CMC Invest crypto review

We currently don't have this product on Finder

- Regulator registration

- AUSTRAC

ASIC - Supported assets

- 8

- Fiat currencies

- 1

Our verdict

Trade with precision and speed on CMC Invest, but expect a narrower crypto selection.

Established in 1989, CMC Invest delivers a clear-cut crypto trading experience through its user-friendly platform. Designed with simplicity at its core, the platform caters to a diverse spectrum of traders, appealing to both novices and seasoned experts alike.

Demonstrating its quality and user focus in the Australian market, CMC Invest won Finder's Investment Award as the Best Overall Broker.

One notable feature is its crypto indices. Think of these as curated collections of cryptocurrencies, simplifying your choices. The All Crypto, Major Crypto and Emerging Crypto Indices offer varied market exposure but keep things less overwhelming than a massive list of individual cryptos.

However, this streamlined approach has its drawbacks. If you're into explouring a wide array of cryptos, CMC Invest might feel limiting. The focus is more on major and emerging coins (8 major coins and altcoins), not the extensive variety you'd find on platforms like Binance (which offers over 390 cryptocurrencies and twice as many trading pairs.)

CMC Invest is also transparent and competitive with its fees. It stands out with its competitive 0.90% brokerage fee on cryptocurrency orders. This is significantly lower than the industry average of around 1–1.5%, offering a more cost-effective trading option for those keen on managing their investment expenses.

Also, the platform is quick, too, with trades executing in just 0.0030 seconds.

Pros

-

Reputable provider. CMC Invest is a well-established platform that has been operating for more than 25 years.

-

Precision pricing. Accuracy in pricing, aggregating data from 18 different feeds. This approach ensures traders receive the most precise price possible for trades.

-

Rapid trade execution. The platform boasts a lightning-fast execution time of 0.0030 seconds. The aim is to minimise slippage and enhance trading efficiency.

-

High fill rate. It offers a remarkable 99.9% fill rate on trades, ensuring that traders' orders are fulfilled without partial fills or manual dealer intervention.

-

Focused crypto indices. CMC Invest offers curated crypto indices, making it easier for traders to invest in broader market trends.

-

Regulatory compliance. CMC Invest is authorised and regulated by ASIC.

-

Robust security protocol. CMC Invest prioritises the safety of client funds, adhering to strict regulatory standards and segregating client money from company funds, ensuring enhanced security and peace of mind for traders.

Cons

-

Limited cryptocurrency selection. Compared to other leading platforms, CMC Invest offers a limited range of individual cryptocurrencies. This might be a drawback for traders seeking extensive crypto diversity.

-

Minimum trade value. CMC Invest imposes a $1,000 minimum trade value for global markets, which can be a barrier for new or small-scale investors looking to diversify.

-

Mandatory currency conversion. All cryptocurrency transactions require a currency conversion to USD and traders cannot withdraw foreign currency directly from their cash or bank accounts associated with CMC Invest, thus incurring some fees.

-

Customer service. The customer support is only 24/5.

Details

Product details

| Product Name | CMC Invest |

| Fiat Currencies | AUD |

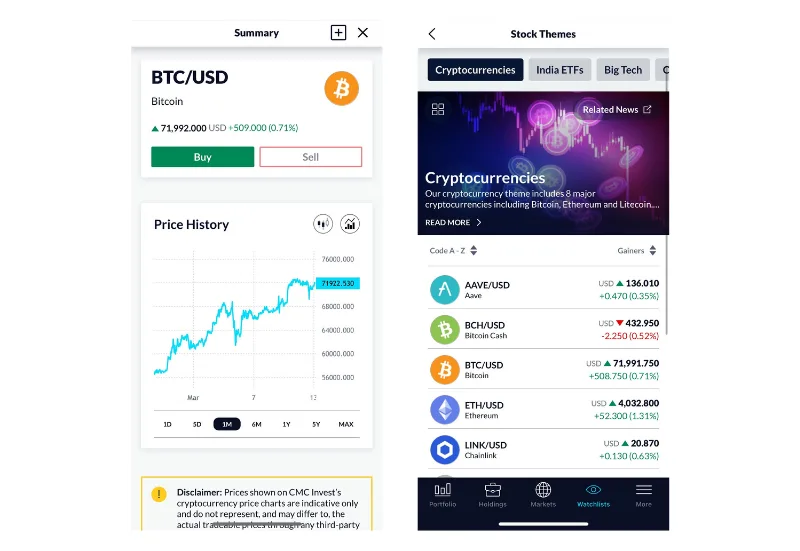

| Cryptocurrencies | BTC, ETH, SOL, LINK, BCH, LTC, UNI, AAVE |

| Deposit Methods |

Debit card Credit card Bank transfer Paypal |

| Trading Fee |

Brokerage fee: 0.90% FX spread: 0.60% |

| Deposit Fees | AUD: None |

| Withdrawal Fees | AUD: None |

About CMC Invest

Founded in 1989, CMC Invest began as a foreign exchange broker in London. Over the years, it evolved into a leading global financial services provider, offering a wide array of trading options including forex, indices, shares, commodities and, more recently, cryptocurrencies.

Listed on the London Stock Exchange, it's a testimony to the company's growth and standing in the financial world. CMC Invest is renowned for its innovative approach, particularly in the digital trading sphere.

To see our CMC share trading market review click here.

The introduction of cryptocurrency trading services showcases its commitment to evolving with market trends and technological advancements. The platform offers unique products such as crypto indices, catering to a diverse range of traders, from beginners to seasoned professionals.

Today, CMC Invest, with a presence in Europe, Asia, Australia, Canada and New Zealand, continues to expand its global footprint, committed to providing intuitive trading platforms, precision pricing and robust security, reinforcing its position as a trusted name in the dynamic world of online trading.

It recently won Finder's Investment Award as Best Overall Broker.

CMC Invest supported assets

CMC Invest supports over 7 cryptocurrencies, but some notable assets are missing. Namely, Tether, XRP and BNB, which are in the top 20 cryptos by market cap. In total, 4 of the top 20 cryptos are available on CMC Invest.

Popular assets on CMC InvestCMC Invest fees review

For Australian traders eyeing the cryptocurrency market via CMC Invest, it's essential to understand the fee structure. Here's a breakdown:

- Brokerage fee. For all cryptocurrency orders, CMC Invest charges a brokerage fee of 0.90% of the traded value. This fee is applied to the total value of the cryptocurrency transaction.

- Currency conversion. When placing a cryptocurrency order, an indicative foreign exchange (FX) rate is displayed on the order ticket (since crypto is transacted in USD). This rate is used to convert currencies at the time of transaction.

- FX spread: The FX spread varies depending on the time of the trade. During standard trading hours, from Sunday 5pm New York time to Friday 5pm New York time, the FX spread is up to 0.60% of the FX rate. Outside these hours, the spread can go up to 1.2% of the FX rate.

In addition to this, traders receive an indicative quote for currency conversion when placing a cryptocurrency order. This quote includes a buffer on buy orders to cover potential fluctuations in the exchange rate between AUD and USD. The actual exchange rate at the time of transaction execution may differ from this indicative quote.

It's important to note that all cryptocurrency transactions require a currency conversion and traders cannot withdraw foreign currency directly from cash or bank accounts associated with CMC Invest.

CMC Invest uses a maker taker fee structure for spot market trading. Instant purchases incur a separate fee.

| Type | Fee |

|---|---|

| Maker | 0.90% |

| Taker | 0.90% |

Maker fee explained. A maker fee is the fee charged when you propose an order for other traders to take. In other words, this fee is charged when you place a limit order to sell an asset, but that order is not filled immediately.

Taker fee explained. A taker fee is a fee charged when a buy order is matched immediately with a sell order on the books. This is the fee charged when you place a market buy order.

CMC Invest deposit methods

- Debit card

- Credit card

- Bank transfer

- Paypal

How to sign up on CMC Invest

Before you can get started trading on CMC Invest, you'll have to go through a Know Your Customer (KYC) verification process (which usually involves proof of identification).

- Get started

Visit CMC Invest's site. After selecting the Get Started button, fill in the create account form. - Set up payment

Before you can start trading, you have to add your bank account to your CMC Invest account. There are several options to choose from, so choose the option most compatible. - Provide identification

Before you can make withdrawals and increase your transaction limits, you must submit proof of address and some additional identification. Use either a passport or a driver's license for this. - Start trading

After all that is processed, you're ready to trade on CMC Invest.

About the CMC Invest app

CMC Invest offers a mobile trading app that aims to replicate the functionality and experience of its web platform for users on the go. This app is designed for committed traders who need constant access to the markets.

| App store | Rating | Total reviews |

|---|---|---|

| Google Play | 4.5 stars | 1.3k reviews with 100k downloads |

| Apple Store | 4.7 stars | 2.4k reviews |

Is CMC Invest safe?

This platform is considered safe. CMC Invest is authorised by 5 Tier-1 regulators, which are considered highly trustworthy. These include ASIC, the Canadian Investment Regulatory Organisation (CIRO), the Monetary Authority of Singapore (MAS), the Financial Markets Authority (FMA) and the Financial Conduct Authority (FCA).

Tier-1 regulators are known for their strict guidelines and rigorous oversight, which typically indicates a high level of trader protection and operational transparency.

As it’s regulated by ASIC in Australia, the platform is required to comply with the ASIC Client Money Reporting Rules and the regulations.

The company adheres to regulatory requirements by segregating retail client money from its own funds. This separation is crucial. In the unlikely event of insolvency, client funds in these segregated accounts are protected and earmarked to be returned to clients (minus necessary administrative costs) rather than being treated as recoverable assets by CMC Invest’s creditors.

Keeping your crypto secure

All centralised exchanges, including CMC Invest, are vulnerable to counterparty risks like hacking, theft and insolvency. Using a self-custodial or hardware wallet is widely accepted as the best way to improve the security of your funds. We've shared some of our top picks below.

Ledger Nano X Wallet |

Trezor Model T Wallet |

SafePal S1 Wallet |

|

|

|

|

|

|

|

|

|

|

|

|

Supported assets 5,500+ |

Supported assets 1,000+ |

Supported assets 30,000+ |

|

Price (USD) $99 |

Price (USD) $129 |

Price (USD) $49.99 |

See more of the best crypto wallets

CMC Invest customer support

CMC Invest provides customer support designed to cater to the needs of traders across different levels of experience. Users can reach the support team via phone, email and live chat support.

There are also plenty of educational resources to improve trading knowledge. These include instructional articles and videos, trading guides, a blog, events run by market experts and much more, plus a free demo account.

Among popular user review sites, feedback has been mixed.

As of 9 April, Trustpilot gave the platform a rating of 4.0 out of 5 stars, based on 2,178 reviews.

The main area of concern among reviewers appears to be customer service. The positive reviews highlight CMC Invest’s user-friendly platform.

How to reach CMC Invest customer support

- Phone

- Live chat

Alternatives to CMC Invest

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseSources

Your reviews

Shubham Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.