What do Australians think of eToro share trading platform?

- 4.06/5 overall for Customer Satisfaction - lower than the average of 4.18

- 4.02/5 for Trust - lower than the average of 4.55, and this was the lowest score in the category

- 4.09/5 for Customer Service - lower than the average of 4.11

Based on eToro share trading platform scores in Finder's 2024 & 2025 Customer Satisfaction Awards.

About eToro

| Fees |

★★★★★ 4.5/5

|

eToro offers zero commission trades on stocks from Australia (til August), the US and other global exchanges, including Hong Kong and the UK. |

| Trading tools |

★★★★★ 4/5

|

It has a lot of trading tools, including copy trading, stop-loss orders, social features and the ability to use leverage. |

| Research and education |

★★★★★ 5/5

|

There's a bunch of educational content available through eToro's Investing Academy, plus you can practice your trade strategy through the online demo account. |

| Available securities |

★★★★★ 4/5

|

You can trade stocks, ETFs, cryptocurrencies, and forex CFDs via eToro. |

| Customer support |

★★★★★ 2.0/5

|

While it's not always easy to contact eToro over the phone, it does offer a live chat option through the platform. |

| Available countries |

★★★★★ 4.5/5

|

eToro offers 16 markets, including the ASX, US, UK, Hong Kong, France and Germany. That being said, it doesn't offer the full range of equities in each market. |

To learn how our star ratings are calculated, read the

methodology here.

eToro is a social network of stocks, CFDs, commodities and forex trading that came out of Tel Aviv back in 2007. In the years since, the broker has become a global powerhouse spreading across 140 countries around the world.

The platform made a name for itself through a few nods to retail investors. Its claim to fame is its popular copy-trading feature, which allows users to track and imitate the actions of the platform's top traders. It also offers cheap brokerage and educational resources, plus it lets you trade a number of financial products all in one place.

If you're looking for more than just a standard forex or CFD broker, then the social trading elements outlined in this review could be for you.

Is eToro safe?

eToro is regulated by a host of financial authorities including the US, Europe and Australia. In Australia, it's licensed by the Australian Securities Investment Commission (ASIC) under the trading name eToro AUS Capital Pty Ltd.

Among popular user review sites, feedback has been mixed. On the complaints side, reviewers primarily point to the withdrawal fees, spreads and poor online customer service. The positive reviews highlight eToro's user-friendly platform and OpenBook feature that allows users to share live trading news and ideas with one another.

Ratings from review sites:

- Forex Peace Army: 2*/5

- AU Trustpilot: 4.2*/5

- ForexBrokers.com: 4.5*/5

Note: Forex and CFD trading always carry risks, which you should be aware of, so read up before you start investing. Do your research before signing up to any forex or CFD trading platform.

What markets can I trade with eToro?

- ASX stocks. Buy and sell Australian stocks with US$2.00 brokerage.

- US stocks. Directly buy and sell US stocks listed on the NYSE and Nasdaq.

- European stocks. Trade stocks from Amsterdam, Brussels, Frankfurt, Lisbon, London, Madrid, Paris, Stockholm and Zurich.

- Forex. Currencies are traded on eToro as CFDs and you have 47 forex currency pairs to choose from.

- Stock CFDs. eToro gives you the option of trading a number of global share market CFDs.

- Indices. Stock market indices allow you to trade a basket of companies, such as the top 500 US stocks in the S&P 500.

- Commodities. You can trade silver, gold, copper, palladium, platinum, natural gas and oil CFDs.

- Cryptocurrencies. eToro allows you to trade cryptocurrency such as Bitcoin or Ethereum.

eToro highlights

Here are the notable account features worth highlighting:

- US$2.00 brokerage. There's a small broker fee (commission) when you trade stocks, including in Australia.

- Copy trading. You can follow the trading activity of other users and imitate their trades if they have a good track record. The trading decisions made by eToro users are uploaded to the eToro network, where you can view them in different statistical ways.

- Market data and news. eToro's platform connects you with users around the world so you can discuss, share and learn market ideas and trading strategies. Its Twitter-like news feature on the OpenBook platform offers live user updates on which trades your peers are making and the markets they are keeping an eye on. You also have access to training courses, research papers and price data.

- Access to markets. From a single account, you can trade US stocks, global forex, commodities, cryptocurrencies and CFDs through any web browser or mobile phone (iOS and Android).

- Risk management. You can choose your desired risk level and the amount you wish to invest with each trade with mandatory stop-loss levels. This allows you to tailor each trade to suit your risk/reward strategy.

Who is eToro designed for?

eToro has users across most of the world. It is a platform designed around its social and active traders, with its features favouring them.

eToro's fees make it appealing to pretty much anyone as it offers US$2.00 commission in a number of countries including Australia. Passive investors might also enjoy the social features that will copy the best traders on eToro's platform.

What are eToro's spreads and fees?

eToro now charges US$2.00 on normal stock trades. It may also charge foreign exchange spreads and fees.

- Deposit fees. There is no fee to deposit money into your account.

- Currency conversion fee: eToro users trade in US dollars, so Australians will need to pay a currency conversion fee when they deposit and withdraw AUD onto and from the account. The fee you get charged depends on what method you use to transfer funds. To make things a bit more confusing, you get charged in pips. Pips is a term most often used in forex trading - for the sake of simplicity, 100 pips means you'll get charged a 1% fee.

- Bank transfer: 150 pips (1.5%) to deposit, 150 pips to withdraw

- Debit / Credit card: 150 pips (1.5%) to deposit, 150 pips to withdraw

- PayPal, Neteller, Skrill: 150 pips (1.5%) to deposit, 150 pips to withdraw

- Withdrawal fees. The same currency conversion fee applies again to withdraw funds. You can withdraw your funds at any time, but the minimum you can withdraw is AUD30 and there is a AUD5 withdrawal fee. You can withdraw funds using a credit card (1–2 days), PayPal (1–2 days) or bank transfer (up to 8 days).

- Inactivity fee. If there has been no log in for 12 months, eToro charges an inactivity fee of US$10 per month until any remaining funds are removed. No open positions will be closed to cover this and the fee will stop once a user logs in.

- Forex trading spreads: eToro doesn't have the lowest forex spreads on the market for forex traders, starting at 1.0 pips for AUD/USD and running as high as 50.0 pips for exotic currency pairings.

Currency conversion example: Say you want to transfer $100 AUD onto eToro using a bank transfer (50 pips). You would be charged $0.50 cents AUD. Since at some point you'll also need to withdraw your funds, you'll be charged another 50 pips (0.5%) plus a withdraw fee of US$5.

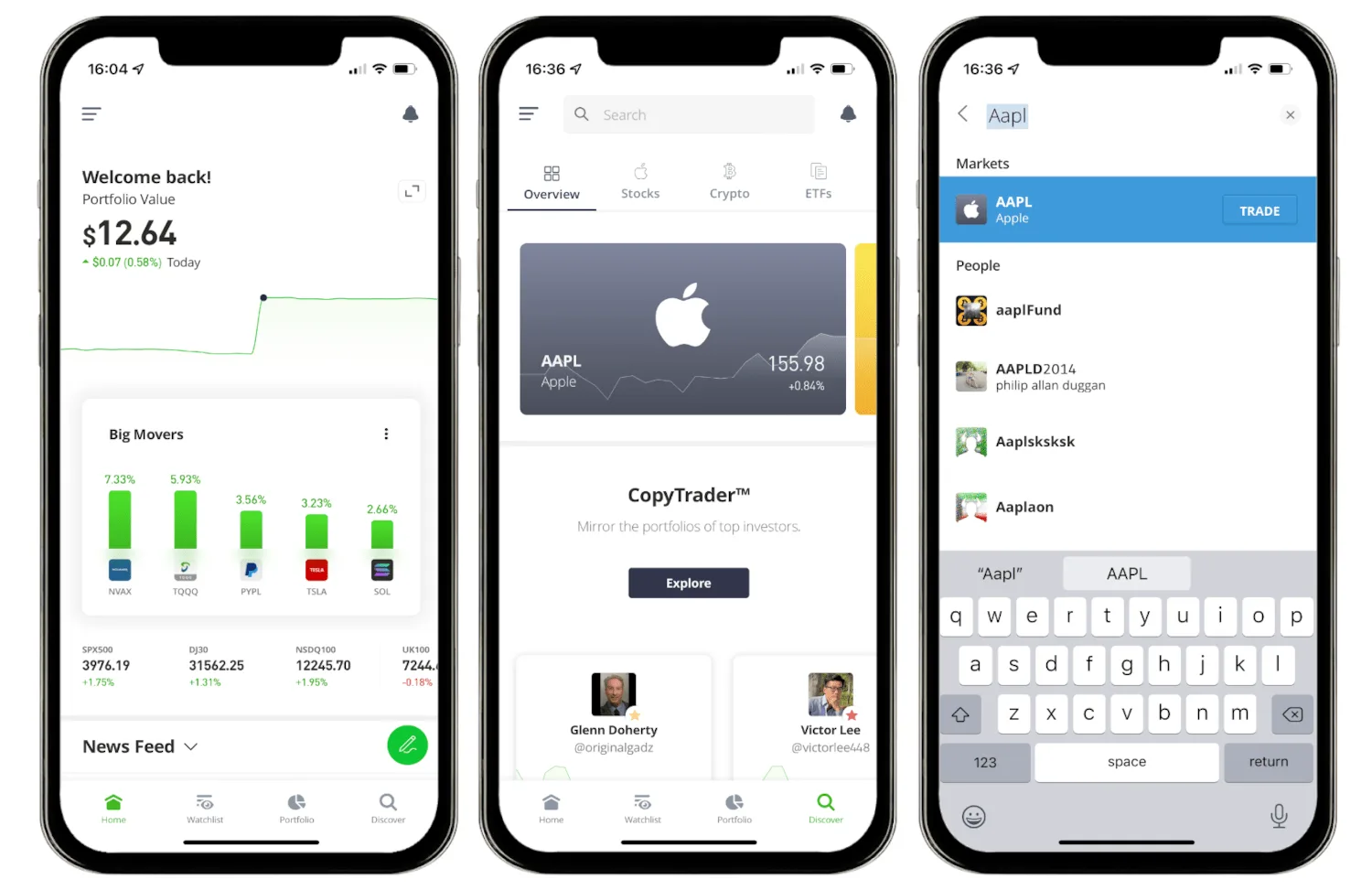

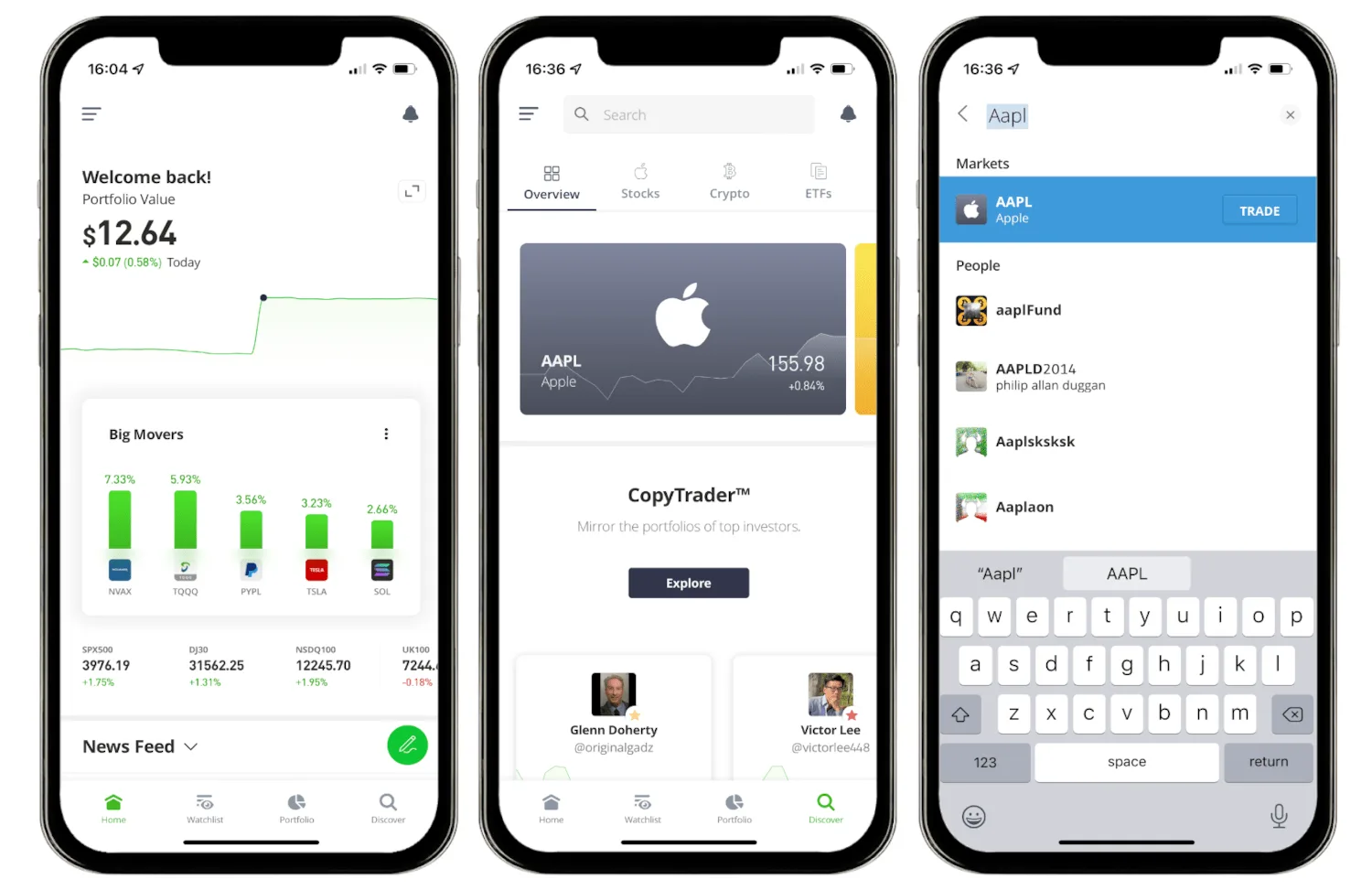

Take a look at the eToro app

eToro's app store reviews

| Google Play app reviews | 3.8/5 stars based on 149,000+ reviews |

| Apple App Store app reviews | 3.9/5 stars based on 3,200+ reviews |

Stocks versus CFD stocks

eToro's platform is unique from most others in Australia's market because you can trade CFDs and stocks from a single account, so it's important to understand the difference.

When you trade stocks, you own the underlying asset and your profits can only be equal to the price rise of the stock. This also means you can't lose more than your initial investment.

CFDs are risky leveraged products that allow you to speculate on the price movements of stocks and other assets such as cryptocurrencies and commodities without ever owning them. Because they're leveraged, both your profits and losses are magnified and you can lose more than your initial investment.

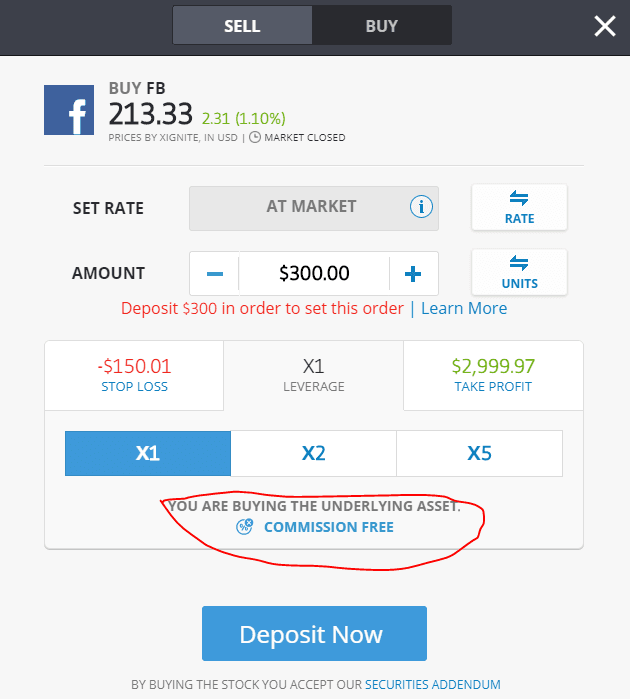

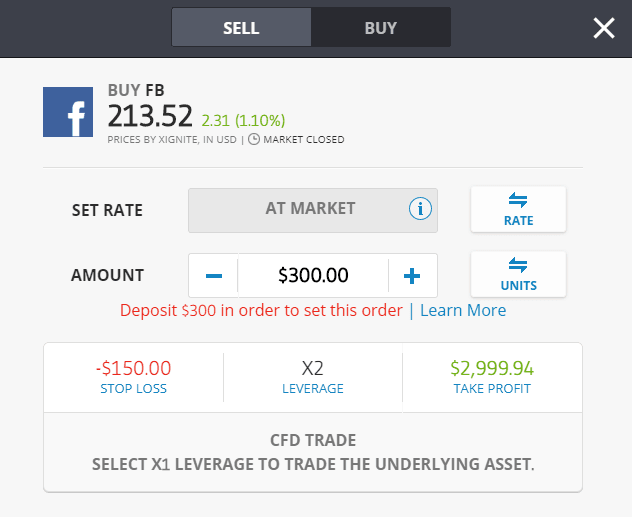

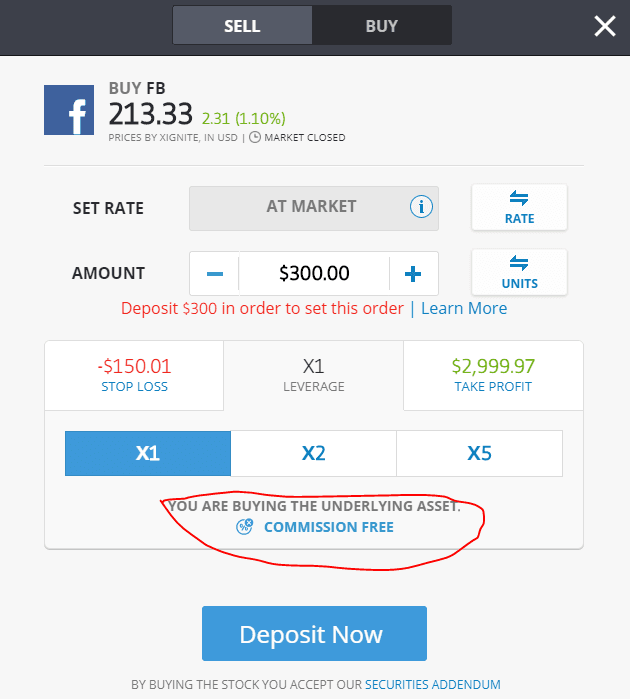

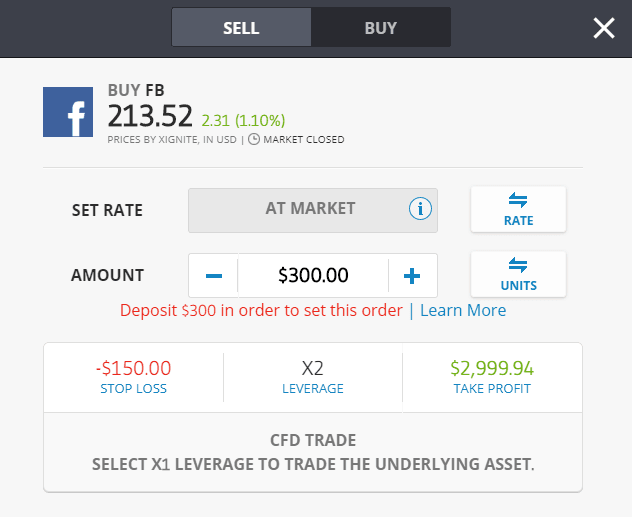

On eToro's platform, you have a choice of adding leverage when you trade stocks. If you choose 1x leverage, you're buying the real stock and you'll see the message, "You are buying the underlying asset."

If you choose to add leverage above 1x, you'll automatically switch to CFD trading as you can see in the image below:

Trading real stocks on eToro. |  CFD trading on eToro. |

Account comparison

When you sign up to eToro, you have the option of opening a retail account or a professional account. Below is a comparison of the fees, minimum deposits and spreads.

| Minimum opening balance | US$50 | US$200 |

|---|

| Spreads | From 1.0 pips | From 1.0 pips |

|---|

| Commission per lot | N/A | $7 |

|---|

| Leverage | 1:1–30:1 | 1:1–400:1 |

|---|

| Minimum trade size | US$10 (For share trading) | US$10 (For share trading) |

|---|

What customer support options are available from eToro?

If you have a question about your account, eToro has a help section on the platform. You'll see a live chat option but this isn't available for Australian users at this stage.

You can also learn more about trading forex and CFDs through the eToro Trading Academy. It offers webinars, an ecourse, trading tips and a dedicated education centre.

Support options:

- Trading Academy

- Email

- No phone service

- No live chat available in Australia yet

How do I open an eToro Australia account?

It's free and easy to create an eToro account. Simply apply online by clicking the "Go to site" button at the top of this article and follow these steps:

- Supply your full name.

- Enter your email address and phone number.

- Create a username and password.

- Supply proof of ID and tax file number.

To satisfy financial service regulations, you'll need to answer a few questions about how much experience you have trading stocks and other products such as CFDs as well as a short quiz that you'll need to pass to qualify for an account.

ARSN 637 489 466, promoted by eToro AUS Capital Pty Ltd AFSL 491139. Your capital is at risk. Other fees apply.

This information should not be interpreted as an endorsement of futures, stocks, ETFs, CFDs, options or any specific provider, service or offering. It should not be relied upon as investment advice or construed as providing recommendations of any kind. Futures, stocks, ETFs and options trading involves substantial risk of loss and therefore are not appropriate for all investors. Trading CFDs and forex on leverage comes with a higher risk of losing money rapidly. Past performance is not an indication of future results. Consider your own circumstances, and obtain your own advice, before making any trades. Read the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the product on the provider's website.

Anthony

May 16, 2025

Testing if this message goes through due to errors

Using your site to ask a question. If it goes through. I will send my detailed questions later on this page as the other page for asking questions has parts missing such as name and email. Guessing this is the problem for message errors. This is to test my theory.

Show more Show less