Key takeaways

- Impermanent loss occurs when the price of one token in a liquidity pool changes relative to the other.

- You might end up with less value than if you had simply held your tokens.

- Using our calculator can help estimate your potential loss before providing liquidity.

The creation of decentralised finance (DeFi) has opened up a world of possibilities for cryptocurrency investors to earn yield on their holdings. By decentralising traditional financial services, anyone can now lend funds to DeFi applications.

Depositing digital assets into liquidity pools can earn investors annual percentage yield (APY) far above what is currently offered by global banks.

However, liquidity pools offer a sometimes unknown downside risk known as impermanent loss.

In this guide, we will explain exactly what impermanent loss is, provide an easy to follow example and outline the steps investors can implement to mitigate the risk.

Impermanent loss calculator

| Original Price of Token A | New Price of Token A | Original Price of Token B | New Price of Token B | Impermanent Loss (%) |

|---|---|---|---|---|

| – |

Must read

Finder survey: How many Australians at at different ages have lost cryptocurrency or had it stolen?

| Response | |

|---|---|

| No I haven't | 84.78% |

| Through an incorrect transaction | 6.16% |

| Lost access to a wallet or private keys | 4.35% |

| Through a centralised exchange hack | 4.35% |

| Other | 2.17% |

| Through a DeFi hack | 2.17% |

What is impermanent loss?

Impermanent loss is a risk involved with providing liquidity to dual-asset pools in DeFi protocols. It is the difference in value between depositing 2 cryptocurrency assets within an Automated Market Maker-based liquidity pool or simply holding them in a cryptocurrency wallet.

Essentially, impermanent loss is where you earn less by depositing assets into an automated market maker (AMM) than if you had just left them in your wallet. In fact, you may not actually lose any money, instead you've lost an opportunity to earn more.

The phrase earns its name because any losses are only realised once the funds are withdrawn from the liquidity pool. Until then, any losses are only on paper and may reduce or disappear completely depending on how the market changes.

| Providing liquidity | Held in wallet | |

|---|---|---|

| Date 1 (Deposited) | Value of asset pair = $200 | Value of asset pair = $200 |

| Date 2 (Withdrawn) | Value of asset pair = $270 | Value of asset pair = $300 |

An extremely simplified example of impermanent loss. Assets have grown in value, but less than they would have compared to just holding.

To properly understand how impermanent loss occurs, you first need to understand how liquidity pools, which are used by AMM-style decentralised exchanges such as Uniswap, SushiSwap or PancakeSwap, work.

Liquidity pools

A liquidity pool is typically made up of 2 cryptocurrencies known as a pair (e.g. ETH:DAI).

These are weighted equally in order to create a market for users to trade in and out of.

For example, an ETH:DAI pool is made up of 50% ETH and 50% DAI.

By prefunding a pool like this, AMMs avoid the need to pair buyers with sellers. Instead traders have access to a permanently available pool of liquidity rather than having to wait for someone on the other side of the trade, which is how traditional exchanges which use spot markets work.

Automated Market Makers

AMMs calculate the exchange prices of standard liquidity pools. They raise and lower the value of cryptocurrency assets based on what assets are being purchased or sold by traders. The formula for each DEX can vary, but the most popular form is:

x*y = k

x is the amount of one cryptocurrency in the pool. y is the amount of the other and k is the total liquidity in the pool. When the total liquidity, k, changes, the ratio of x and y must adjust to remain balanced.

The total liquidity in a pool can change when trading fees are added, or when a liquidity provider adds or removes their liquidity.

How impermanent loss occurs

When you provide liquidity to a pool, you deposit an equal value of each asset (e.g. $100 of ETH and $100 of DAI). You then receive liquidity provider tokens (LP tokens) which is a receipt that entitles you to a certain percentage of the pool, which is dynamic and corresponds to the amount of liquidity you provided compared to the overall amount in the pool.

So if you provided $200 of assets to a pool bringing the total up to $1,000, your LP tokens would entitle you to 20% of the pool when you go to use them to withdraw your assets again at a later date (which now includes trading fees or other rewards). But if other people add assets to the pool over time and bring the total up to $2,000, you would now only be entitled to 10% of the pool.

Unfortunately, though, there is a unique risk involved when providing 2 assets into a pool that requires the value of the assets to remain balanced.

For example, an ETH/LINK pool with a total value of $2 million would need $1 million of ETH and $1 million of LINK to remain balanced, regardless how many tokens that actually equates to.

As one (or both) of the tokens begins to fluctuate in value, the balance of the pool is going to shift. People are also trading in and out of the pool, which may also cause one side of the pool to grow or contract, ending up with something like a 60/40 balance.

When this happens, it presents an opportunity for arbitrage traders who essentially get to purchase one of the assets at a discount, compared to the rest of the market. By taking advantage of this, arbitrage traders end up naturally rebalancing in the pool. This is an important part of how AMMs stay operational, but creates a problem for liquidity providers.

Due to rebalancing, the number of tokens on either side of the pool has changed, even though the values have remained the same. Remember that LPs are entitled to a percentage of the pool, rather than a set amount of tokens or dollar equivalent. This means that when you withdraw from a pool, you may receive more of one token and less of the other.

Depending on how those assets changed in price, you may wind up with a "loss" compared to if you had just left those tokens in your wallet in the first place.

Example of impermanent loss

To understand the potential of impermanent loss, it is always best to go through an example with real numbers.

- Investor A wishes to deposit liquidity into the ETH:DAI liquidity pool on SushiSwap. For the purposes of explaining impermanent loss, let's imagine that the total liquidity in the pool remains the same throughout. No trading fees are added and no liquidity is removed or added.

- The current price of 1 ETH is $100. As DAI is a USD stablecoin, 1 DAI is $1. The ratio of the liquidity pool must be balanced (50:50), so Investor A deposits 1 ETH and 100 DAI into the liquidity pool. The total investment equals $200.

- In total, there is 10 ETH and 1,000 DAI in the liquidity pool. Based on the AMM formula above, the total liquidity in the pool is $10,000 (10 x 1,000). Investor A's share represents 10%.

- During the week, the real-world market price changes significantly so that the price of 1 ETH is now $200 (or 200 DAI). There is now an imbalance between the real-world market price and the liquidity pool exchange price. This is an arbitrage opportunity.

- Arbitrage traders buy ETH from the liquidity pool that is 50% cheaper than the real-world external market price. This decreases the amount of ETH and increases the amount of DAI. The process continues until 1 ETH = 200 DAI.

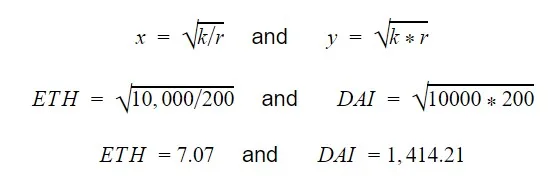

- There is now a new distribution of ETH and DAI in the liquidity pool. One that can be calculated. This involves defining a few variables taken from the Automated Market Maker formula and adding in a new variable 'r'. r is the new ratio of cryptocurrency assets.

For this example, x = ETH, y = DAI, k = $10,000 (total liquidity) and r is 200 (1 ETH = 200 DAI). The new distribution of each asset can then be calculated using the following formulas:

- After the arbitrage process, there is just over 7 ETH and just over 1,400 DAI in the liquidity pool.

- Remember, Investor A is entitled to 10% of the liquidity pool. If, at the end of the week, they wish to withdraw their share, they can withdraw 0.707 ETH and 141.42 DAI.

At the new market price, this equals $282.82. Investor A has gained $82.82 compared to the initial investment. However, ... - If Investor A had left the initial 1 ETH and 100 DAI in a crypto wallet, the value of their assets at the new market price would be $300.

- The impermanent loss in this example can be calculated by subtracting $282.82 from $300. The impermanent loss is $17.17.

"If you're thinking of providing liquidity, try starting with a small amount to get a sense for how the process works - and how impermanent loss may affect your holdings."

How to avoid impermanent loss

In a volatile marketplace, impermanent loss is almost guaranteed when staking cryptocurrency assets within a standard liquidity pool. Exchange prices are always going to move. However, there are ways that the effects of impermanent loss can be mitigated.

Trading fees

In the above math example, no trading fees were added to the liquidity pool. Trading fees are collected from traders using the liquidity pool and a share of those fees are then rewarded to liquidity providers. These fees are sometimes enough to mitigate and offset any impermanent loss. The more trading fees collected, the less impermanent loss there will be. Past a certain point, if a pool collects enough fees an investor will have gained more from staking assets in a liquidity pool compared with holding them.

Low volatility pairs

Impermanent loss is likely to occur for most volatile cryptocurrency pairings. However, impermanent loss can be mitigated by choosing a cryptocurrency pairing where the exchange price is not volatile. Examples of low volatility pairs include stablecoin pairings such as DAI:USDT, or different variations of the same token such as wETH(wrapped Ether):ETH. These examples include cryptocurrency pairings that follow a very similar price. Therefore, significant price movements between the pair are unlikely. If price volatility does not exist, impermanent loss can be avoided.

Complex liquidity pools

One of the main reasons for impermanent loss is due to the 50:50 split that is required by most liquidity pools. To overcome this issue, some decentralised exchanges such as Balancer offer users a variety of liquidity pool ratios. They also offer pools with more than 2 digital assets. Price changes in pools that have a higher ratio, such as 80:20 or 98:2, do not result in as much impermanent loss when compared with pools that have a 50:50 split.

One-sided liquidity pools

Impermanent loss occurs in a standard liquidity pool where 2 different cryptocurrency assets must be deposited. However, some exchanges such as Bancor have developed liquidity pools that offer users the opportunity to stake only one side of the pool. The other side of each liquidity pool on Bancor is made up of the native Bancor token, BNT. For example, for all ETH that is provided to the ETH:BNT liquidity pool, the equivalent BNT is added by the system. As a user only has to provide one side of the liquidity pool, there is no risk of impermanent loss.

Bancor has also recently integrated price feeds via the decentralised oracle, Chainlink. By tying liquidity pools with a live market price, they can automatically adjust when significant price changes occur. This is not possible in standard liquidity pools.

Other things you need to know about impermanent loss

While the basics of impermanent loss have been covered, there are a couple of extra details that are worth knowing before staking liquidity in DeFi protocols.

Impermanent loss can occur regardless of price direction. In the math example above, we increased the price of ETH and explained that impermanent loss meant gains were lessened in comparison to digital assets sitting in a wallet. However, impermanent loss occurs regardless of which asset in the cryptocurrency pair is moving. An investor can only withdraw digital assets that have not suffered an impermanent loss if the exchange price happens to be exactly the same at the time of withdrawal.

Secondly, an impermanent loss is only realised when funds are withdrawn. It is "impermanent" because prices could return to the initial exchange price at any time. If prices returned, the impermanent loss would no longer exist. The loss is only permanent if an investor withdraws their funds from the liquidity pool.

Impermanent loss calculators/tools

To help investors deal with the complexities of impermanent loss, there are now several calculators online that can help an investor determine the potential risks of depositing assets into specific liquidity pools. Below are a few options:

- Daily DeFi. Daily DeFi is an educational website covering most aspects of the decentralised finance sector. Included within the website is a built-in impermanent loss calculator. The calculator applies the AMM formula from Uniswap, and allows users to input current token prices and future token prices. Any future impermanent losses can then be calculated.

- DecentYields. DecentYields is a website focused on providing users with the best insights for yield return from the lending and liquidity pools within DeFi. The website also provides a detailed impermanent loss calculator. The calculator allows a user to input the dollar value of the digital assets they are thinking of staking, the amount of each token, and the percentage change in price.

Bottom line

The incentives for liquidity providers in the DeFi sector are strong. However, they are strong for a reason. Each protocol needs to provide users comfort that they will not lose out to impermanent loss. While an impermanent loss is inevitable when staking liquidity in standard liquidity pools, there are alternatives that investors can use to mitigate the risk.

Those new to liquidity provision should stick with low volatile cryptocurrency pairings or stablecoin liquidity pools. Alternatively, investors can utilise some of the more complex liquidity pools to mitigate the impact. For the more advanced cryptocurrency user, yield farming techniques can be implemented to ensure returns always stay far ahead of impermanent losses.

Frequently asked questions

Sources

Ask a question

More guides on Finder

-

What is a DAO? Decentralised Autonomous Organisations explained

DAOs are already replacing traditional business models and revolutionising the world of investing. Find out how they work and how to invest.

-

DeFi coins and tokens: A simple guide for beginners

DeFi tokens compose a prominent sector in the cryptocurrency markets. Learn the basics of these tokens here.

-

Yield farming: A beginner’s guide

Put those cryptocurrency assets to work in the DeFi sector and earn yield with yield farming.

-

DeFi and Web3 wallets in Australia

Find out how a Web 3.0 wallet can allow you to access the world of DeFi, plus discover which wallets we recommend.

-

Liquidity Pools: The backbone of DeFi

Find out how to become a liquidity provider and how liquidity provider tokens can be used.

-

What is an automated market maker?

Discover what an automated market maker is in DeFi and what it offers in comparison to the traditional market-making system.

-

The ultimate guide to decentralised exchanges (DEXs)

A comprehensive guide to decentralised cryptocurrency exchanges, how they work and the benefits they offer to anyone looking to buy or sell digital currency.