a score between 0 and 1,000. The higher the better.

Along with the score you'll get your credit report, which contains:

Once you have your credit score you can identify the best ways to increase it.

Look at the details contained in your credit report. If it all looks accurate, then jump to step 3. But if you find any errors you can get them corrected and your credit score should increase pretty quickly.

Here are some examples of possible errors:

You can request a correction on your credit report through the agency that issued the report. And you can contact the credit provider that made the mistake directly.

You'll need some personal identification, plus the report, the specific detail you're challenging and evidence of the error.

Fix the biggest issues dragging your credit score down as soon as possible. Red marks on your credit report are usually:

Prioritise paying off any outstanding debts, especially a default. Make sure you pay any missed payments before the 14 days if possible. Paying off an outstanding payment looks better on your credit report but the missed payment or default is still recorded.

It sounds obvious, but don't miss a payment on your credit card or loan. Pay off at least the minimum on your credit card before it's due.

🔥 Hot tip

Set up direct debits so payments are made automatically. Just make sure you have money in the bank account to cover the payment.

If you have a credit card you hardly ever use, a personal loan nearly paid off or any other debts you can pay out and close, doing so will instantly give your credit profile a boost.

This is because when you cancel a credit card, you're reducing the amount of overall debt you have access to. This is seen as a positive and may improve your credit score.

If you already have a credit card and you're making repayments on time, you can further improve your credit score by lowering the card limit. That's the maximum amount you can spend using the card.

It's much easier to get into financial trouble with a card that lets you spend $10,000 versus one with a limit of $2,000. If you don't need to make big purchases on your credit card, lower your limit and your credit score should increase by the following month.

Your credit record collects both positive data (all the years you've spent paying your phone, internet, electricity and gas bills on time) and negative data (late payments, defaults). When you pay your bills on time, you're building a positive credit score over time. Setting up direct debits for your bills (or even automatic reminders) is the easiest way to do this.

You might think someone who has never had a cent of debt to their name would have a perfect credit score. But that's not the case.

To prove you are a reliable borrower you need to actually have a history of managing debt responsibly. If you've never had a loan or credit card before it can be hard to show this. You can start to build your credit rating with a credit card.

Just make sure:

Having some debts is good – a borrower with a single credit card and a home loan who never misses a repayment is likely to have a strong credit score.

But if you have 3 credit cards and 2 personal loans, you may struggle to improve your credit score even if you never miss a repayment.

If you can cut down to 1 or 2 credit cards and consolidate your loan debts you can lift your score.

Alternatively, prioritising paying off one of the loans completely would help too. A balance transfer credit card can be the best way to roll card debts into one manageable debt.

Buy now pay later (BNPL) products like Afterpay might not seem like credit products. But using BNPL can harm your credit score.

Missing BNPL repayments will hurt your credit score. And some BNPL providers make a credit enquiry when you sign up, meaning the company takes a look at your credit report. This can impact your credit score too.

When you apply for a loan or credit card the lender requests a copy of your credit report. This is called a hard inquiry and it can negatively affect your report.

This is because multiple applications for credit in a short time are considered a bad sign.

To avoid this:

🔥 Hot tip

Getting rejected for a credit application hurts your credit score because of the hard inquiry mentioned above. Avoid applying for another credit product until you understand why you got rejected for the first one. Multiple inquiries can harm your credit score even more. Checking your own credit score is considered a soft inquiry and doesn't affect the score in any way.

| Response | |

|---|---|

| No | 68.8% |

| Yes | 31.2% |

Unfortunately there is no quick fix or shortcut to improving your credit score. If you have a poor score, it can often take time before you see a huge improvement in your credit rating.

However, by consistently following the steps above you should see your score gradually increase.

One exception may be if you have multiple errors in your credit report that are harming your score. Getting these corrected and removed from your report may have an immediate impact on improving your credit score. In the meantime:

If you've had a very bad run with your finances – missed payments, defaults, a bankruptcy – then time is your friend.

In Australia, defaults stay on your credit report for 5 years. Missed payments stay for 2. If you were declared bankrupt, the bankruptcy stays on your report for 2 years from the end date or 5 years from the date you became bankrupt (whichever of the 2 is later).

So while all the tips we've outlined above are very useful, for people with terrible credit the passage of time also helps a lot. Just avoid getting into more credit trouble in the meantime.

There may be mistakes on your credit report you can fix. And there are companies that offer credit repair services who can fix those for you.

But these companies can charge high fees and are often just doing things you can easily fix yourself, for free.

Paying off debts completely is good financial advice. But it's often worth keeping a credit card you rarely use and have always paid off on time. This card is a good example of your creditworthiness.

Just make sure you keep the limit as low as possible.

If you're struggling to make repayments and need financial help you have options:

Credit Repair Australia can help you sort out your credit score and improve your chances of getting a loan or credit card.

Missing a phone bill can end up hurting your credit score, but simply having a mobile plan won't impact your credit report.

Follow these tips to get a handle on your credit with this free tool.

The average Australian has a "very good" credit score according to Finder analysis. Here's how credit scores are categorised in Australia, and how to check yours.

Credit reporting bureaus issue credit reports and scores to consumers and lenders. Discover how they work in this guide.

If you're planning to cancel a credit card, here's what you need to know about the impact it could have on your credit score.

How to remove incorrect negative listings from your report and adopt positive money habits to get your credit history back on track.

How to remove enquiries from your report in 4 steps and a guide for improving your credit score.

Discover how you can use a credit card to build or repair your credit history.

Hi Team,

my current credit scores are as follows; WeMoney Equifax 575/Experian 797 & ClearScore Illion 703/Experian 782 and I have a 4k limit on my credit card (Humm90 useful with Long-Term Interest-Free finance) and an initial fixed personal loan of 11k. I have found out from the financial institution that I received the loan from that they do not provide credit information to credit bureaus which stunned me (they are OurMoneyMarket). I technically took the loan to improve my credit score prior to applying for a home loan in the next 18 – 24 months.

Would there be any benefit of showing ‘proof’ of repayments to the credit bureaus and adding this as a special note from myself that I successfully repaid the loan once I do so? I may have had incorrect understanding but I assumed that all financial institutions must at least provide information to 1 credit bureau.. is that not the case..?

Hi Marcin,

Securing a loan from OurMoneyMarket will generally show up on your credit file as a hard credit inquiry – I would be very surprised if this isn’t the case, as it’s a legal requirement. Obtaining a loan requires a hard credit inquiry to be performed to assess your creditworthiness for the loan application. However, getting a quote or pre-approval from OurMoneyMarket is a soft credit inquiry, will not impact your credit score – this may be what you were referring to.

You can request a free copy of your full credit report from Experian which outlines all of your hard credit enquiries, where you can check for yourself.

Hope this helps!

I don’t have any debts, I certainly don’t have any bad or outstanding debts, I don’t have any credit cards, I pay my bills on time, I have a good paying full-time job. Why isn’t my credit score good enough?

Hi Stephen, Your credit score is based in part on your history of repaying debt – so not having a credit card or mortgage means it’s unlikely to go up. Potentially you could improve it by using a credit card which you pay off in full each month.

Can I get more information around my credit score there is only 2 missed payments surely that can’t be the reason for a low score??

Hi Liana, If you contact the provider of your credit score (eg Experian) you can request a copy of your credit file. This lists the full details of your financial history for the last few years, so you can look for any discrepancies. You can access all of this information in the Finder app; you’ll also get sent a monthly update with any changes to your score.

Best of luck!

I have a credit card for $1k and a personal loan of $53k which I used to start my business. Now my business has generated me a good amount of cash flow, If I pay about $20k back to my loan, would that increase my credit score? Or would I need to fully pay my loan off in order to see a better credit score? And if I only pay $20k, would I be eligible to apply for another business loan? Thanks.

Ps. I love your services.

Hi Luis, A number of things can impact your credit score. We know that credit scores tend to increase when a credit facility is closed altogether; reducing the credit limit can also have a positive effect. Making payments on time also contributes towards positive credit reporting. Overall, it’s hard to say with certainty what impact repaying $20k as lump sum would have.

As for obtaining another loan, your eligibility depends on several factors including your income, expenses, how long the business has been operating etc. There are a few options you could explore, such as consolidating your personal loan and credit card into one new personal loan for a higher amount to access new funding, then closing your existing 2 accounts.

Hope this helps!

I currently have Debt Agreement which will expires in January 2024. Will this fix my credit score?

Paying off an existing debt should have a long-term impact. However, other factors influence your credit score so you might not see an immediate change in your score even once that debt is repaid.