upcover business insurance review

upcover offers a range of cover types for small Aussie businesses, with tailored cover available for thousands of different professions.

upcover makes a big point about how easy the online application process is, so I gave it a try for my passion project. I put in the type of business I run, music composition, and my yearly revenue. Yo be clear, I multiplied my actual income by about 100 to make the quote more reasonable. One of these days...

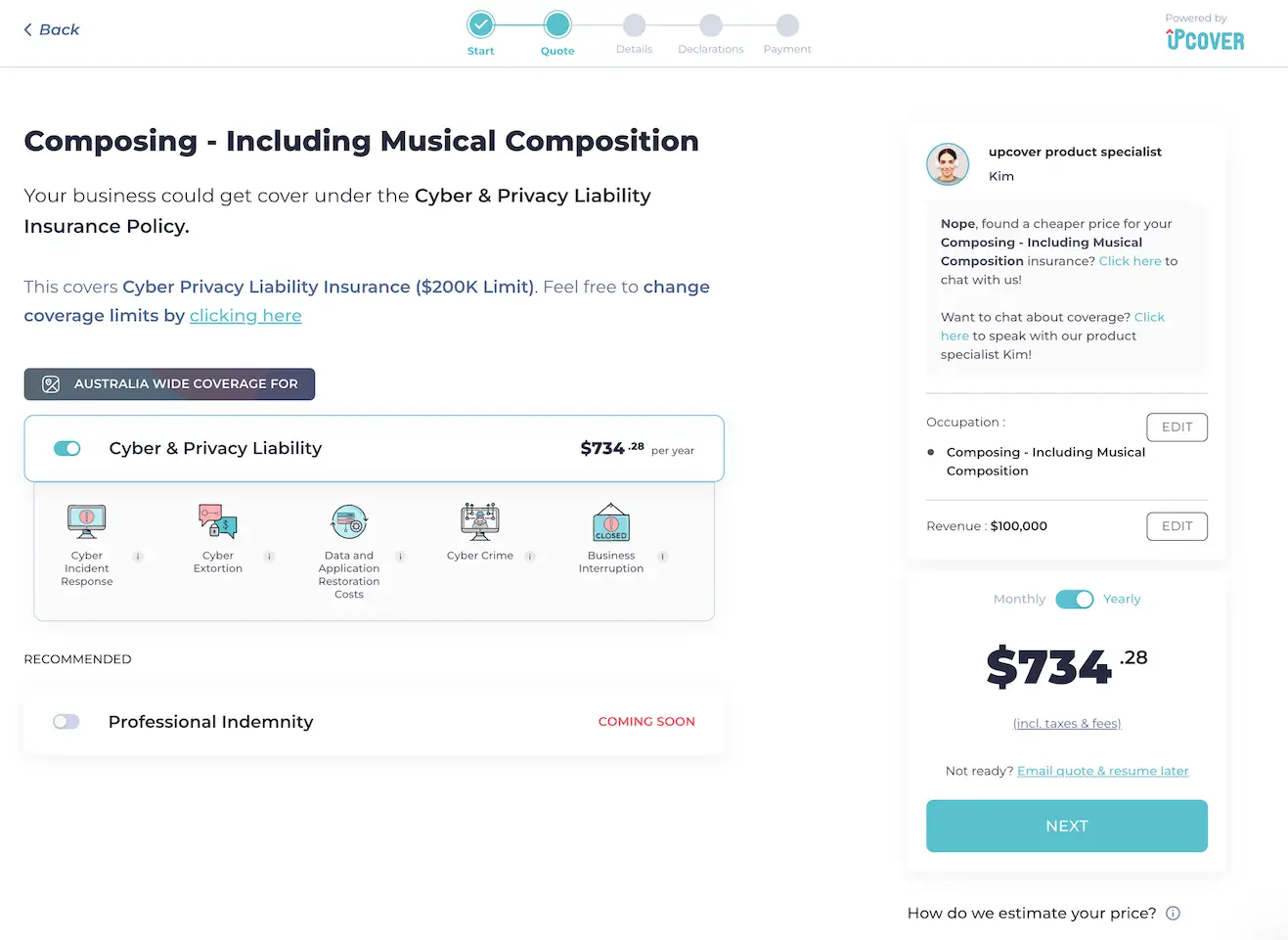

The screenshot below is the quote I got. upcover recommended Cyber & Privacy Liability cover, but didn't offer professional indemnity for my work. I tried a few different professions and it had different cover types for things like doctors or fitness instructors.

Overall, it was a pretty nice experience, especially getting a quote in less than 15 seconds. If things were ever to pop off and I needed cyber cover, I'd definitely get a more detailed quote.

Farm insurance can provide the protection Australian farmers need. It can include ✓ building insurance ✓ crop insurance ✓ livestock insurance

There are various types of insurance to consider based on your specific business needs. Find out more in this guide.

Complete guide to getting insurance for trucks in Australia.

Read the Finder guide to workers compensation insurance and get cover in place.

This hourly rate calculator helps you consider your costs and profit and divide that by the number of hours you will work.

Read more about NRMA business insurance and its features.

If you run a business from home you need to make sure your business is properly insured. Read our guide to this specific type of business insurance and learn how to cover your home business.

Receive quotes for cyber liability insurance from Australian brands.

Commercial property insurance is designed to protect business items.

When faulty products cause injury or loss, your business needs to protect itself with product liability insurance. Learn how product liability cover works and get quotes.