Key takeaways

- Yield farming is where you earn rewards on your crypto by lending it to others through DeFi (decentralised finance) platforms.

- You don't have to sell your crypto to earn from it, instead you can lock it into a platform and earn extra tokens or interest in return.

- It can offer high returns but comes with higher risks than traditional saving or staking.

Yield farming is the process of lending cryptocurrency assets to be rewarded with more crypto tokens. It is a way for cryptocurrency investors to earn passive income from digital assets that would otherwise be sitting idle.

The process is similar to staking as it involves depositing and locking cryptocurrency holdings for a certain period of time. However, while staking uses cryptocurrency tokens to power a blockchain or protocol, yield farming uses cryptocurrencies as liquidity for other investors or traders.

Those that take part in yield farming and provide liquidity to DeFi platforms are known as liquidity providers (LPs). The liquidity is often used for decentralised exchanges, trading or loans. As the sector advances, there will undoubtedly be even more use cases in the future.

How yield farming works

Yield farming is powered by Decentralised Finance (DeFi), a system that uses smart contracts instead of banks to run financial services like trading, lending and borrowing.

The core of yield farming is the liquidity pool, a big pot of crypto that people can trade or borrow from. You can become a liquidity provider (LP) by depositing your crypto into one of these pools.

In return, you'll earn a share of the transaction fees from anyone who uses the pool, plus bonus tokens offered by the platform.

Liquidity providers, those seeking to earn yield from idle cryptocurrency holdings, can deposit their funds into a liquidity pool. Liquidity pools can be thought of as a "pot" of cryptocurrencies that other users can use for exchanges or loans.

To use the pot of cryptocurrencies, the user has to pay a fee. These fees are then distributed proportionally to liquidity providers depending on their share of the liquidity pool. The rewards are usually in the form of cryptocurrency tokens.

What are automated market makers?

Most DeFi platforms use algorithms (a series of smart contracts) called automated market makers (AMMs). These contracts calculate the exchange prices and rates on a platform based on the available liquidity held within liquidity pools.

Automated market makers (AMMs) explained.

Rules surrounding the distribution of fees and the length of time cryptocurrency assets must be locked in can vary between protocols. The use of AMMs and liquidity pools has facilitated the growth of yield farming in the sector.

How does yield work?

Yield is the annual return you can receive for lending cryptocurrency assets. This is often written as a percentage, either as annual percentage rate (APR) or annual percentage yield (APY). As the AMM calculates rates using supply and demand, unlike traditional financial investments, yields can vary daily.

With yield farming, liquidity providers move liquidity between high-yield pools to take advantage of these changes in yield. Chasing the highest possible yield could involve moving to a different liquidity pool on the same platform or changing platforms altogether.

When you deposit into a pool, you'll often receive a special LP token that represents your share of the pool and proves your ownership if you want to withdraw your funds later.

What are DeFi protocols?

Finder survey: Which crypto industries are Australians investing in?

| Response | 75+ yrs | 65-74 yrs | 55-64 yrs | 45-54 yrs | 35-44 yrs | 25-34 yrs | 18-24 yrs |

|---|---|---|---|---|---|---|---|

| DAO or governance tokens | 1.92% | 1.16% | 0.56% | ||||

| Gaming and metaverse | 1.92% | 0.62% | 0.65% | 2.91% | 6.7% | 4.79% | 1.96% |

| Layer-1s | 1.92% | 0.62% | 4.55% | 6.98% | 15.64% | 13.3% | 4.9% |

| Layer-2s | 1.92% | 2.6% | 1.74% | 4.47% | 3.19% | ||

| Memecoins | 1.92% | 1.95% | 2.91% | 7.26% | 3.19% | 0.98% | |

| Bitcoin | 4.32% | 11.04% | 13.95% | 29.05% | 26.6% | 20.59% | |

| Artificial Intelligence (AI) | 1.85% | 2.6% | 2.91% | 4.47% | 4.79% | ||

| I don't know | 1.85% | 5.19% | 5.81% | 5.59% | 5.85% | 2.94% | |

| Stablecoins | 0.62% | 2.6% | 1.74% | 6.15% | 4.26% | 1.96% | |

| DeFi | 1.95% | 2.91% | 3.91% | 4.26% | 1.96% | ||

| Exchange tokens | 0.65% | 2.91% | 2.79% | 3.19% | 1.96% |

Yield farming strategies

Yield farming can be simple with a liquidity provider lending cryptocurrency assets to one platform. On the other hand, investors can utilise complex strategies to increase returns. This involves moving cryptocurrency assets between liquidity pools to catch the best rates.

With a variety of platforms offering yield farming opportunities, there is no "best way" to yield farm. Risk management should always be the focus as opposed to high-yield returns. A user needs to understand the protocol and remain in control of their funds throughout.

Automated yield farming

Thanks to increased popularity, there are now platforms that automate yield farming, which can be attractive for many passive investors. Yield farming can be time-consuming and confusing for those initially entering the space, so automated options are a good solution.

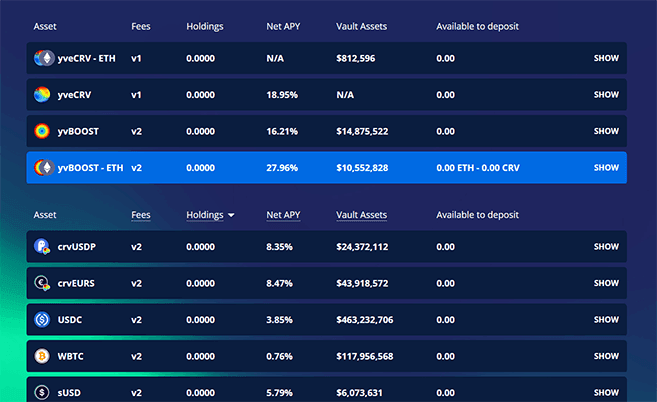

- Yearn Finance. This is a decentralised DeFi aggregator that compares the yield farming opportunities from a range of DeFi protocols. A user can deposit cryptocurrencies into a "vault" that will then be distributed to the best performing liquidity pools. The vault rebalances periodically to ensure the best yield farming opportunity is being exploited.

How to get started using Yearn Finance.

Popular yield farming platforms

The expansion of the DeFi sector has resulted in the expansion of yield farming opportunities. Here is a list of some of the most popular platforms currently used for yield farming:

- Compound. Compound is a borrowing and lending platform where rewards for liquidity are compounded over time.

- AAVE. AAVE is a decentralised borrowing and lending platform. APY rates are adjusted by an algorithm based on supply and demand.

- Curve Finance. Curve Finance is a decentralised exchange focused on the trading of stablecoins. By focusing on stablecoins, Curve Finance is able to offer lower fees and lower slippage.

- Uniswap. Uniswap is a decentralised exchange that allows users to deposit funds into liquidity pools. The liquidity pools are then used to facilitate trades.

- Synthetix. Synthetix is a trading platform for synthetic assets backed by the native SNX token. Users can deposit native SNX tokens or ETH in return for rewards.

- Yearn Finance. Yearn Finance is a decentralised aggregator for finding the optimum yield across multiple DeFi platforms.

Yield farming vs staking

Two of the most popular passive income activities in DeFi are yield farming and staking. Although they bring the same results, rewards in the form of cryptocurrencies, they serve different purposes.

Yield farming is the process by which users lock their cryptocurrencies in a protocol, providing liquidity for users in need of assets for other activities. The fees paid to the protocol for borrowing get paid out to the liquidity providers, also known as yield farmers.

Alternatively, an equally popular activity in the passive income world is staking. While yield farming implies providing liquidity for other users, staking is used to power a blockchain.

Stakers will lock their cryptocurrencies on any given network, which will give them the power to validate and confirm blocks, and receive rewards for doing so. The idea behind this activity is for security and decentralisation, along with governance options on some protocols.

Risks of using yield farming

Although dramatically increasing in popularity over the last year, the DeFi sector is still a young industry which means that risks need to be evaluated carefully.

- Smart contracts. Smart contracts are the backbone of DeFi protocols but they are also programmed by humans, so errors can occur. There are systems in place to mitigate this risk, but if a smart contract does malfunction, it could mean that a user's liquidity deposit is lost in the DeFi ecosystem.

- Composability. Smart contracts increase the composability of DeFi protocols. Composability refers to the interaction of different protocols within the DeFi ecosystem (think of different mobile apps all working together for a seamless experience). This is one of DeFi's greatest strengths, but it can also be considered a secondary risk as it can amplify any issues within a smart contract system.

- Hacks. The decentralised applications that front the DeFi protocols are connected via the Internet. Like anything connected to the Internet, there is always a risk of a security breach from hackers. Hackers also look for cracks in smart contract code that they can use to their advantage.

- Rug pulls. Rug pulls are a risk primarily associated with decentralised exchanges (DEX). Due to the open-source nature of the blockchain, anyone can create a new cryptocurrency token. On a DEX, scammers can then create a new liquidity pool and pair the worthless token with a valuable one, such as ETH. Once enough liquidity enters the fraudulent liquidity pool, the owners pull the pool and leave with the valuable ETH, leaving little to no trace.

- Impermanent loss. Impermanent loss happens when the value of your assets changes after you’ve deposited them into a liquidity pool. If one token rises or falls sharply in price, the pool’s balance shifts. When you withdraw, you might end up with fewer of the higher-value token — meaning your total return could be lower than if you’d just held your assets in a wallet.

The bottom line

Yield farming is undoubtedly one of the most exciting aspects of the DeFi sector. It hands control to the individual user and offers the opportunity to put cryptocurrency assets to work.

The industry is still in its infancy, which comes with associated risks, but it is advancing at an incredible rate. With each advancement comes increased security, improved decentralised governance and more opportunities.

Yield farming can be simple or complex, but it provides cryptocurrency investors with a way to earn a little passive income from otherwise idle investments.

"Yield farming can offer impressive returns, but it’s not for the faint-hearted. You’re essentially lending out your crypto in exchange for interest or rewards, but the risks, such as impermanent loss, smart contract bugs and platform collapse, are very real. It’s crucial to understand exactly where your funds are going and who controls the protocol before jumping in. "

Sources

Ask a question

More guides on Finder

-

What is a DAO? Decentralised Autonomous Organisations explained

DAOs are already replacing traditional business models and revolutionising the world of investing. Find out how they work and how to invest.

-

DeFi coins and tokens: A simple guide for beginners

DeFi tokens compose a prominent sector in the cryptocurrency markets. Learn the basics of these tokens here.

-

What is impermanent loss?

Impermanent loss can be an unforeseen risk when providing liquidity to DeFi. Here we explain what it is with an easy to follow example, and outline how it can be avoided.

-

DeFi and Web3 wallets in Australia

Find out how a Web 3.0 wallet can allow you to access the world of DeFi, plus discover which wallets we recommend.

-

Liquidity Pools: The backbone of DeFi

Find out how to become a liquidity provider and how liquidity provider tokens can be used.

-

What is an automated market maker?

Discover what an automated market maker is in DeFi and what it offers in comparison to the traditional market-making system.

-

The ultimate guide to decentralised exchanges (DEXs)

A comprehensive guide to decentralised cryptocurrency exchanges, how they work and the benefits they offer to anyone looking to buy or sell digital currency.