Finding a single source for crucial crypto stats can be a challenge. This guide lists the most important statistics for enthusiasts wanting to understand the state of the market.

General market statistics

Before we delve into what sets participants apart, the first category in our crypto stats deals largely with what ties us together.

- Total value: The entire coin market, made up of thousands of cryptocurrencies, is currently valued at $1,138 trillion. (Source: CoinGecko)1

- Annual growth: The market's valuation has grown by more than 29% over the past year. (Source: CoinGecko)1

- Number of coins: The total number of active cryptocurrencies has grown substantially. By November 2021 there were 7,557 unique digital currencies. (Source: Statista)2

- ICOs: Initial coin offerings (ICOs) help companies raise the money needed to create cryptocurrencies. By March 2020, more than 2,300 ICOs had been launched throughout the industry. (Source: Statista)2

- Five biggest: The top five cryptocurrencies by market cap are currently Bitcoin, Ethereum, Tether, BNB, and USD Coin. (Source: CoinGecko)1

- Recent price movements: The price movements of the top 5 coins over the last 90 days is shown below. Each coin in the index starts at 100. A rise to 110 for would represent a 10% rise in price for that coin. (Source: CoinGecko)1

- Dominance: The vast majority of the market is made up from the combined market cap of the top 7 coins. The dominance, or share of the total cryptocurrency market, of each of these coins is shown here. (Source: CoinGecko)1

- Daily volume: Trade volume measures the level of current activity in the market. The daily crypto trade volume stands at US$128,697,546,577. (Source: CoinGecko)1

- Top five volume: The change in volume for the top five coins over the past 90 days is shown below. (Source: CoinGecko)1

- Bitcoin volume market share: As the world's first and largest cryptocurrency, Bitcoin alone accounts for 24% of the entire market's trading volume over the last 24 hours. (Source: CoinGecko)1

- Bitcoin value market share: Bitcoin's share of the cryptocurrency market's current value, referred to as dominance, is currently sitting at 46%. (Source: CoinGecko)1

- Bitcoin trading value: More than US$30 billion worth of Bitcoin has been traded over the past 24 hours. Bitcoin's daily volume over the past 90 days is shown here. (Source: CoinGecko)1

- Bitcoin blockchain size: The Bitcoin blockchain grows each year as adoption increases. Currently, the network contains more than 320 gigabytes of information. (Source: Statista)2

- Bitcoin ATH: Bitcoin's all-time high was reached on November with a price of . (Source: CoinGecko)1

- Bitcoin market cap: Bitcoin's total market cap currently stands at $519,055,347,635. (Source: CoinGecko)1

- Bitcoin ATMs: By January 2021, there were nearly 14,000 Bitcoin ATMs around the world. (Source: Statista)2

- Annual transactions: By the end of 2020, the number of digital payments worldwide exceeded US$700 billion. That's an increase of nearly 100 transactions for every man, woman and child on Earth. (Source: Consultancy.uk)3

- Daily volatility: Cryptocurrency prices can change quickly – and unpredictably. The measured volatility from the top 250 coins over the last 24 hours was $519,055,347,635 (Source: Finder)4

- Mining revenue: Coins using PoW consensus mechanisms require participants, known as miners, to process transactions with computers. Miners are rewarded with cryptocurrency. The yearly income generated through crypto mining has recently topped US$20 billion. (Source: Digiconomist)5

- Number of NFT collcetions: Non-fungible tokens (NFTs) are unique digital assets, often represented by works of art. Along with DeFi, NFTs have led to increased adoption. As of December 16, 2021, there were 119 NFT collections being tracked by CoinGecko. (Source: CoinGecko)1

- Costliest NFT: The most expensive NFT ever sold, an artwork by Beeple, titled The First 5000 Days, fetched US$69 million. (Source: Finder)6

Crypto geography

Where are the people most interested in cryptocurrency located? And how is adoption of this technology changing in the world around us? The following statistics seek to answer the fundamental questions concerning geography and crypto investment.

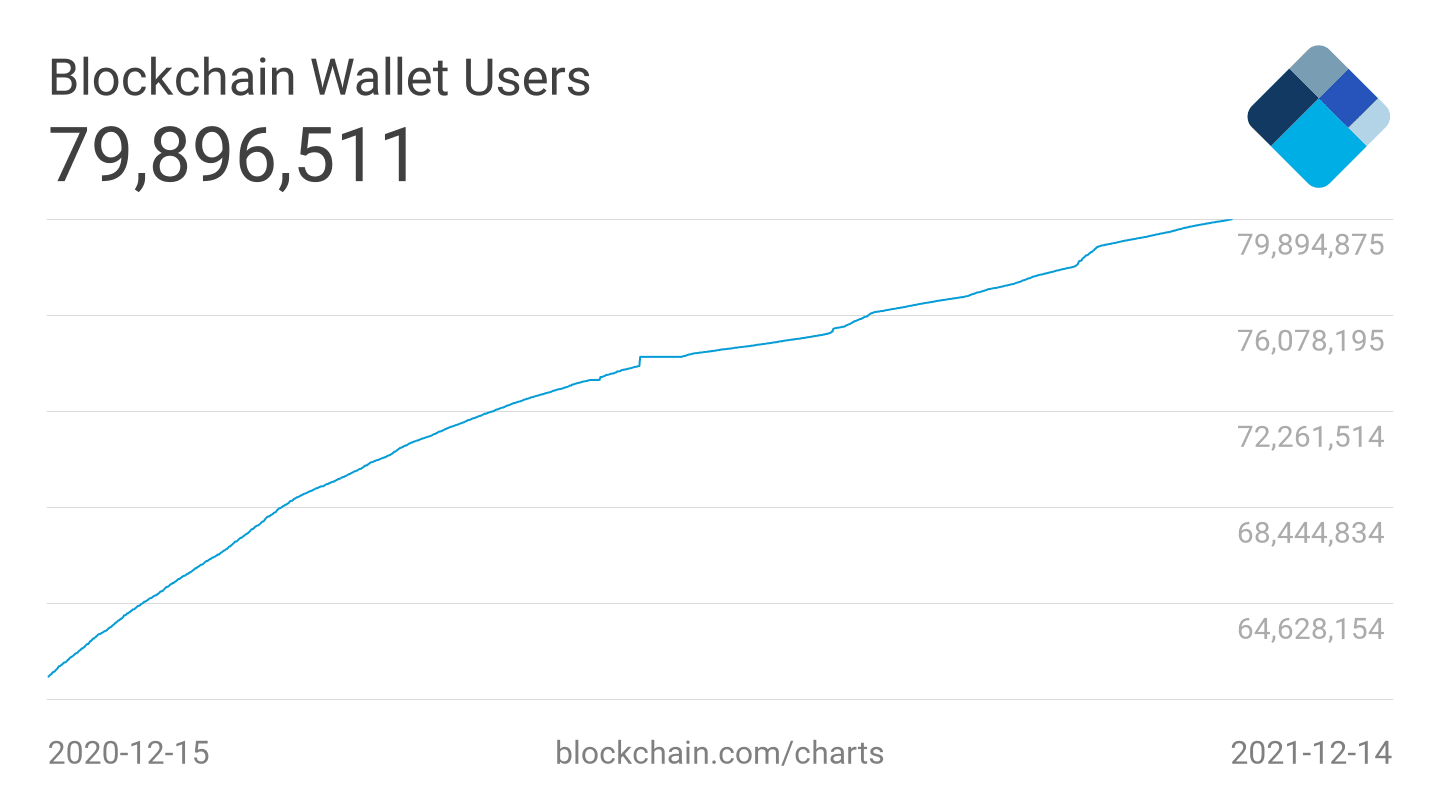

- Number of wallets: A great way to track adoption is by looking at the number of Blockchain wallets in use worldwide. By December 2021, there were nearly 80 million Blockchain wallet users. (Source: Blockchain.com)7

- Percentage owning crypto: Adults owning cryptocurrency, as a percentage of the world's population, now equal 11.4%. (Source: Finder)8

- Twitter mentions: Did you know that every day, more than 14,000 posts concerning cryptocurrency appear on Twitter? If your social media feeds are as cluttered as ours, this statistic might not surprise you. (Source: Reuters)9

- Adoption by geo: The following chart looks at 20 countries with varying adoption rates. Vietnam tops the list with 28.6% of people owning cryptocurrency. Japan comes in last with an adoption rate of only 5.8%. (Source: Finder)8

- Crypto adoption annual increase: Global adoption of cryptocurrencies has soared by more than 880% in 2021. (Source: Chainalysis)10

- Crypto use cases: The share of the global crypto market by end-use has been tracked. Trading makes up 42.8% of the market, followed by ecommerce, peer-to-peer (P2P) payments and remittances, respectively. (Source: Fortune Business Insights)11

Australian demographic cryptocurrency stats

Demographics describe the differences between participants holding crypto in their portfolios. Categorizing users into representative segments can help us understand who is driving the market forward.

- Gender split: Globally, cryptocurrency ownership varies by gender. Men are generally more likely to own virtual assets than women, but that's not the case in every country. In Norway, 55% of crypto owners are female. (Source: Finder)8

- AU gender gap: The gender gap in Australia favors men. In 2021, 21.8% of men, versus 14.1% of the country's women, owned crypto. (Source: Finder)8

- Crypto ownership: In Australia, 17.7% of the population owns crypto. This is well ahead of the global average of 11.4%. (Source: Finder)8

- Adoption rate: In 2021, Australia had the 3rd highest cryptocurrency adoption rate worldwide. (Source: Finder)8

Bitcoin's environmental impact

The carbon footprint created through cryptocurrency mining has stirred numerous controversies. As the world's largest cryptocurrency, Bitcoin's impact is the most notable. The statistics outlined here give insights into Bitcoin's energy consumption.

- Comparison with country electricity: Securing the Bitcoin network uses energy equivalent to the consumption of entire countries. Currently, Bitcoin mining uses more electricity than Argentina and slightly less than Norway. (Source: BBC)12

- Crypto carbon footprint: The carbon emissions from Bitcoin mining are greater than those produced by New Zealand. (Source: The New York Times)13

- Crypto's emissions vs gold's: Bitcoin's emissions are even greater than those created by gold mining, globally. (Source: Digiconomist)5

- Bitcoin mining cost: Bitcoin's electricity usage doesn't come cheap. Mining Bitcoin costs US$4,466,697,344 per year. (Source: Digiconomist)5

- Transaction carbon footprint: The carbon footprint of a single Bitcoin transaction is equal to 2,144,091 Visa purchases. (Source: Digiconomist)5

- Mining cost/revenue: Nearly 59% of the total income derived from mining Bitcoin goes to paying the energy costs. (Source: Digiconomist)5

- GPU usage: The need for Bitcoin miners to use graphic processing units (GPUs), rather than central processing units (CPUs), results in larger electricity consumption. (Source: Joule)14

- Bitcoin and renewable energy: In 2020, only 39% of the energy used by Bitcoin miners came from renewable sources. (Source: Decrypt)15

- Bitcoin and global warming: It has been estimated that the emissions from Bitcoin mining alone could raise global temperatures by 2 degrees in the future. (Source: Nature Climate Change)16

- Bitcoin vs cars' carbon footprint: A single US$50,000 purchase of Bitcoin has a carbon footprint of approximately 270 tons. That's roughly equal to the total footprint of 60 internal combustion engine (ICE) vehicles. (Source: Financial Times)17

- Bitcoin vs planes' carbon footprint: Bitcoin's carbon emissions are so large, its total falls somewhere between those created by American Airlines, with 200 million passengers per year, and the entire US government. (Source: Financial Times)17

- Value to carbon ratio: Every US$1 billion of inflows into Bitcoin creates 5.4 million tons of carbon emissions. (Source: Financial Times)17

Cryptocurrency regulation

Regulations are increasingly important to investors in the global market. The following crypto stats can help you understand how the rules have changed.

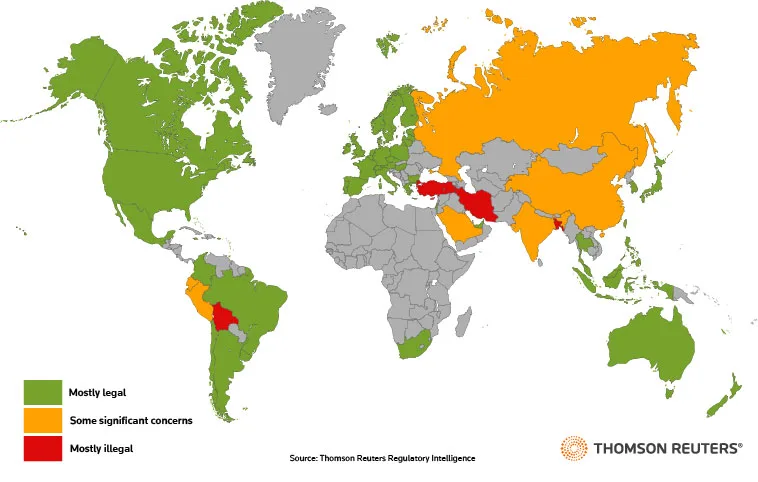

- Crypto regulations by country: Which countries allow for cryptocurrency participation, and which ban the practice? This graphical representation from Thomson Reuters helps sort out crypto's legal playing field across the world: (Source: Thomson Reuters)18

- Crypto as legal tender: As the first nation to adopt Bitcoin as legal tender, El Salvador has set a global precedent. Whether more countries will follow suit is yet to be seen. (Source: be[IN]crypto)19

- Countries banning crypto: While El Salvador opens its arms to cryptocurrency's potential, many countries have severely restricted, or even banned, cryptocurrency transactions. These countries currently include Algeria, Bolivia, China, Columbia, Egypt, Indonesia, Iran, India, Iraq, Nepal, North Macedonia, Russia, Turkey and Vietnam. (Source: euronews)20

- Crypto and AU tax: In Australia, disposed cryptocurrency is paid as capital gains. If you wait 12 months before selling or trading, however, a 50% discount on owed taxes is given. (Source: TokenTax)21

- IRS underreporting: The IRS has long believed that cryptocurrency transactions are under-reported. In 2018, a federal court agreed with the IRS, granting a summons of Coinbase records and refusing Coinbase's request for an evidentiary hearing. (Source: Journal of Accountancy)22

- Countries with no guidance: Of 43 countries surveyed by the OECD, 13 still had no guidance available on the classification of crypto assets. These countries include Bulgaria, Costa Rica, Czech Republic, Denmark, Grenada, Italy, Korea, Mexico, Norway, Peru, Saint Lucia, Spain and Sweden. (Source: OECD)23

- Taxable events: Generally, exchanging crypto for fiat, other virtual assets, or even goods and services (including wages) will generate a taxable event. (Source: OECD)23

Crypto crime

As more users have come online, cyber crime has increased dramatically. But how does this affect the cryptocurrency market? The following statistics may surprise you.

- Crypto heists: The amount of money stolen by crypto criminals year after year has decreased substantially. In 2020, the amount stolen decreased by US$2.4 billion from the year before. That equates to a decrease of 57%. (Source: finaria)24

- Defi hacks: In 2020, decentralized finance (DeFi) hacks equated to nearly 25% of all hacked volume. (Source: Ciphertrace)25

- Hacking groups: 60% of all publicly reported crypto hacks were linked to just 2 professional hacking groups. (Source: Chainalysis)26

- fraud v hacks: According to information gathered by Ciphertrace, blockchain fraud remains much more prevalent than cryptocurrency hacks and thefts. (Source: Ciphertrace)25

- Crypto fraud percentage: In 2020, 73% of cryptocurrency crimes were a result of fraud. (Source: Ciphertrace)25

- Crypto thefts: In 2020, cryptocurrency thefts, as opposed to fraud, totaled US$513 million. (Source: Ciphertrace)25

- Scam ICOs: According to research published by Bloomberg, more than 80% of ICOs created in 2018 have been since identified as scams. (Source: Bloomberg)27

- Criminals and wallets: US$41.2 million was sent directly to criminally associated wallet addresses from US exchanges. (Source: Ciphertrace)25

- Fraud recovery: After a US$281 million hack occurred in 2020, the popular exchange, KuCoin, was able to recover 80% of its compromised funds. (Source: Ciphertrace)25

- Bitcoin illegal ratio: Despite the serious nature of criminal activity uncovered in the cryptocurrency market, less than 0.5% of Bitcoin transactions have been connected to illegal activity. (Source: Ciphertrace)25

- Crypto illegal ratio: Overall, only 1.1% of cryptocurrency transactions are linked to illicit activity. (Source: Ciphertrace)25

Sources

Ask a question

More guides on Finder

-

Blockchain statistics 2023

See our visualised data on blockchain growth and adoption in 2023.

-

DeFi statistics 2023

We take a look at DeFi adoption rates and some of the places where it’s most utilised.

-

Binance statistics report for 2023

Key statistics on Binance, Binance.US and the BNB Chain.

-

Coinbase statistics 2023

See our visualised stats on Coinbase's users base, trading volume, revenue and income.

-

Finder Cryptocurrency Adoption Index report 2022

Finder's Cryptocurrency Adoption Index measures the growth of cryptocurrencies across the world through a regular survey.

-

Finder’s Cryptocurrency Report 2021

Finder's Cryptocurrency Report 2021 explores the rise of cryptocurrency, why Australians are investing, and trends underpinning its future.

-

Binance Coin statistics 2021

These are some of the essential statistics about Binance Coin.

-

Finder Cryptocurrency Predictions Report october 2025

Every three months, Finder empanels a range of industry specialists to get a pulse on what the future holds for crypto. This is a summary of those findings.