Here's what we found when we sent live transfers to Mexico and France through Xoom:

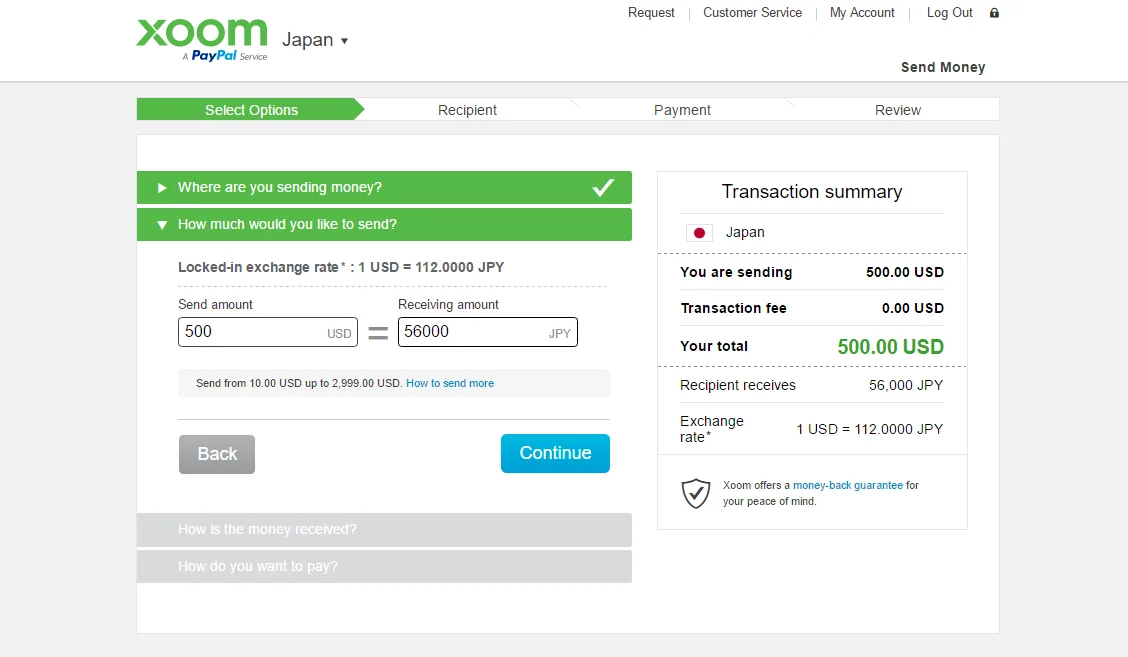

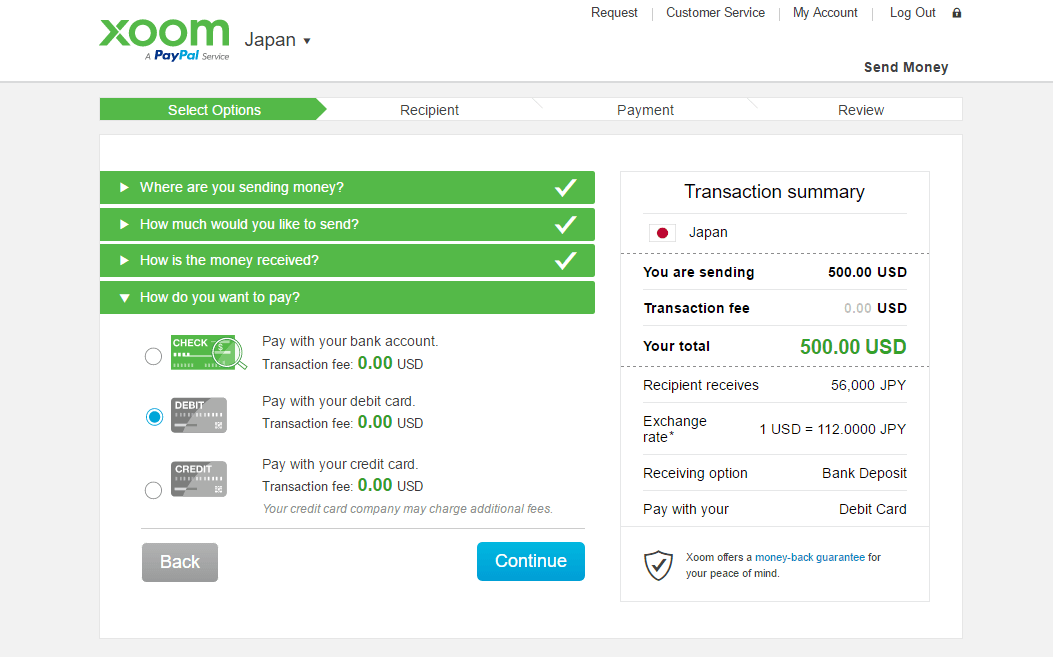

- We paid low fees and received competitive rates within 2.4% of the mid-market rate on average, with rates updated multiple times a day.

- Our transfer to France arrived ahead of schedule, while our funds were deposited into our recipient's Mexican bank account within 24 hours.

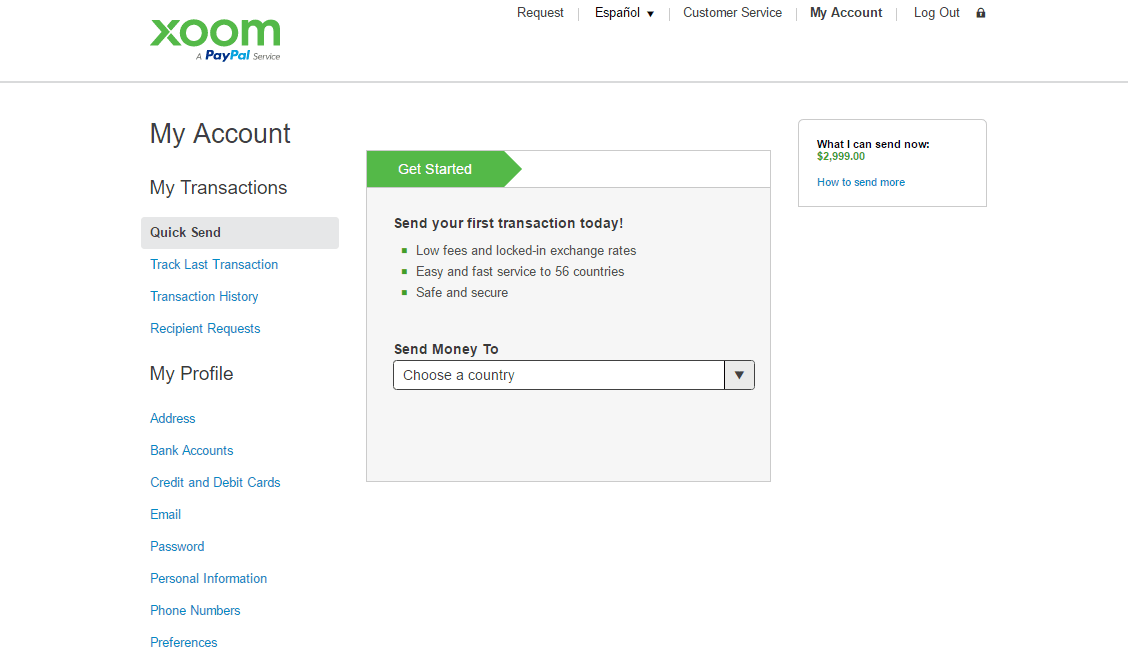

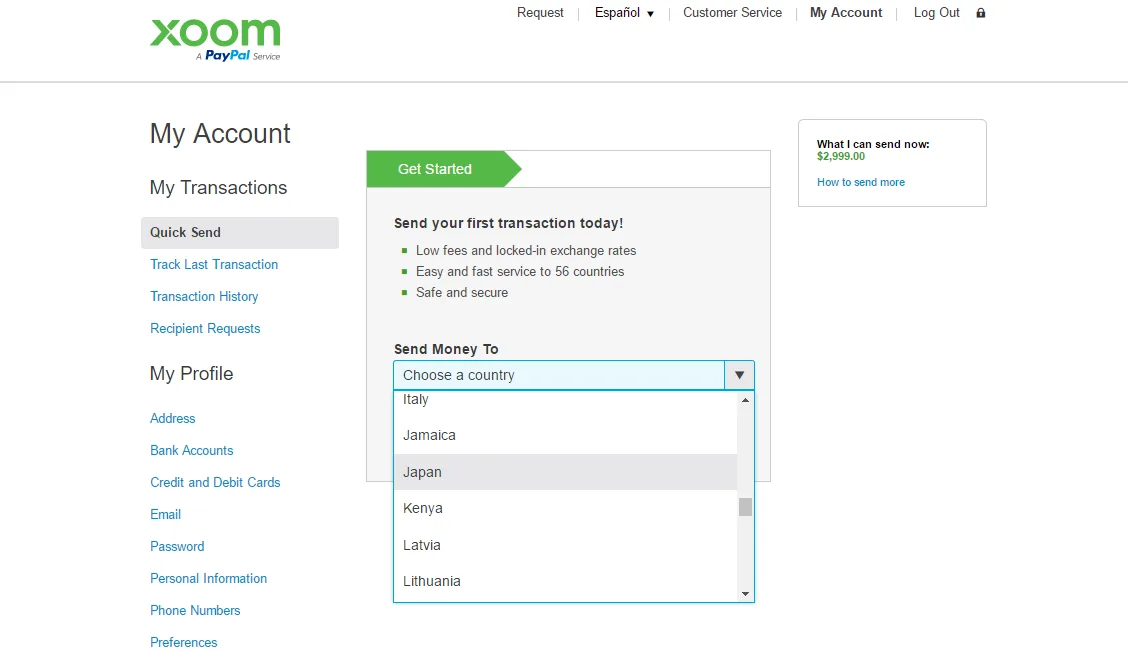

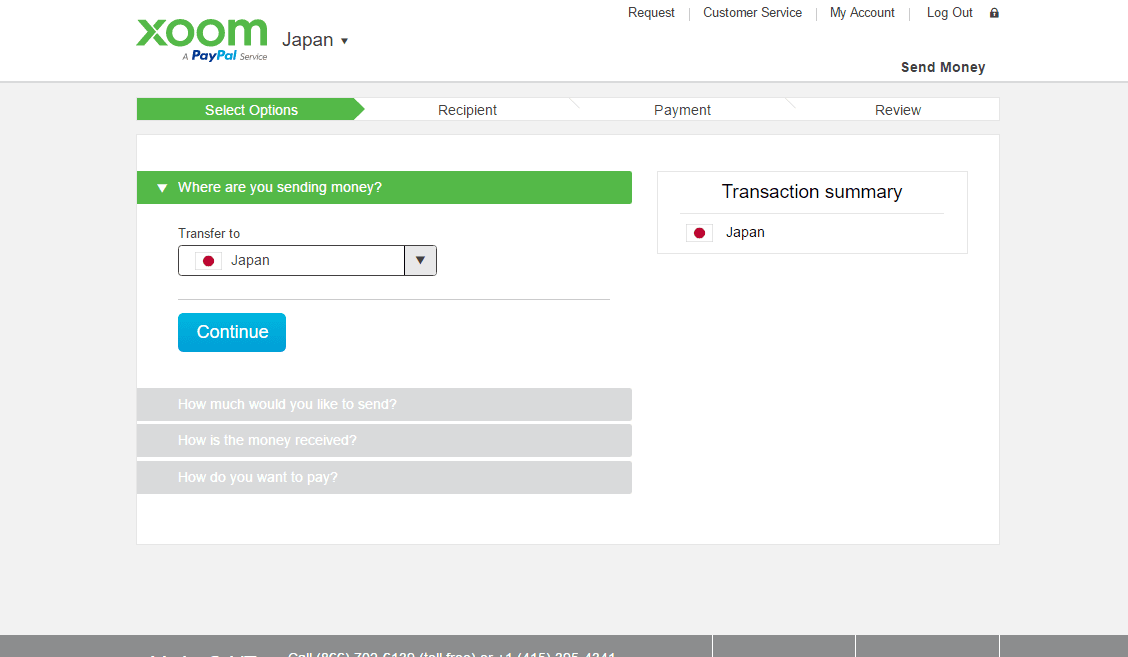

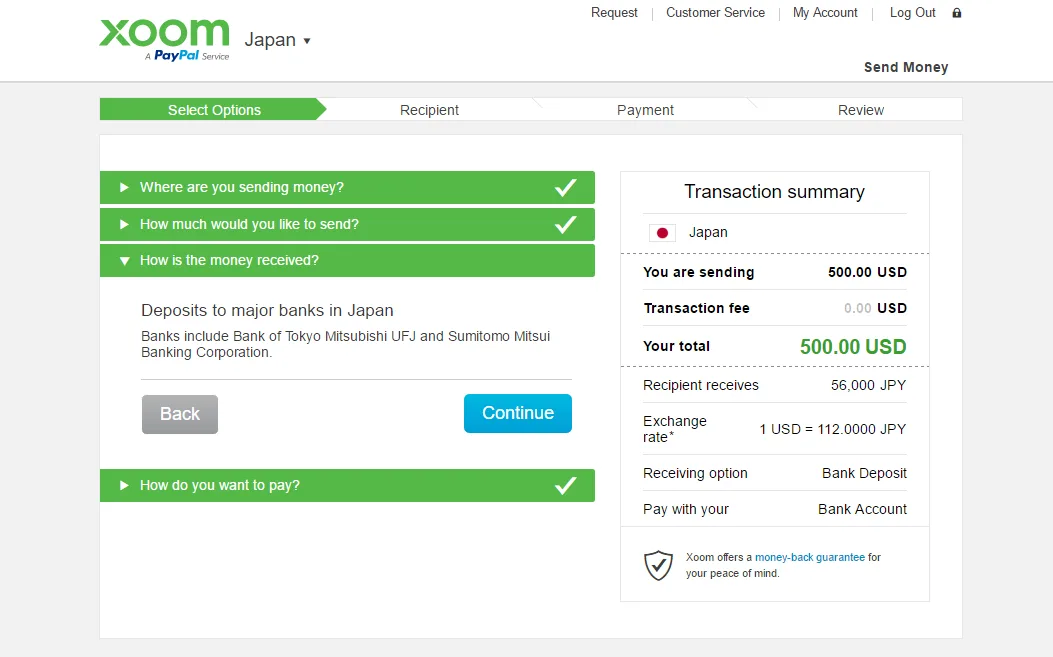

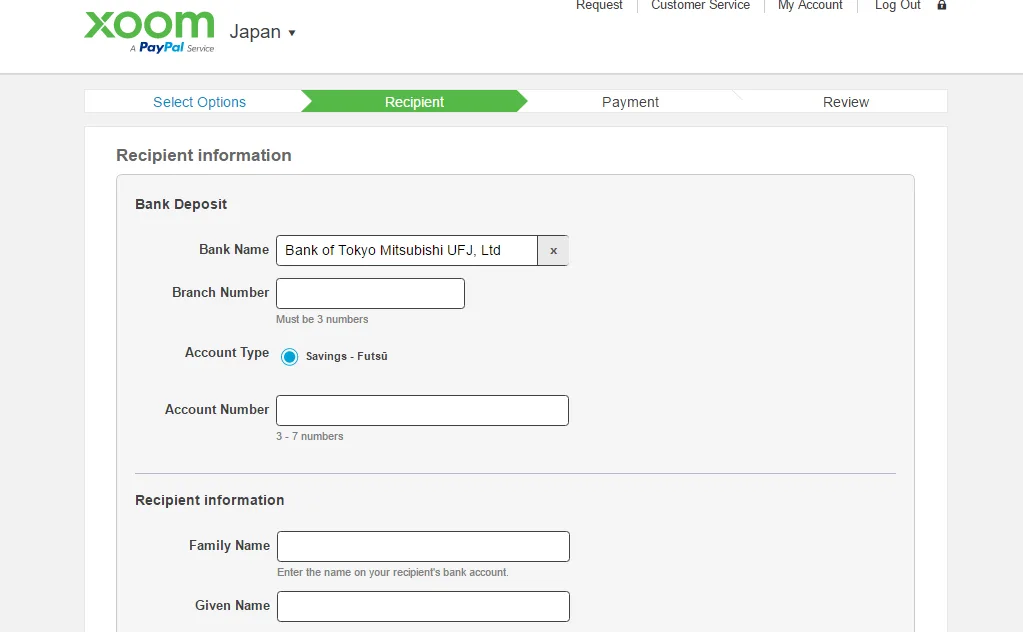

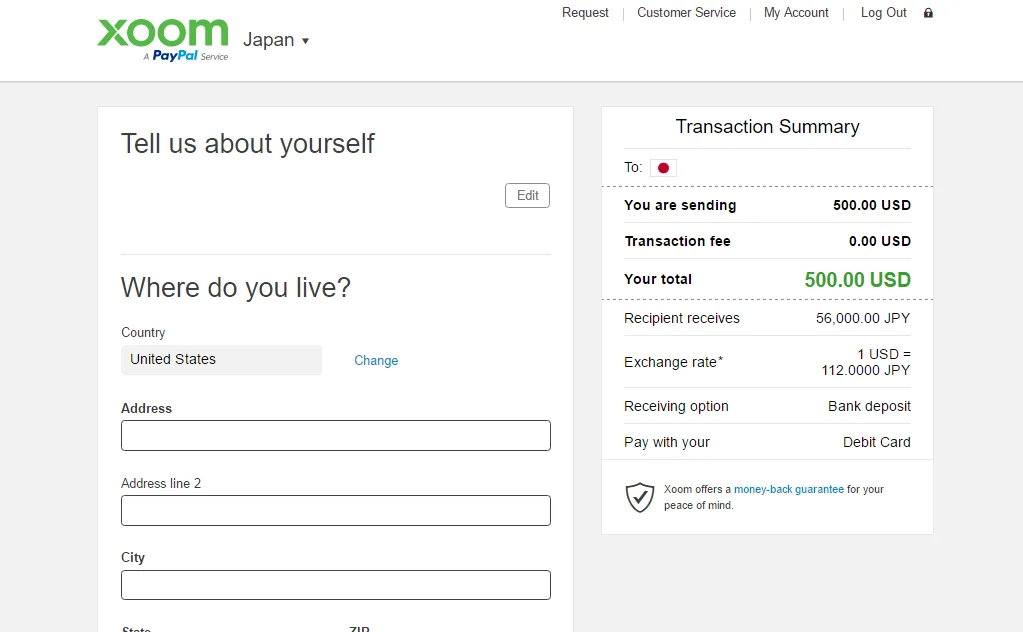

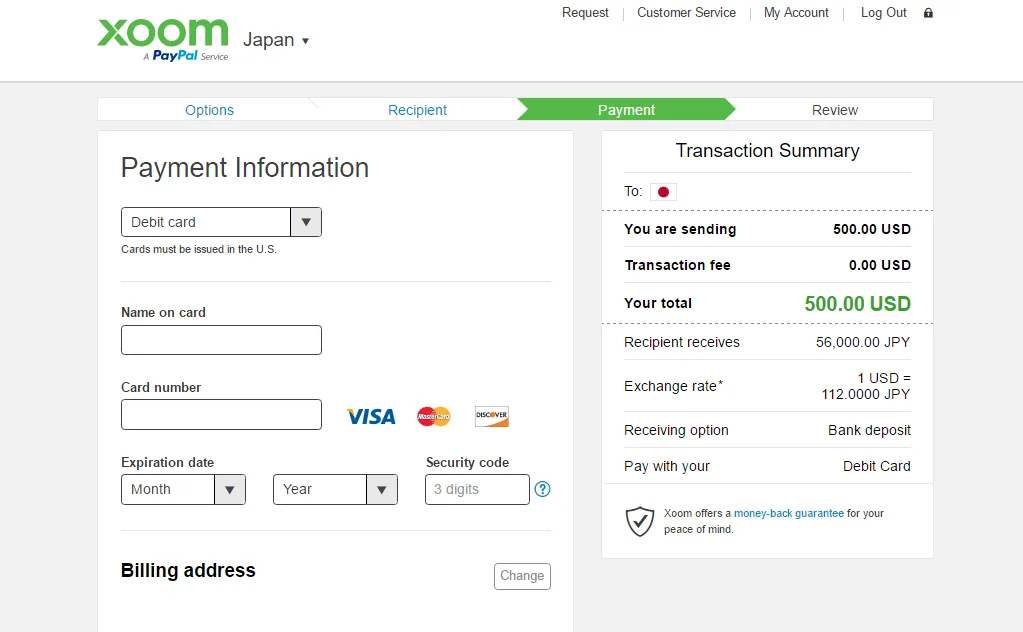

- Xoom's easy-to-use website allowed us to sign up and initiate a transfer in just about 3.5 minutes.